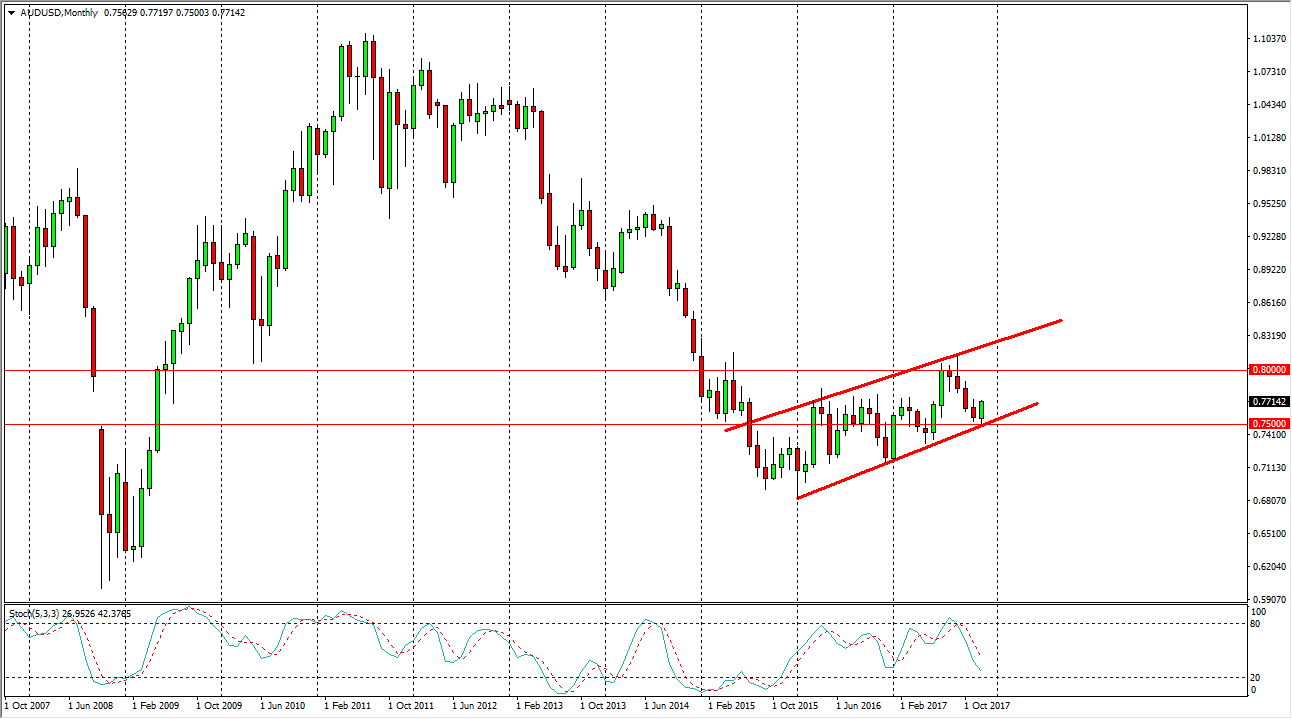

The Australian dollar has been rather choppy over the course of the last year, but as you can see on the chart we have been bouncing around in a nice uptrend in channel. Because of this, I think we continue to find support on dips, and I think we’re going to go looking towards the 0.80 level. Once we clear that area significantly, and perhaps more importantly the highs of 2017, I think that the market is free to go much higher, probably the 0.90 level above. Alternately, if we were to break down below the 0.75 handle, that would be a very negative sign and could send this market back down to the 0.68 handle.

As I look at the gold markets, which of course are one of the biggest drivers of the Australian dollar in general, I noticed that we are starting to see buyers jump into the marketplace. I think that the year is looking to be a very negative one for the US dollar in general, so having said that I think that the market will probably continue to be one that will grind its way to the upside, but for those of you focusing on short-term charts it might be a bit difficult. By the time we get through the year, I fully anticipate that we are breaking out above the 0.80 level, and continuing to the upside. I think the one outlier could be is if the global markets melt down due to some type of geopolitical event, or financial crisis. Beyond that, I think that we are probably looking at a very constant and steady moved to the upside as global growth seems to be picking up overall, which will drive demand for commodities coming out of places like Asia, which is very good for Australia.