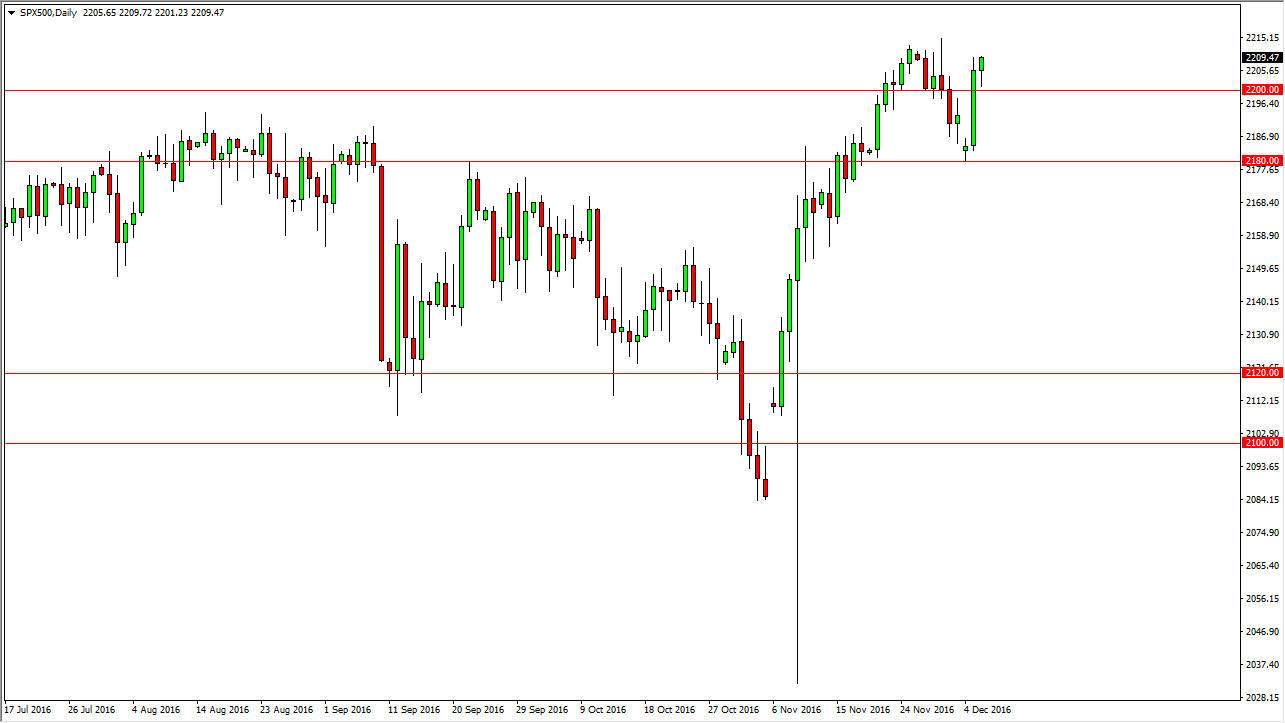

S&P 500

The S&P 500 fell initially on Tuesday but found enough support at the 2200 level to bounce and form a hammer. The hammer of course is a bullish sign, and ultimately I believe that the market is going to continue going higher. I think there is a massive floor down at the 2180 handle, so it’s not until we get below there that I would remotely consider selling this market. Given enough time, we should continue to see buyers enter based upon the overall strength of the S&P 500, and because of that I have no interest in trying to go against what we have seen over the last several weeks. The S&P 500 should continue to be one of the better performing indices in the world.

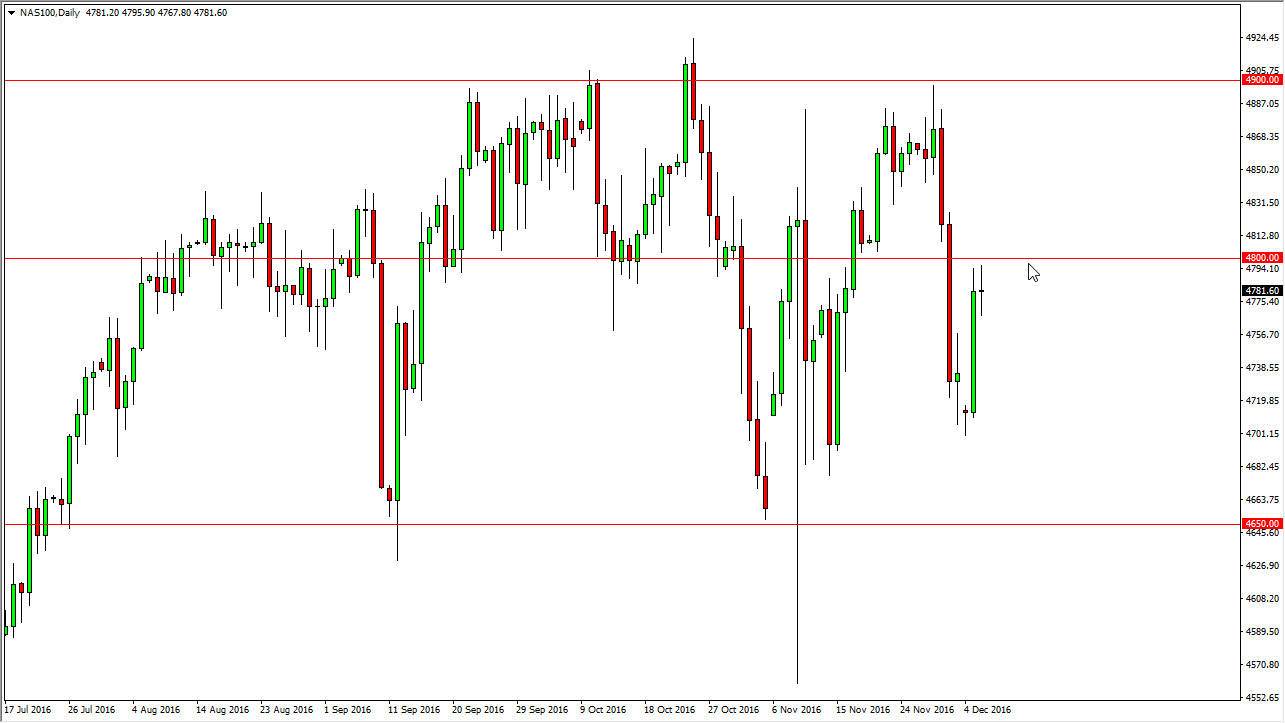

NASDAQ 100

The NASDAQ 100 went back and forth on Tuesday, forming a neutral candle. Because of this, it looks as if the market is trying to build up enough momentum to finally break above the 4800 level. We get above there, market should then reach towards the 4900 level, which is the end of the overall consolidation that the market has been in. I believe that if we do break above there, we should then reach towards the 5000 level. Ultimately, I think pullbacks continue to be buying opportunities in a market that should follow the S&P 500 as well as the Dow Jones 30.

I do believe that we break out to the upside given enough time, especially considering that the US economy is by far the strongest of the major ones. I have no interest whatsoever in selling the NASDAQ 100, as I believe that the old axiom “a rising tide lifts all boats” should come into play when it comes to this market place, and because of this I continue to be bullish.