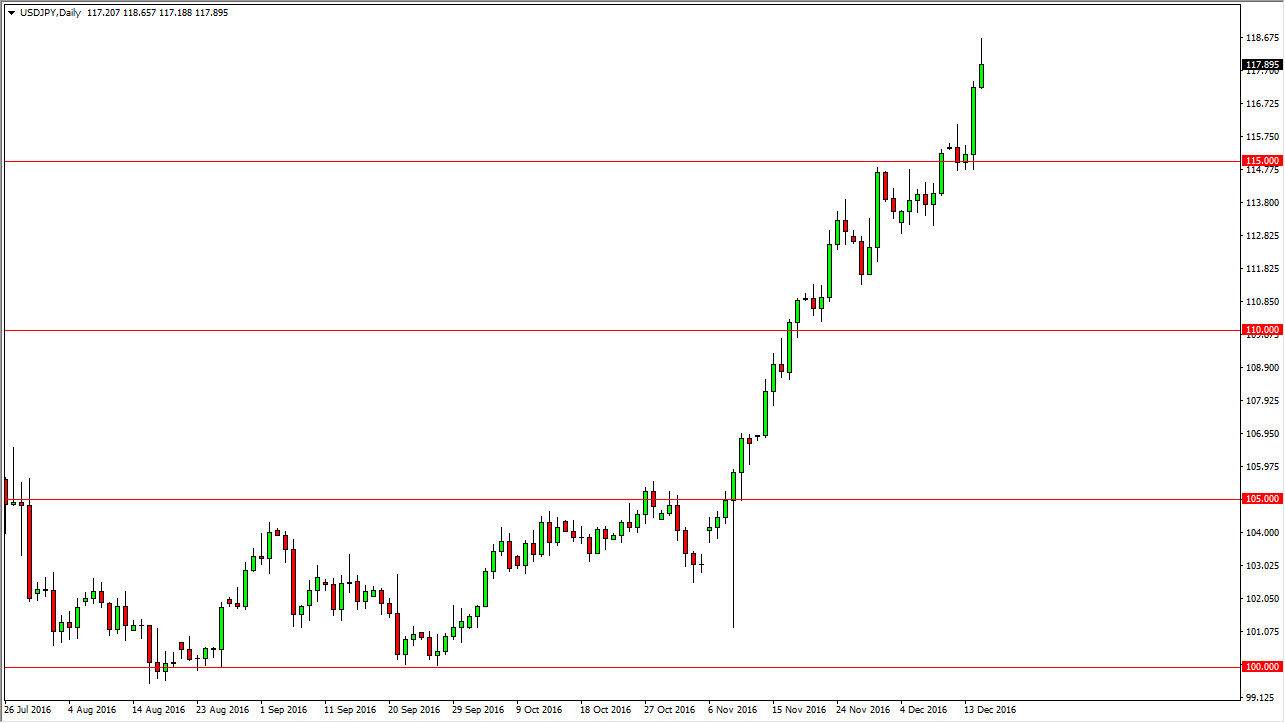

USD/JPY

The USD/JPY pair rallied on Thursday, as we continue to see bullish pressure in the greenback. I believe this will be the case going forward, but we are getting a bit overextended. I think the best way to trade this market is to wait for pullbacks in order to take advantage of “temporary value” in the US dollar, as the 150 level below should be massively supportive and essentially the “floor” in this market. I have no interest in selling, the Bank of Japan is light years away from raising interest rates while the Federal Reserve looks to do so several times over the course of 2017. I think we go to 120 sooner rather than later.

AUD/USD

The AUD/USD pair fell on Thursday as the US dollar continues to strengthen in general. After all, the Federal Reserve is looking to raise interest rates while the Reserve Bank of Australia is nowhere near doing it, so of course it makes sense that the market continues to fall. I think that the US dollar rising is going to continue to put a lot of bearish pressure on the gold markets in general, which in turn has a very bearish force on the Aussie dollar itself. I think that rallies will continue to offer buying opportunities again and again, and that sooner or later we will break down below the 0.73 level and go all the way down to the 0.70 level after that.

I don’t have any interest in buying, but if we can break above the 0.75 level I think it would be likely that the buyers would continue to push harder as that would be a real turn around in the attitude of the markets in general. However, the US dollar remains essentially “the only game in town”, so I think selling is going to be all we can do.