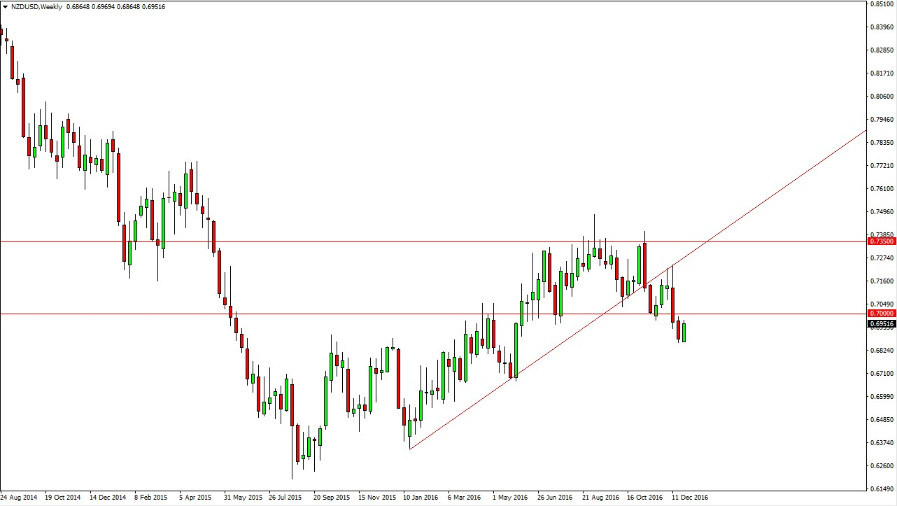

The New Zealand dollar has been volatile over the last couple of weeks, as we have broken down below an uptrend line, and more recently have tried to rally towards the 0.70 level above. I think somewhere between the 0.70 level in the 0.71 level, the sellers will come back into this market and continue to push the New Zealand dollar higher. This makes a lot of sense, because the Federal Reserve is raising interest rates this year, and will continue to put a bit of a bid into the US dollar overall. On top of that, there are a lot of optimistic traders going forward as the US dollar has been rewarded for a Donald Trump presidency. If nothing else, the idea of a President Trump bodes well for business in the United States, and that of course works well for the greenback.

Commodity markets

You have to keep in mind that the commodity markets have an influence on the New Zealand dollar, although not as directly as they do on the Australian dollar or the Canadian dollar. The New Zealand dollar is essentially a “barometer on how the commodity markets feel”, meaning that if the overall attitude markets continue to be negative, the New Zealand dollar will continue to be punished. This is more or less true with soft rather than hard commodities, but in general it holds true.

With an interest rate differential shrinking, it makes sense that more people are going to be attracted to the US dollar as it is considered to be “safer.” It’s not that the New Zealand dollar is a risky asset, just that it is highly leveraged to the Asian economies, and of course the aforementioned commodity markets. I think that the New Zealand dollar will probably try to make its way down towards the 0.65 level over the next month, but like all other currency markets it will be very choppy.