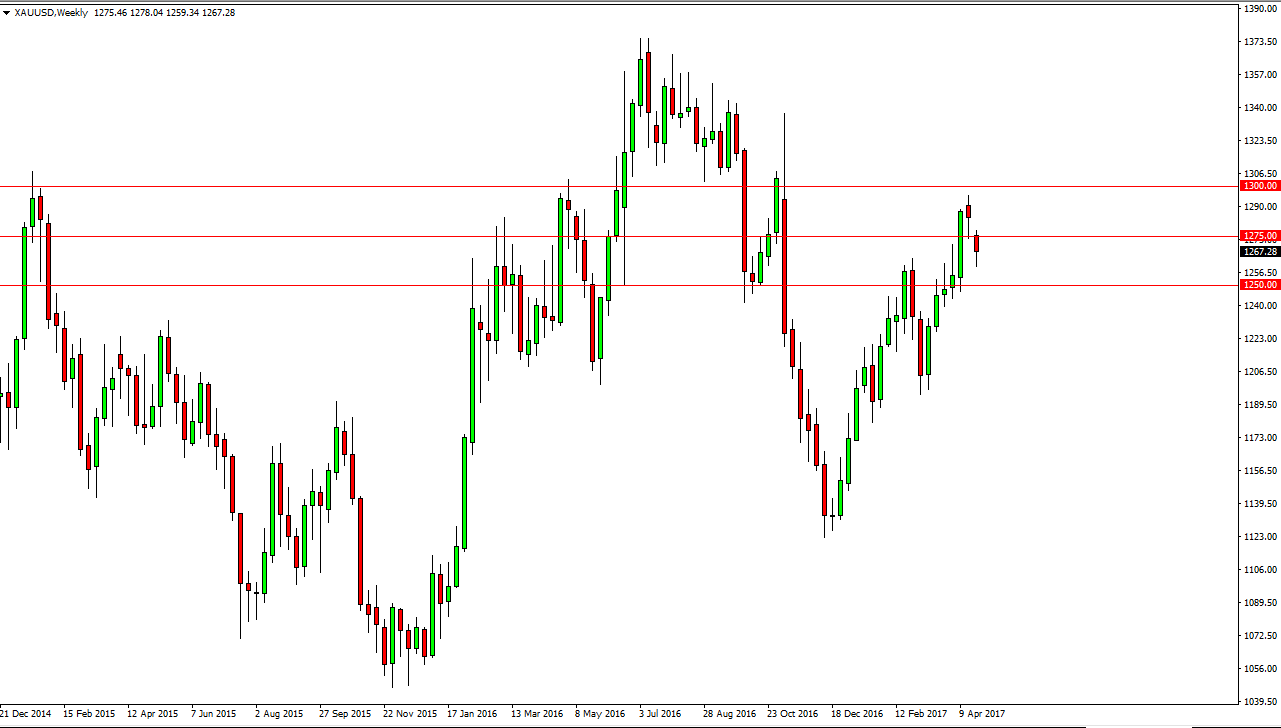

Gold markets gapped lower at the open of the week, and continued to go lower from there. The 1250 level offered support and bounced. The market has been bullish longer-term, and recently has seen a pullback. This could offer support as people will look for value in the market place. The markets will have a bit of a bid due to geopolitical concerns around the world. The majority of people look at this asset as a safety trade, and while that could be at times, this is more about diversification than anything else. The 1300 level above will be resistive, and this being broken to the upside would be a sign that the market is going to go much higher.

Buying on dips

The market pulling back should continue to offer the value, and traders so far have been willing to take advantage of. The 1250 level below should be the ‘floor’ in this market. The longer-term outlook should continue to be positive, but keeping low leverage should be in the back of your mind as it is volatile. The situation in the Korean peninsula by itself could be reason to drive the price of precious metals higher, especially gold.

The market also has Syria to think about, as well as the situation in the European Union, and the possibly of a French surprise in the election. Because of all of these reasons, I think that gold will find a reason to rally no matter what happens over the next several weeks. If you have the ability to buy physical metal, that is also is a possibility to lessen any issues. The markets will continue to jump around from time to time, but the overall strength of the last few months cannot be denied. There is no interest on my part to short this market.