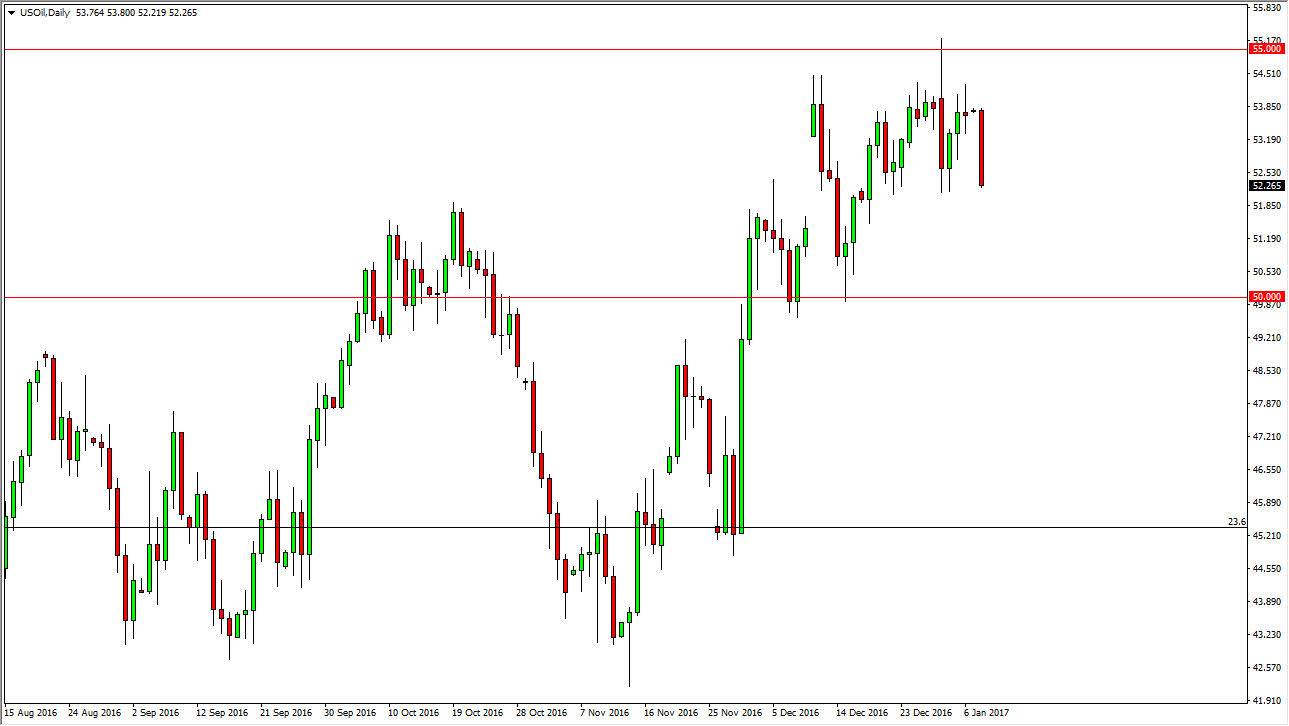

WTI Crude Oil

The WTI Crude Oil market broke down on Monday, showing signs of weakness yet again. I believe if we can get below the $52 level, the market should then drop to the $50 handle. This is a market that’s going to have to deal with oversupply, as higher prices have US and Canadian drillers getting aggressive with shale oil production, and other types of petroleum fields. Even if OPEC it does stick to its production cuts, the reality is that the only have so much as far as influence, and on top of that you must worry whether there is going to be enough demand for petroleum. Recent inventory numbers to come out of the United States suggest otherwise. Because of this, I believe that rally should be selling opportunities.

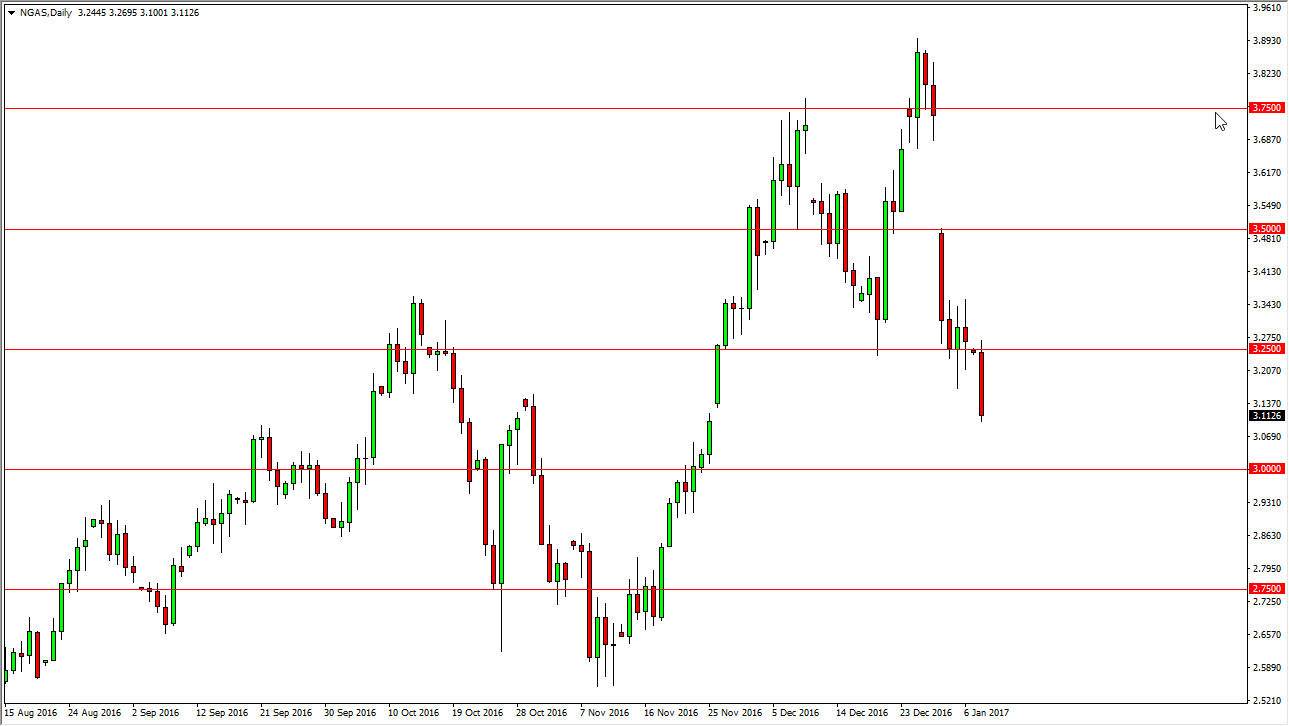

Natural Gas

Natural gas markets continue to crater during the session on Monday, as we reach towards the $3.10 level. I think that there is significant support at the $3.00 level, so we could get a bounce from there. We have certainly taken off to the downside, as stronger than anticipated temperatures during the month of January have shaken the demand equation when it comes to natural gas. On top of that, the US dollar is strong, so that of course has some influence as well. There is a massive gap above that suggests the downtrend is going to take over again, but we have not tried to fill that gap yet, which typically happens. Because of this, I believe there is a massive bounce coming soon, but I’m going to wait until that runs out of strength to start shorting aggressively.

In the short-term, I might be willing to sell on a break down below the bottom of the range during the day on Monday, but this is a short-term opportunity at best.