The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 16th April 2017

Last week, I predicted that the best trade for this week was likely to be long the Japanese Yen, and short of the New Zealand Dollar. This trade worked out very well, falling by 1.29%.

The Forex market is in a more settled mood. The Japanese Yen and other “safe-haven assets” continue to advance, while the U.S. Dollar looks weak. The market has been dominated by concerns over Korea, although the concerns seem to have been overstated as the Japanese Yen was continuing to advance right until the market closed at the end of the week. Although the Japanese Yen benefits from money flow into perceived safe havens, it could be expected that a real expectation of an outbreak of war in Korea would have hurt the Yen as Japan could be a target in such a war.

The most bearish currency in general against a long-term basket of currencies is now the U.S. Dollar, while the most bullish is the Japanese Yen. Therefore, I suggest that the best trade of the coming week will be long the Japanese Yen, and short of the U.S. Dollar. Gold and Silver also look bullish against the U.S. Dollar.

Fundamental Analysis & Market Sentiment

The major element affecting the market right now is nervousness over military confrontation. However, this may lift now as it seems that the North Korean missile test was a failure, and both sides will now step away from bellicose rhetoric, with no more potential flashpoints scheduled for the time being.

Technical Analysis

USDX

The U.S. Dollar printed a strongly bearish engulfing candle this week, closing hard on its low, with a long real body. The new bullish trend line is threatened, but still intact. The price is returning to an area I had identified as supportive, shown by the blue lines in the chart below. The price still below its level from 3 months back. The signs are bearish, but it would not be a surprise if the bearish movement fails here, at least for a short while. Alternatively, a break below 12218 could trigger a sharp fall in the greenback and a more decisively bearish outlook.

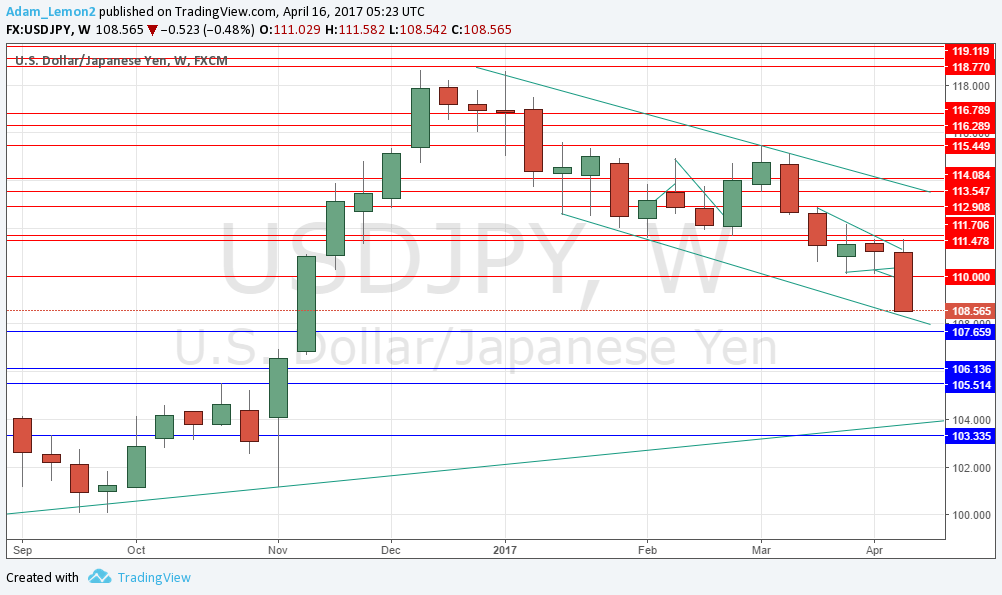

USD/JPY

The weekly chart below shows that this currency cross is in a strong downwards trend, printing another strongly bearish candle which closed near its low. The price is also well below its recent historical levels. The only possible factor standing in the way of a further fall would be the lower channel trend line shown in the chart below, which the price is now close to.

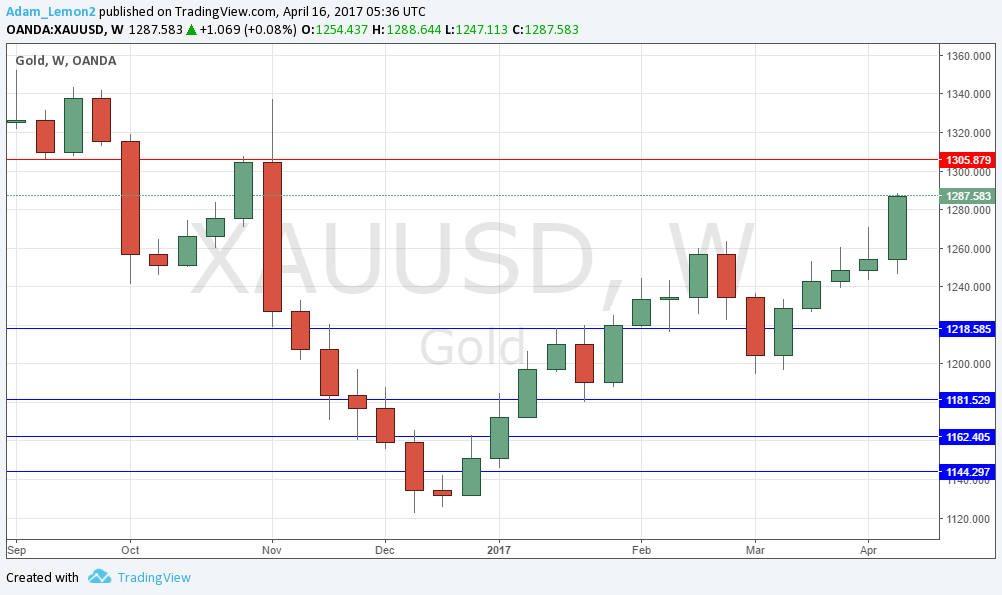

GOLD

The weekly chart below shows that this currency cross is in a strong upwards trend, printing a strongly bullish candle which closed near its high. The price is also above its recent historical levels from both and 3 and 6 months. However, a possible factor standing in the way of a further large rise would be the key resistance level at $1305, which the price is now close to.

Conclusion

Bullish on the Japanese Yen; bearish on the U.S. Dollar.