USD/CHF Signal Update

Yesterday’s signals were not triggered as the bullish price action took place a little way below 1.0123 and 1.0115.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be entered before 5pm London time today.

Long Trades

Go long after bullish price action on the H1 time frame following the next entry into the zone between 1.0080 or 1.0050.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

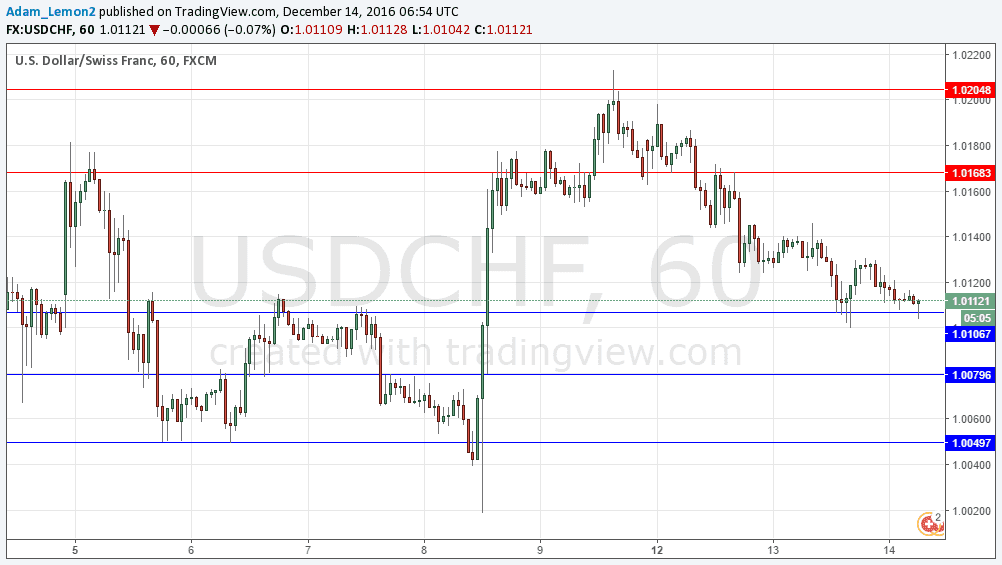

Go short after bearish price action on the H1 time frame following the next touch of 1.0168.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

The picture is starting to look interesting from a bullish perspective, as although the support levels above 1.0100 did not exactly hold, the price is finding it hard to break below that round number, so we may ultimately see a move up from here.

The support levels further down are even more interesting and strong, especially 1.0050 which is a very significant level.

The momentum now is still clearly bearish and for that to change, we need to see a fast, strong upwards movement of about 35 pips or so for the pattern to be broken.

There is nothing due today regarding the CHF. Concerning the USD, there will be releases of Retail Sales and PPI data at 1:30pm London time, followed later by Crude Oil Inventories at 3:30pm. Finally, we will get the FOMC Statement, Economic Projections and Federal Funds Rate at 7pm.