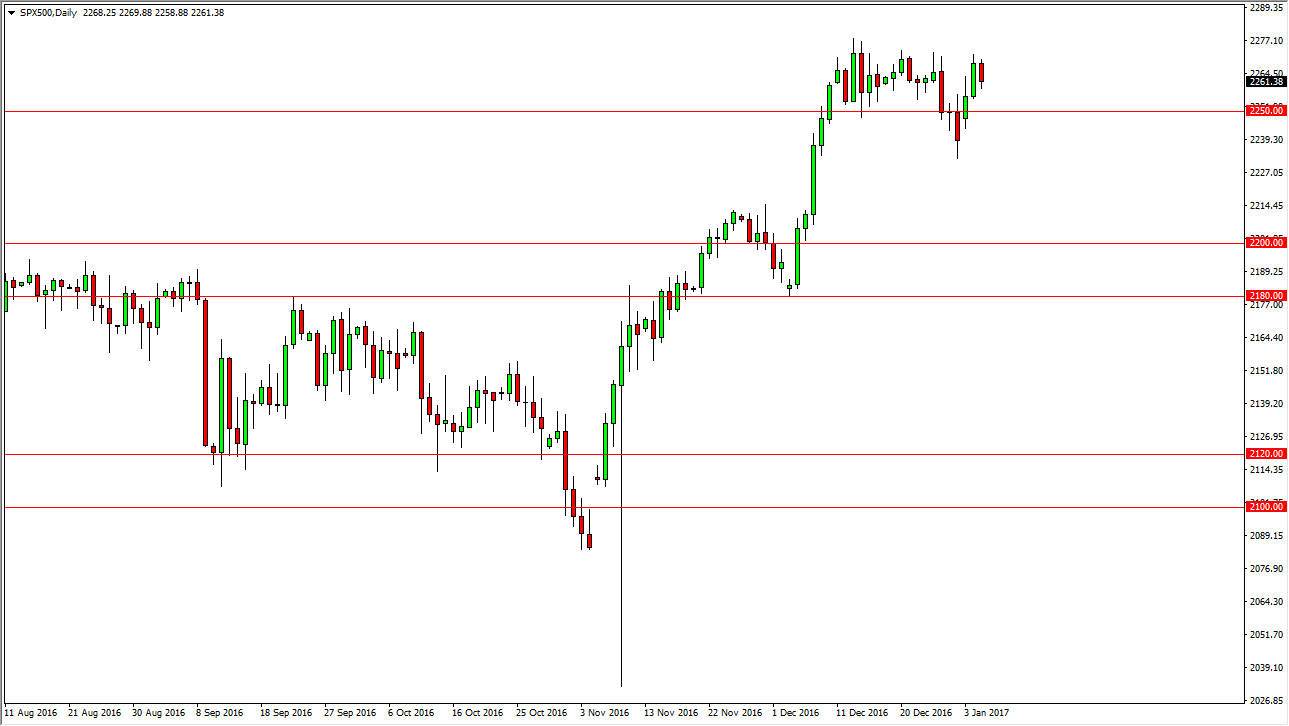

S&P 500

The S&P 500 fell during the day on Thursday, showing signs of exhaustion at the top of what has been decent consolidation. I believe that the market will find buyers below, and every time we pullback it’s more than likely going to offer value that people will want to take advantage of. If we can break above the 2275 level, the market should then go to the 2300 handle, perhaps even higher than that. We are in a longer-term uptrend, so therefore have no interest in shorting this market as US indices overall look very healthy. The 2200 level underneath offers quite a bit of support, and is essentially the “floor” in this market.

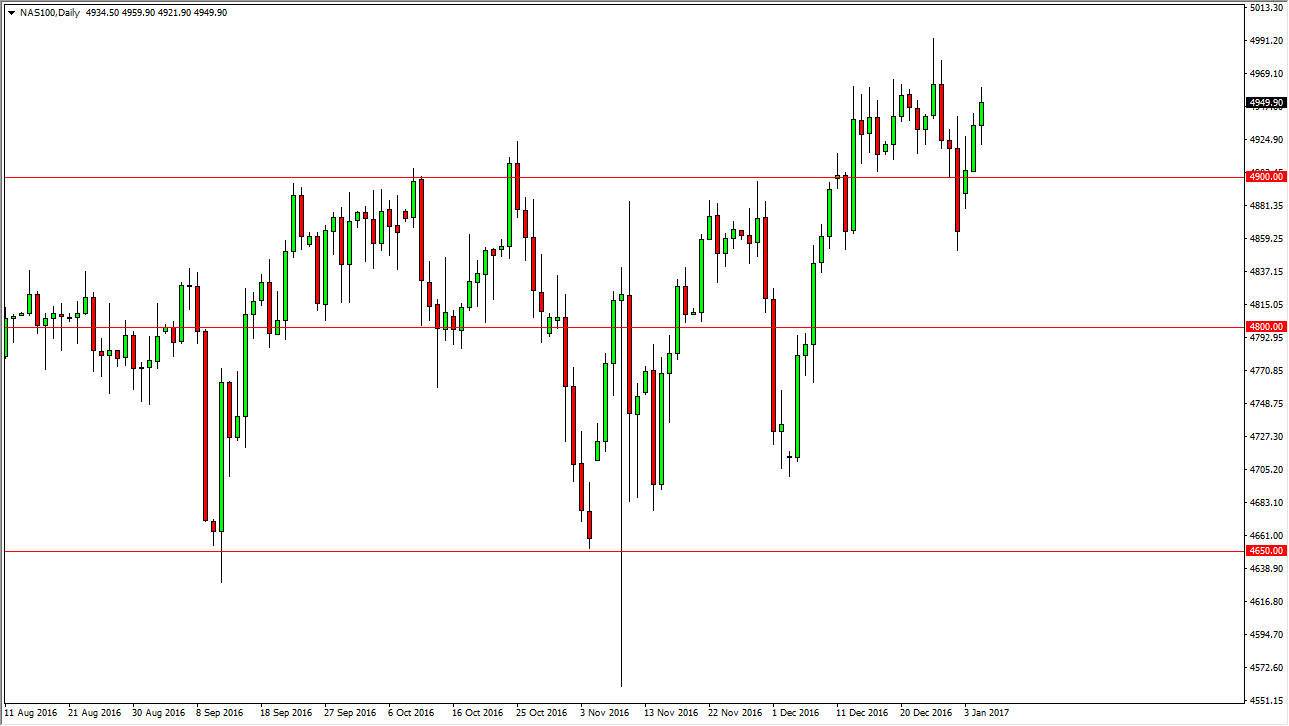

NASDAQ 100

The NASDAQ 100 fell initially during the day on Thursday, but turned around to break towards the 4950 handle. Ultimately, on pullbacks I think that the 4900 level below is the short-term “floor” in the market, perhaps giving us an opportunity to reach towards the 5000 handle above. Once we break above there, the market should then continue to enjoy a longer-term uptrend. I have no interest in selling, because quite frankly there is so much in the way of support below and US indices on the whole have been very healthy.

The market looks likely to be volatile, but if we get a good jobs number I don’t see any reason why the NASDAQ 100 doesn’t just shoot to the upside. This would offer longer-term buyers some confidence and a continuation of the uptrend, and could flood the market with decent amount of money as they have been in a liquid due to the holidays. Now that the jobs number is coming out, larger players will feel more comfortable putting money to work in the market has traders return to their desk.