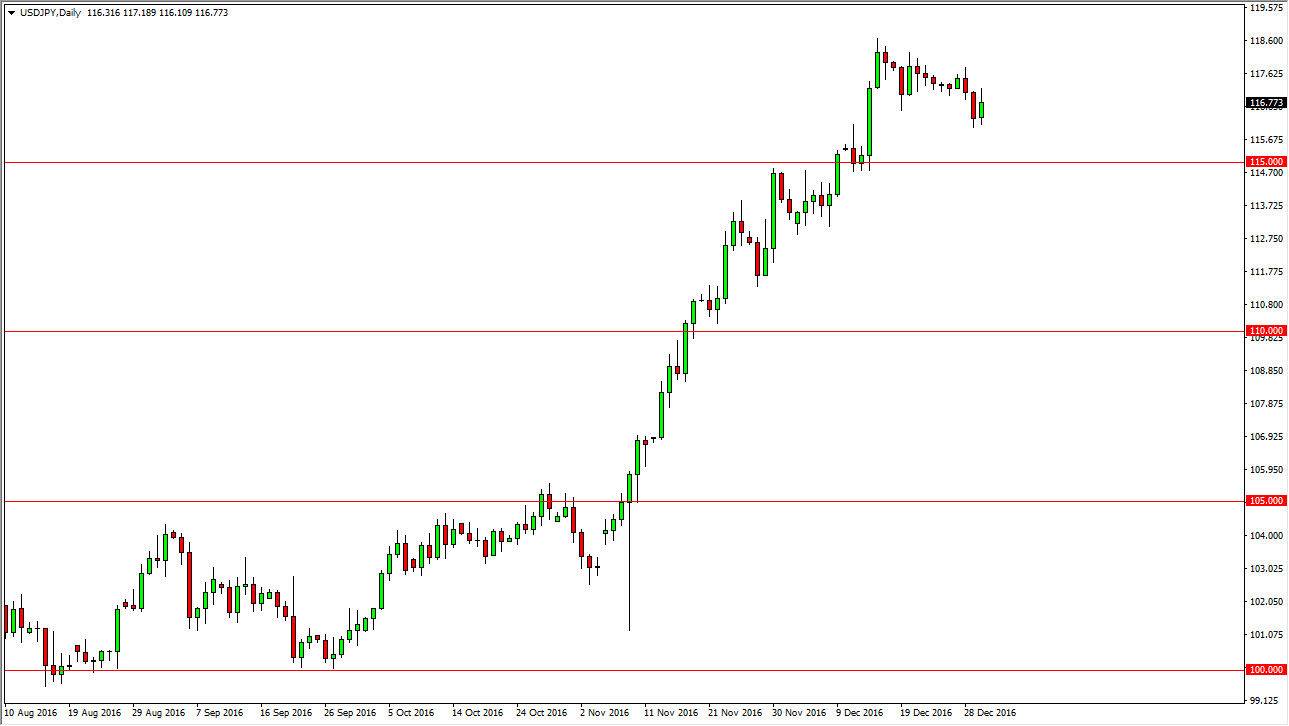

USD/JPY

The US dollar rallied against the Japanese yen during the session on Friday, bouncing off of the 116 region. However, this is a market that continues to show quite a bit of volatility, ultimately with an upward slant. The 115 level underneath continues to be supportive as far as I can tell, as it was previously resistive. A supportive candle in that area would be a nice buying opportunity, as we should continue to reach higher and perhaps towards the 120 handle above there. Keep in mind, the Japanese yen sells off against almost anything at the moment, so this market should continue to favor the US dollar over the longer term. Have no interest in selling until we get below the 111 handle.

NZD/USD

The New Zealand dollar initially fell on Friday, but turned around to form a neutral looking candle. The 0.70 level above should now be resistive, so I’m waiting to see whether or not we turn around and start falling from that area. An exhaustive candle in that area should be a nice opportunity to pick up the US dollar “on the cheap”, as the New Zealand dollar of course is very sensitive to the commodity markets in general. Even if we broke above there, I think there is a massive amount of resistance all the way to at least the 0.72 level, so I have no interest in buying.

I think the target will be the 0.68 level based upon the longer-term charts, because it was so important in the past. I also recognize that most commodity markets are struggling, perhaps with the exception of energy which of course the New Zealand dollar has almost nothing to do with. Because of this, I remain bearish and am waiting for selling opportunities via exhaustive candles above or possibly a break down below the bottom of the hammer from the session on Friday.