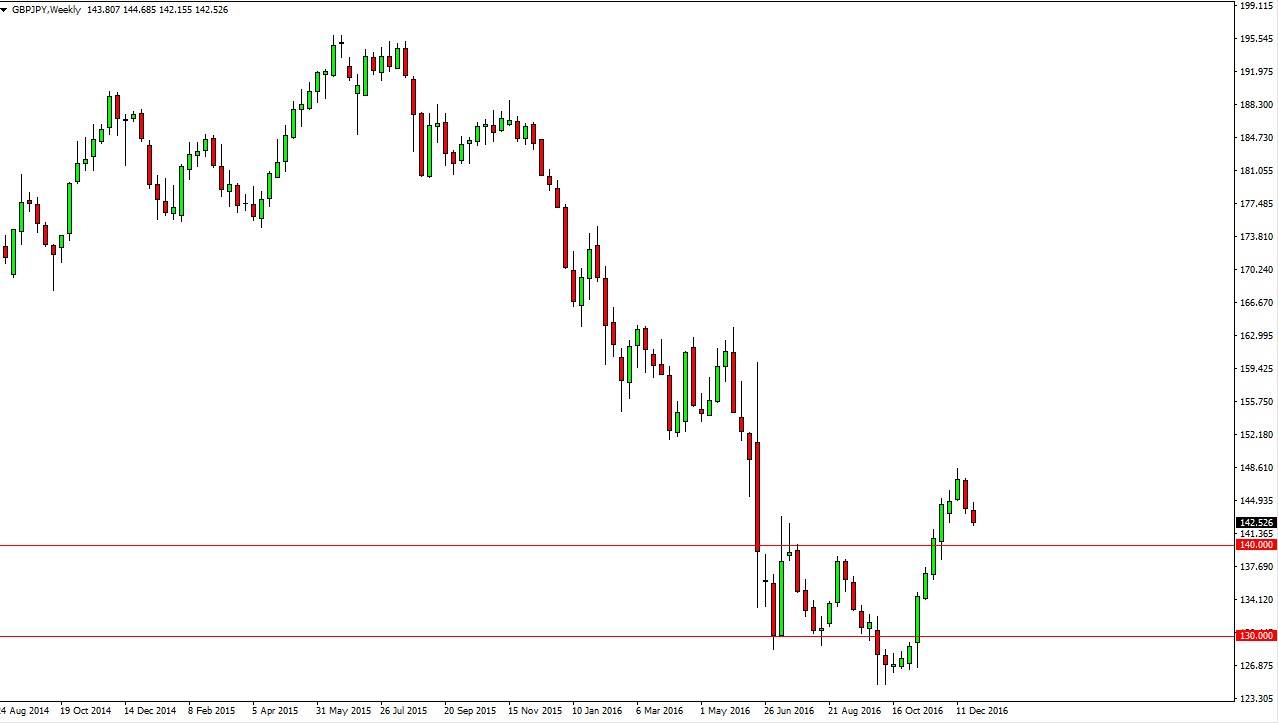

The GBP/JPY pair continues to be very volatile, but over the last couple of weeks we have seen a bit of a pullback. I think ultimately the 140 level will be tested, but I also recognize that it should be supported. It’s not because I like the British pound, it’s because the Japanese yen is so toxic at the moment. A supportive candle in that region gives us an opportunity to start going long and reaching towards the 150 handle. The 150 handle of course will be massively resistive due to the large, round, psychological significance of that number, but I think we can get above there as well given enough time. One of the biggest things I notice about this chart is that we are overextended, just as most other yen related pairs are at the moment.

Bank of Japan

The Bank of Japan is literally light years away from raising interest rates, and are more than likely going to raise the prospects of further quantitative easing sometime soon. The Japanese love the fact that the Japanese Yen is starting to fall in value, as it helps exports. There are no other central banks around the world, with perhaps the exception of the Federal Reserve, that can move their own currency in a negative way like the Japanese, and you are starting to see the fruits of their labor.

I have no interest in selling, I believe that the 140 level will be rather supportive. In fact, I don’t really have a scenario in which I am willing to sell this pair, unless of course something drastic comes out of England itself. If that happens, my suspicion is that the British pound can be sold against almost anything. Barring something like that, this pair should continue to go higher but I think the first couple of weeks will be soft in this pair before finding quite a bit of buying pressure.