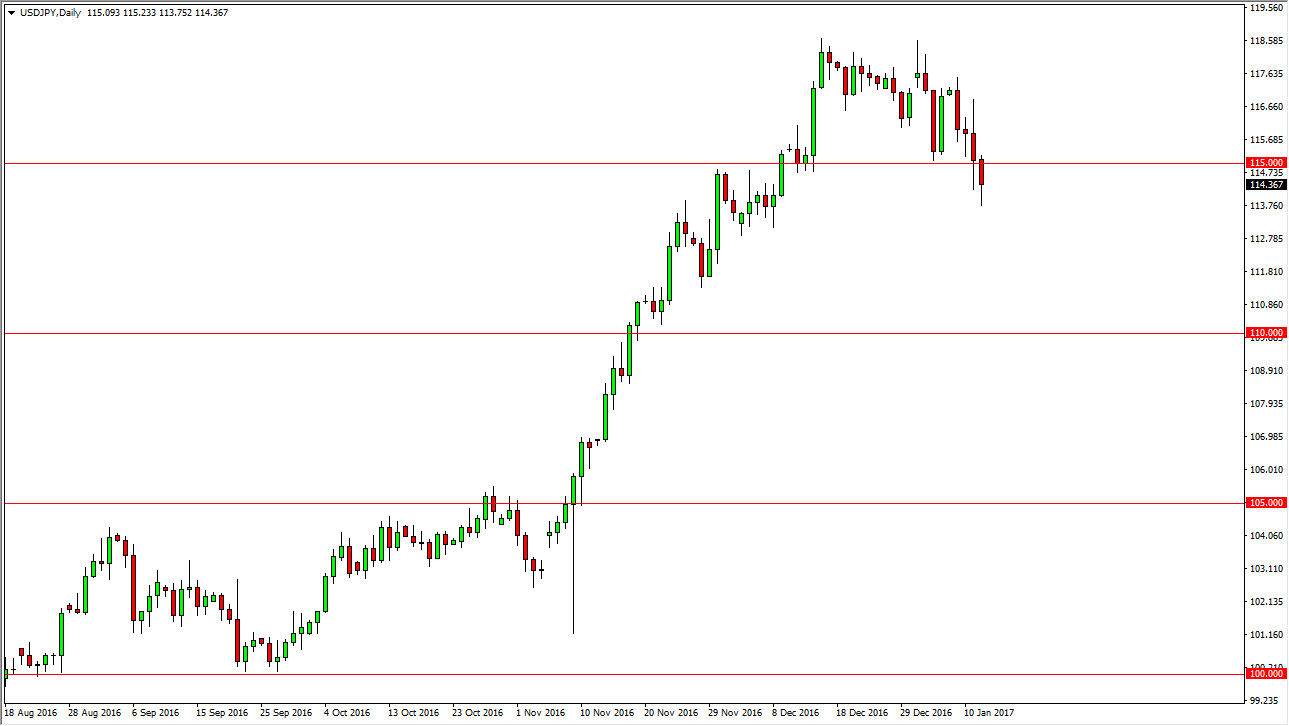

USD/JPY

The USD/JPY pair fell during the session on Thursday, breaking below the 115-support barrier. While that is a very negative sign, the reality is that I see a massive amount of support at various levels all the way down to at least the 111.50 handle. Because of this, I’m waiting to see a supportive candle on the daily chart to start buying again. I have no interest in shorting, and I believe that given enough time traders will look at this as value in a market that has been extraordinarily strong until the last couple of weeks. This pullback is natural, and should only attract more traders to go into the market for the longer-term move that is undoubtedly coming.

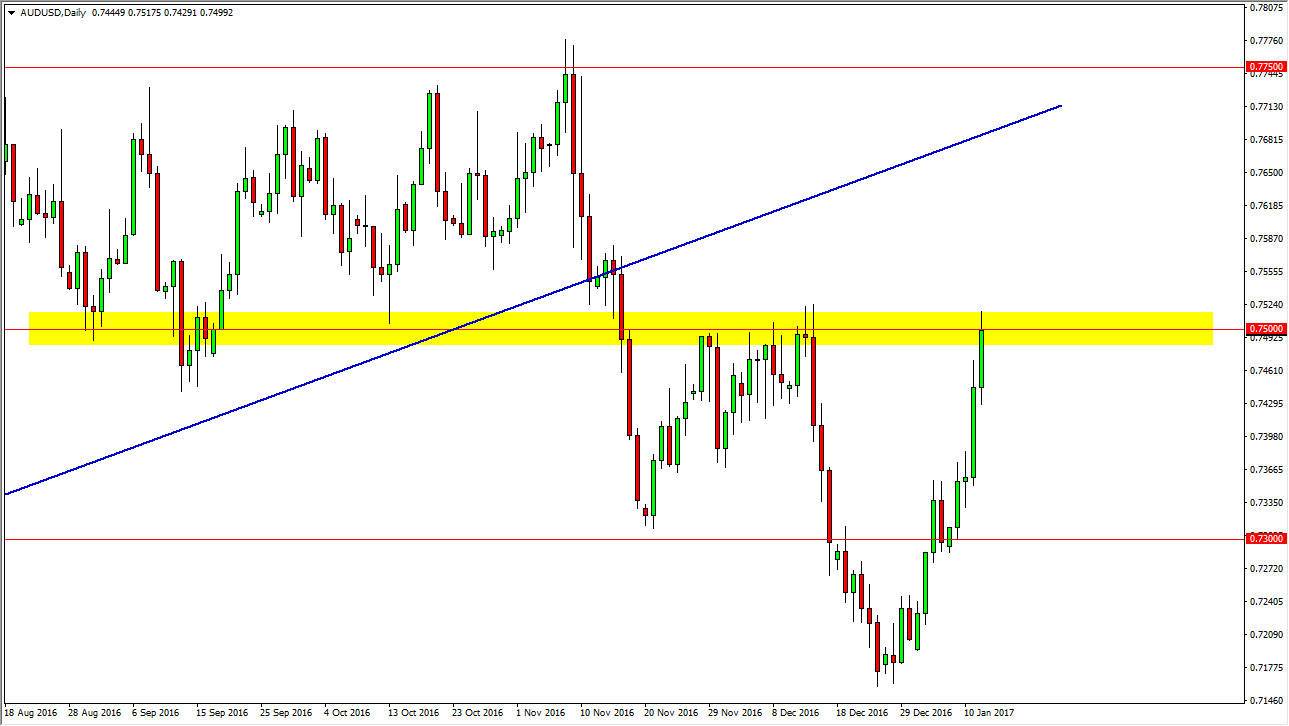

AUD/USD

The Australian dollar rallied on Thursday, crashing into the 0.75 resistance barrier. This is an area that I believe will show a significant amount of resistance, so the fact that we are overextended has caught my attention as well. Because of this, I’m waiting to see whether or not we form an exhaustive candle that we consider selling. At the same time, the gold markets are testing significant resistance, so I feel it’s only a matter of time before the sellers come back in. However, I recognize that I don’t have the right signal, and I also recognize that a move higher breaks all resistance in the market should continue to grind to the upside. A break above the 0.7525 level should be a sign that we are going to continue to reach towards the 0.7650 handle. If we can turn back around and break below the 0.7450 level, I feel the market will drop just as suddenly as it rose due to the inherent volatility of both the gold market and the Australian dollar itself.