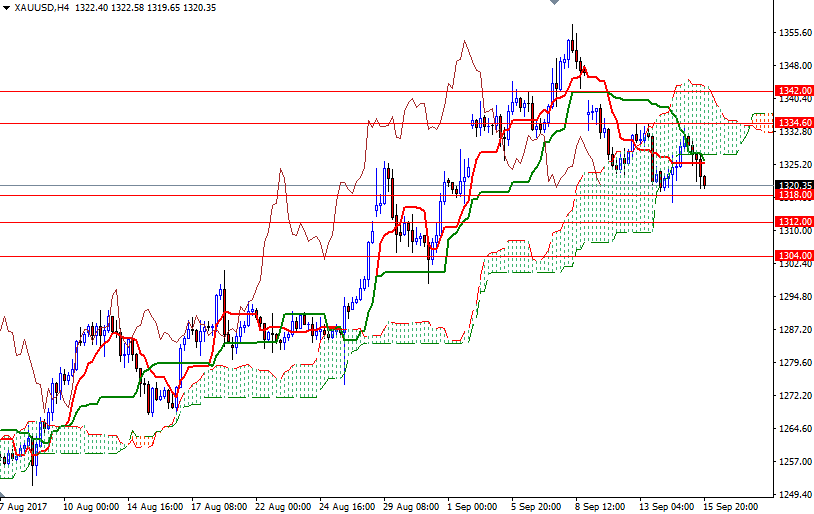

Gold ended the week down 1.23% at $1320.35 an ounce, ending its three-week winning streak, as signs of stabilization in riskier markets took some momentum away from the precious metal. XAU/USD tried to climb back above $1342-$1339 after a gap down on Monday but ultimately ended up breaking below the support in the $1334.60-$1332 zone. The rallying U.S. stock markets and a rebound in the dollar were negatives for the safe-haven gold market.

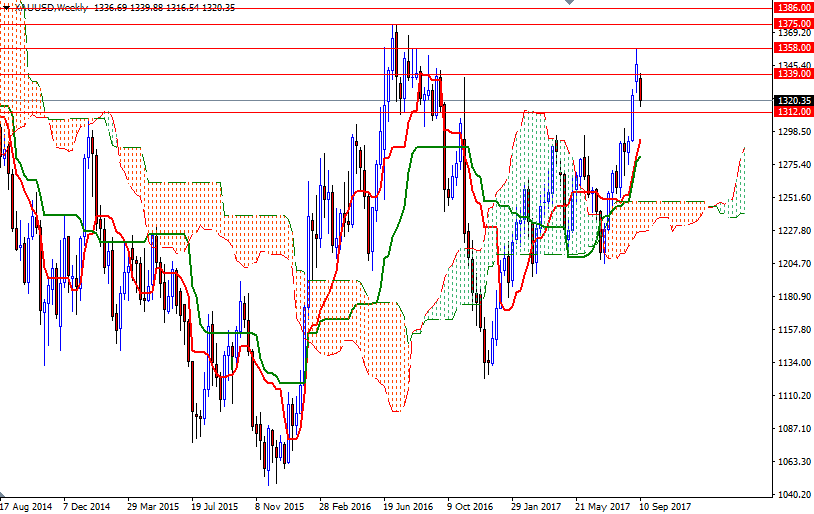

Last week's decline was not a big surprise though. As I mentioned in my previous weekly analysis, the failure to break through the 1358/3 area had suggested that the market was due for some kind of correction or at least a hiatus in the rally. All eyes will be on the Federal Reserve policy meeting this week. While the outlook for rates is uncertain, it seems more likely that the Fed will announce the start to the process of reducing its balance sheet at its meeting. From a chart perspective, residing above Ichimoku clouds (the weekly and the daily time frames) suggests that gold is likely to maintain bullish trend over the medium term. However, downside risks remain as the market trades below the clouds on the 4-hourly and the hourly charts.

XAU/USD spent much of the week between 1334.60-1332 and 1318-1316.50 so I will be focusing on this consolidation box. A drop below 1316.50 could lead to a test of the 1312 level, which happens to be the daily Kijun-sen (twenty six-period moving average, green line). If this support is broken, look for further downside with 1308 and 1304/0 as targets. Closing below 1300 on a daily basis implies that the bears will be aiming for 1294/2 next. To the upside, the initial resistance sits at 1328, the bottom of the 4-hourly cloud, followed by the aforementioned 1334.60-1332 zone. A daily close beyond there signals an expansion to 1339/8 or perhaps 1344.40-1332. The bulls have to capture this strategic camp (1344.40-1332) if they intend to make an assault on 1352/0.