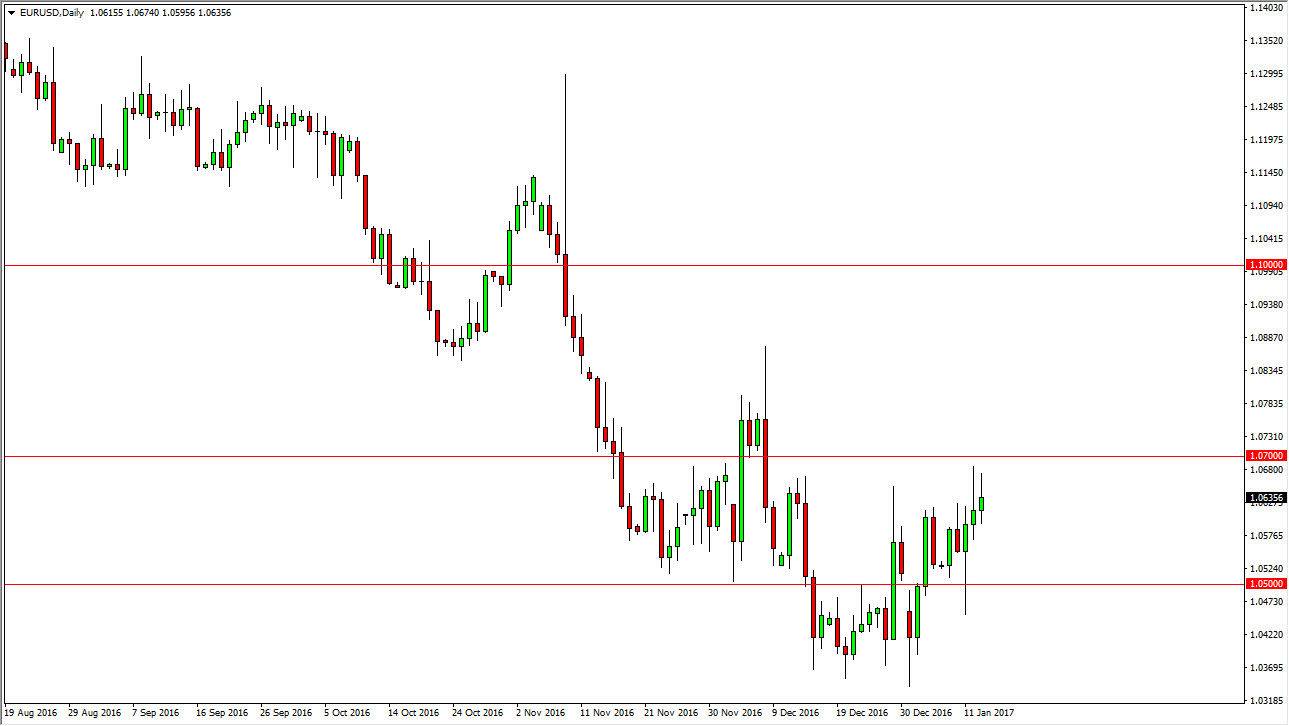

EUR/USD

The EUR/USD pair rallied on Friday, but found quite a bit of resistance above. The 1.07 level continues to be a ceiling in the market, so given enough time I feel that the market will roll back over. The 1.07 level should continue to be difficult to break above, and I don’t think that the breakout can be relied upon until we get above the 1.08 level above. If we can roll back over at this point, I feel the market should then go down to the 1.05 level where we had previously seen support. I think choppiness will be the order of the day, but I do think that the sellers will win out.

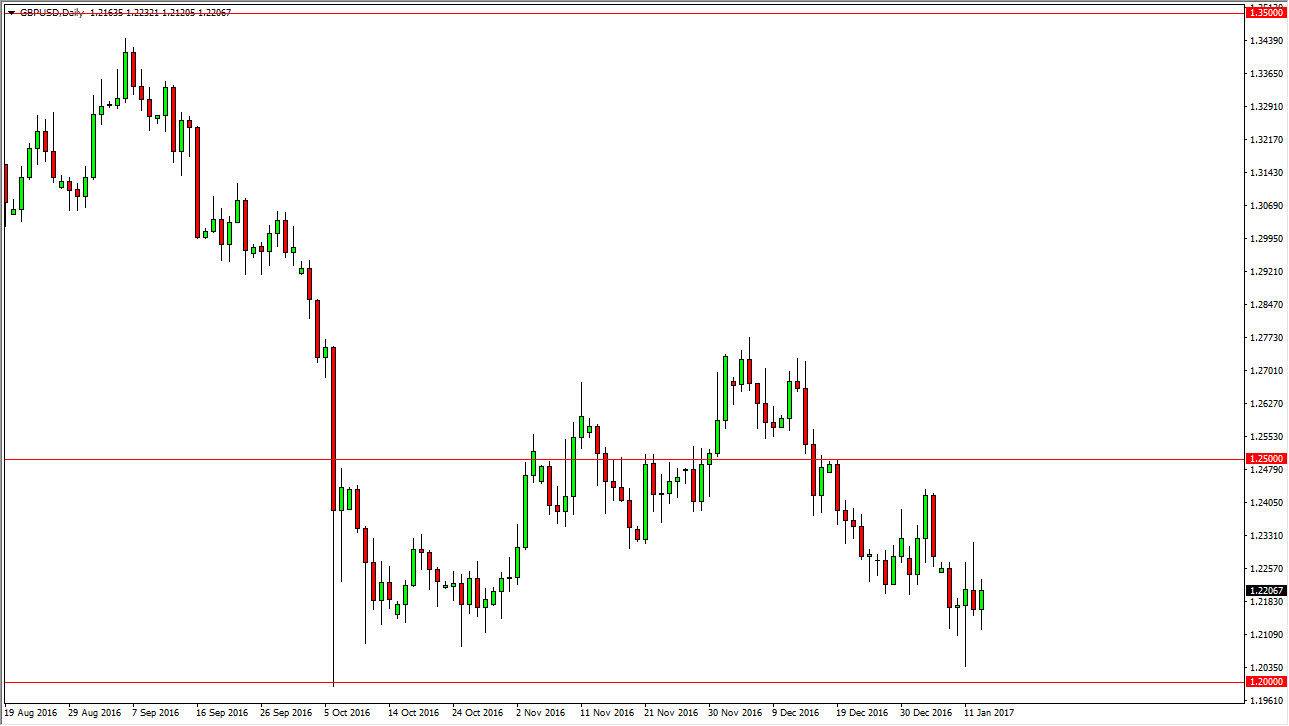

GBP/USD

The British pound had a volatile session on Friday, ultimately settling on a slightly negative candle. The shooting star from the Thursday session offers a shooting star that show signs of exhaustion, but the Wednesday candle show signs of support. What I will look for direction from will see the weekly chart, which shows a strong hammer. That hammer suggests that we are trying to form a bit of a bottom now, and if that’s the case I believe the buyers will one out. Ultimately though, in the short-term it looks like we are going to be very volatile and choppy, so I think that this is a market that might be best avoided in the short-term. If we drop from here and reach towards the 1.20 level, I think the buyers will get involved, and that’s probably the easiest trade to take now.

Ultimately, I think if you have a longer-term perspective buying might pay off but short-term traders are going to continue to struggle as anytime you get close to forming a bottom or trend change you see massive amounts of volatility.