The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 12th March 2017

Last week, I predicted that the best trades for this week were likely to be short NZD/USD and long USD/CAD. Both these trades were winners, with the NZD/USD falling by 1.73% and the USD/CAD rising by 0.64%. The average gain was 1.19%.

The Forex market remained in a relatively indecisive mood with few clear trends, particularly regarding the U.S. Dollar which is usually the main engine behind major market moves. Although the non-farm payrolls came in last week at a healthy number, it was below the ADP forecast and the market seemed as if it was somewhat disappointed. This suggests that the bullishness in the greenback is somewhat muted and less likely to be the main driver of the Forex market over the coming week.

The most bearish currencies in general against a long-term basket of currencies remain the New Zealand and Canadian Dollars, and to a lesser extent the British Pound. Therefore, I suggest that the best trade of the coming week will be long the U.S. Dollar and short of the New Zealand and Canadian Dollars, as well as the British Pound.

Fundamental Analysis & Market Sentiment

The major element affecting the market right now is the perception that a U.S. rate hike is more likely to happen this week, following recent comments from two members of the FOMC. There are several central bank inputs due later this week, so it seems as if the market will be in a holding pattern and waiting to react to each of them.

The British Pound has also had some attention as a war of words intensifies between the E.U. and the U.K. government, with the U.K. government making clear that it is prepared to exit the E.U. without any agreed deal. This has weighed on the Pound over the past week.

Technical Analysis

USDX

The U.S. Dollar printed a small bullish candle with a notable upper wick within the scope of a wider bullish trend that is manifested over the long term. Note how the price has found support close to the supportive trend line and the horizontal level at 12293, as shown in the chart below. Also, the price is

still above its level from 3 months and 6 months back, which is a sign the bullish trend remains in force. However, the upper wick on the recent candle suggests the Dollar is struggle to advance.

NZD/USD

This week we see another large bearish candle following last week’s large bearish candle, which seems to be forming with a lot of strong downwards momentum. The price is also below its levels from both 3 months and 6 months, indicative of a long-term bearish trend. All the signs are bearish except one: the price is now not far from an area of significant support in the region of 0.6860. This may be likely to halt the fall, if the price gets there.

USD/CAD

This week we see another bullish candle, which is bullish except for the fact that is has a noticeable upper wick. The strong upwards movement has brought the price to above its levels of both 3 months and 6 months suggesting a new bullish trend is beginning. However, the price is very close to an area of key resistance at about 1.3550 resistance, which has held for an entire year and as such might be hard to break.

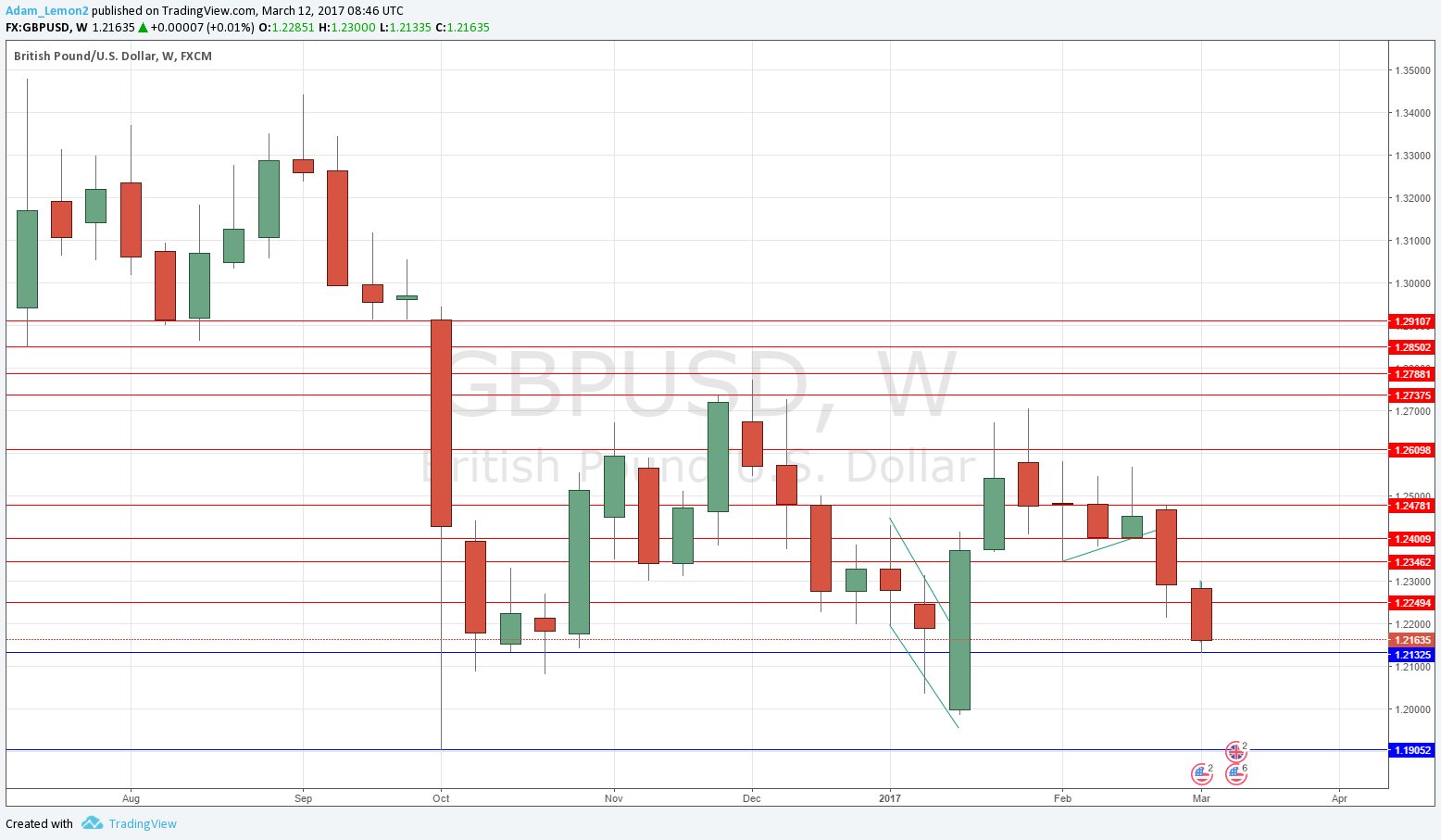

GBP/USD

This week we see another bearish candle, which has closed near its low. Its looks to be a very solid part of a downwards movement. This movement has brought the price to below its levels of both 3 months and 6 months suggesting a strong bearish trend is in force. The only note of caution lies in the fact that the 1.2000 level and below may prove to be very tempting for long-term buyers, which could drive the price up if it is reached.

Conclusion

Bullish on the U.S. Dollar; bearish on the New Zealand and Canadian Dollars, and the British Pound.