S&P 500

The S&P 500 initially tried to rally during the day on Friday, but turned around to form a negative looking candle. It now appears that we may try to pull back from here, and if we do I think that will simply be a nice buying opportunity. I believe that there is a massive “floor” in the market below at the 2200 level, and as a result a supportive candle should be reason enough to start buying. I have no interest in selling, believing that this market will finally break out towards the 2300 level. Ultimately, the market is in an uptrend, and it now looks as if we are going to continue that uptrend going forward.

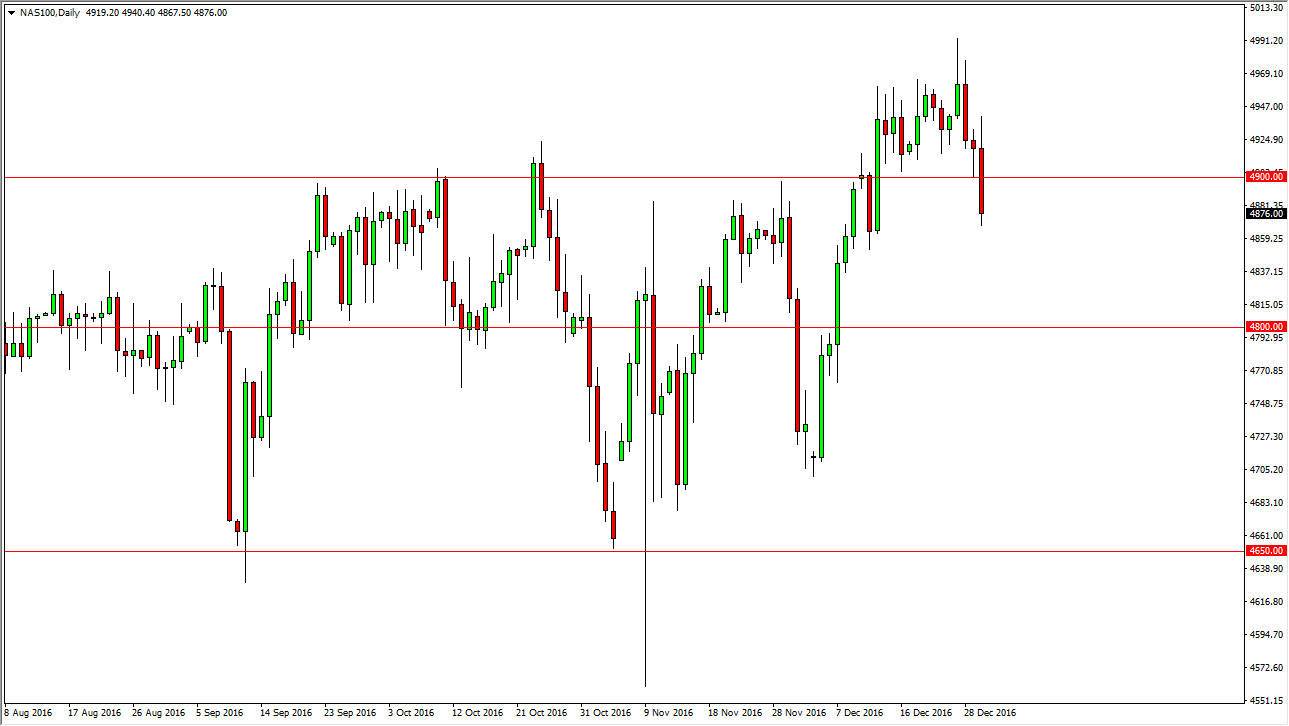

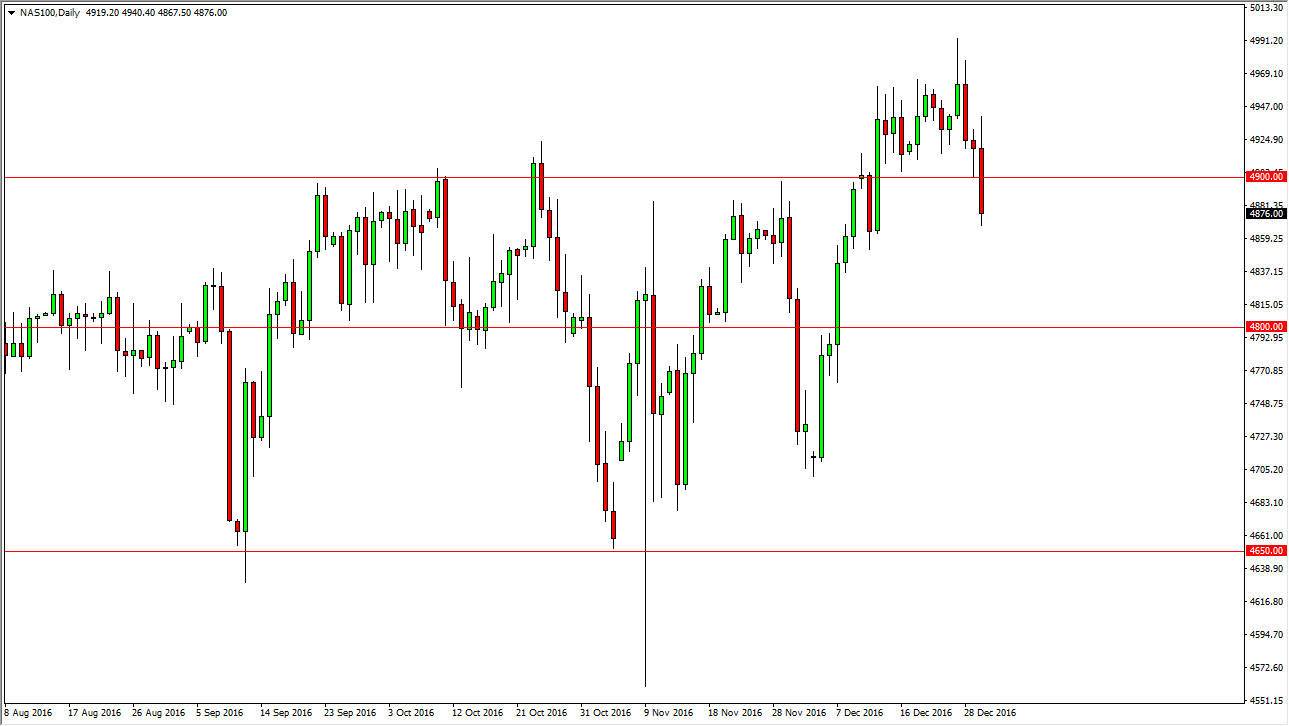

NASDAQ 100

The NASDAQ 100 initially tried to rally during the day on Friday, but then turned around to fall through the 4900 level. This is a bit surprising, but the 4900 level begins a significant amount of support that should come back into the marketplace. Keep in mind that the illiquid markets offer more extreme moves based upon little volume, so having said that I don’t read too much into this “breakdown.” I think given enough time we will have buying opportunities on supportive candles, and as a market will reach towards the 5000 level in the future.

I believe that the 4800 level underneath continues to offer massive support, and as a result I’m simply waiting for an opportunity to go long. I have notched in shorting, and I believe that the US indices in general should continue to go higher. The market continues to favor the US indices overall anyway, and I think a lot of this could’ve been due to money managers looking to book profits at the end of the year for clients. The next couple of sessions could be very volatile, but eventually the buyers come back.