USD/JPY

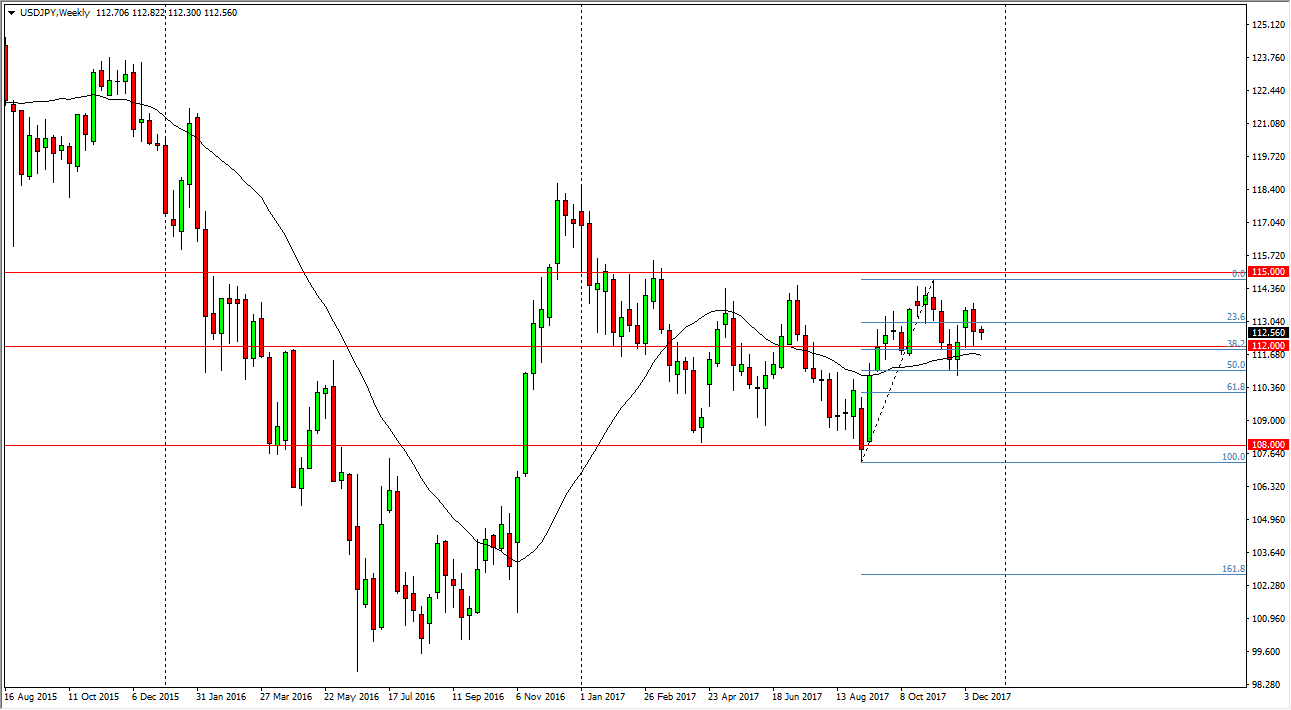

The US dollar has been reasonably positive against the Japanese yen over the last several months, and it looks likely that we will continue to see buyers underneath, as the 112 level is the 38.2% Fibonacci retracement level from the recent rally. Below there, we have the 50% Fibonacci retracement level at the 111 level, and I think these 2 areas of the most important levels to pay attention to. When I look at the last year, it’s obvious that we have formed some type of “W pattern”, and that means that we could be looking for bullish pressure going forward. A break above the 115 handle would be a very bullish sign, and I think that could send this market looking for the 122 handle as it would be a break of the range for the last year.

In general, this is a market that is risk appetite driven, and of course will be influenced by the tax reform bill. If we were to break down below the 110 level, that could roll this market over to the 108 level. A breakdown below there would be catastrophic. Nonetheless, I believe in buying, and I think that eventually we get the “risk on” attitude that markets need to push higher. We will be very noisy between now and then, so looking for short-term pullbacks for signs of opportunity. I think the given enough time, this is a market that could end up being a very strong trade for the year, and could be one of the most interesting markets. If we break out to the upside with the stock markets, then I think there could be a strong argument for this market to go higher. Otherwise, expect choppiness in general.