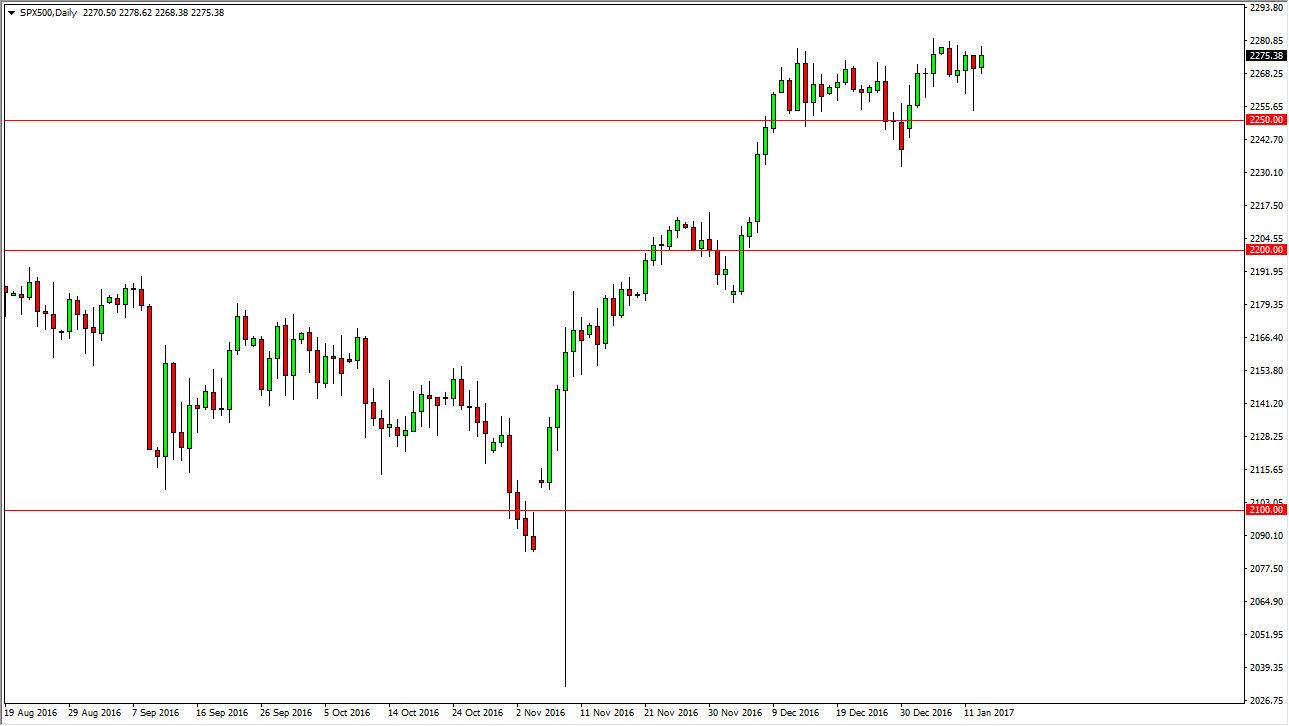

S&P 500

The S&P 500 rallied on Friday, but in a relatively calm manner. The market formed a hammer on Thursday that I’m paying more attention to, because I believe it shows that we are going to break out given enough time. If we can get above the 2280 handle, the market should then reach towards the 2300 level. On the other hand, we could drop from here but if we do I think that the 2250 level below will be the “floor” in the market, and that should offer us plenty of opportunities go long on signs of support and of course bounces. Either way, I don’t have any interest whatsoever in selling, as US indices in general look extraordinarily bullish.

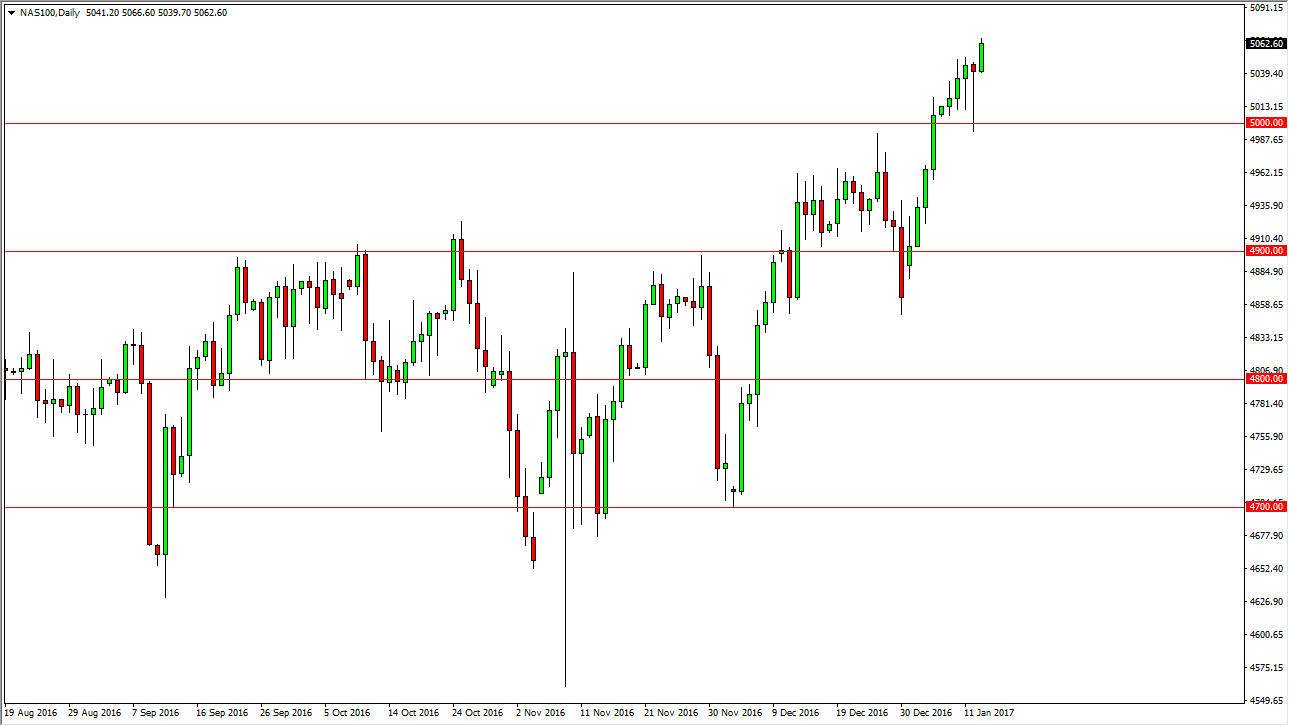

NASDAQ 100

Unlike the S&P 500, the NASDAQ 100 has broken out and continues to look very bullish. We broke above the top of the hammer from the previous session, and it now looks as if are going to try to reach towards the 5100 level. I believe that the “floor” of the market is the 5000 handle. That of course is a psychologically important level, so of course a lot of traders are going to be attracted to trading that region. We are obviously in an uptrend, and the entire world knows it. Because of this, the only thing you can do is start buying. I believe that every time this market pulls back, it’s a buying opportunity, and I think at the very least were going to see a move towards 5100, but I would anticipate even higher moves than that.

Of particular note is the fact that the NASDAQ 100 is now leading the other indices in the United States to the upside, so if you miss this move you might be able to pick up value in something like the Dow Jones 30 instead.