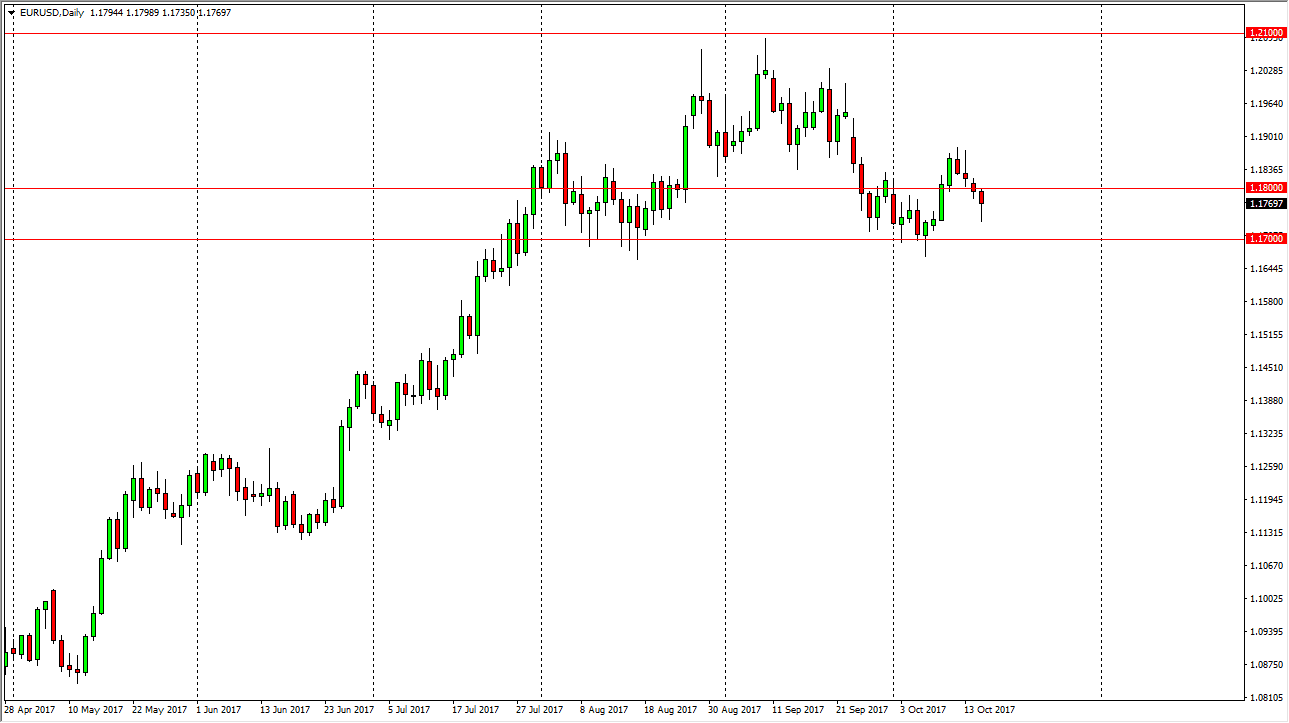

EUR/USD

The EUR/USD pair fell during the Tuesday session, reaching towards the 1.17 level underneath. The market has a significant amount of support there though, so the fact that we ended up bouncing and form a bit of a hammer suggests to me that the market is going to break above the 1.18 level above, and continue to grind its way to the upside. I think that the market will eventually go looking towards the 1.20 level above, perhaps even the 1.21 level after that. If we can break above the 1.21 level, the market then should go looking towards the 1.25 level above. We had recently broken above a consolidation area that extended almost 3 years, and measured for a move to the 1.25 level. There’s nothing on this chart the tells me we are going to be able to do that.

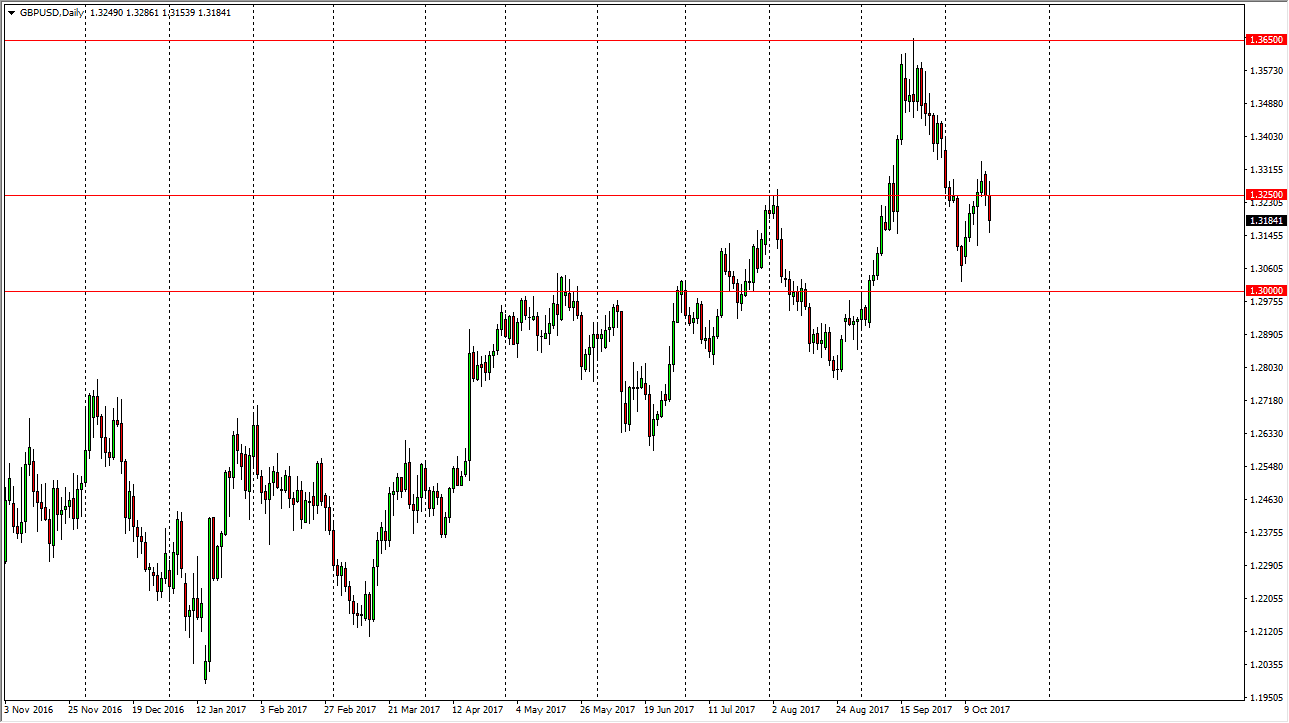

GBP/USD

The British pound initially tried to rally during the day on Tuesday, but found enough resistance above the 1.3250 level to turn around and fall again. I think there is significant support underneath, closer to the 1.30 level underneath. I think that the market will eventually find buyers between here and there, and eventually tries to break out to much higher levels. The market should then go looking towards the 1.3650 level over the longer term. There is a bit of an uptrend line just below the 1.30 level as well, which should keep the market somewhat afloat. When I look at the US dollar against many other currencies around the world, it looks as if the greenback is going to have a tough session, so a bounce in this market would not be a huge surprise. Nonetheless, the British pound continues to be very noisy.