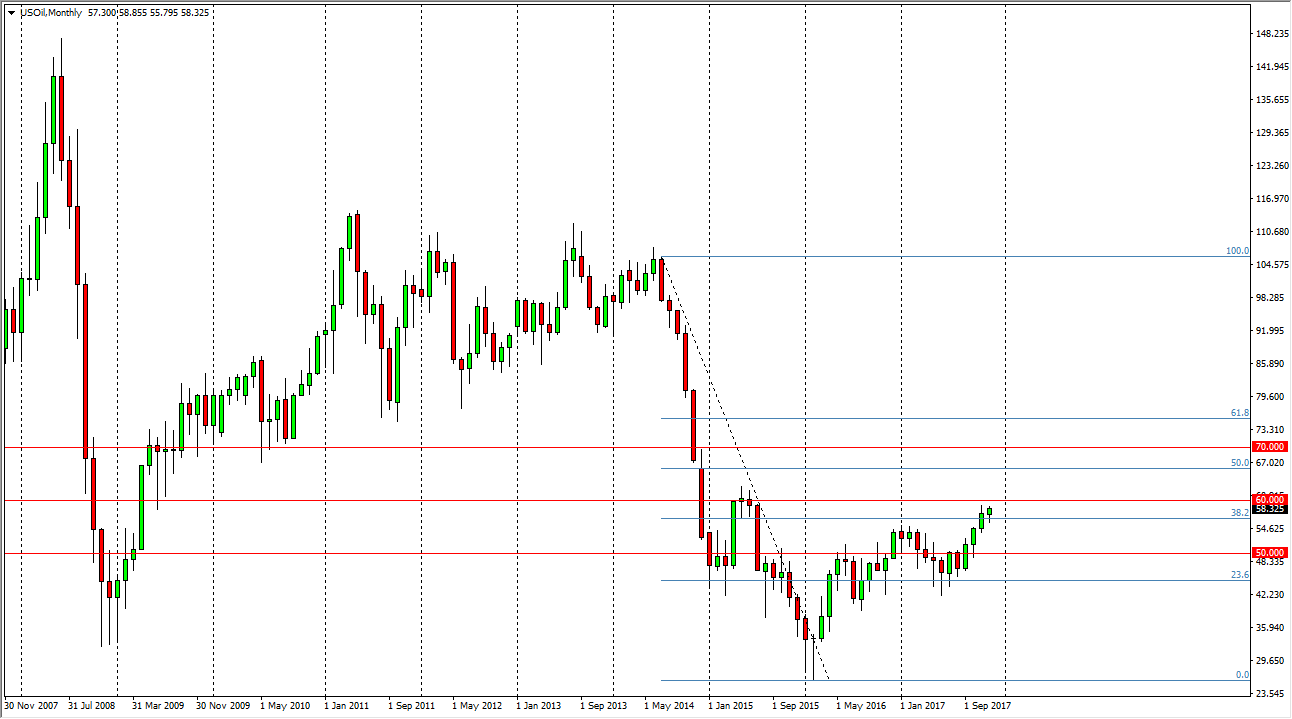

This is a market that is can be difficult to predict where it goes on for 2018, because we have a massive amount of noise in it. Currently, we see that OPEC and Russia are cutting production, but at the end of the day they sooner or later going to have to produce more. Currently, the Americans haven’t started producing more oil, and one would think that if we can break above the $60 level, they may. It is because of this that I think the upside is somewhat limited this year and we will probably continue to see more choppiness. I recognize the $60 level as a barrier, but once we get above there and perhaps more specifically the $62.50 level, I think will probably go towards the 50% Fibonacci retracement from a couple of years ago, which has the market looking for $67.

Beyond that, we have the $70 level above which has been a massive level in both directions, so having said that I think there will be a lot of volatility there. Beyond that level, we have the 61.8% Fibonacci retracement level which is near the $75 level. I think at best we reach $75 during the year, and then roll back over. To be honest, I would be surprised if that we even got to that point. I suspect that the 50% Fibonacci retracement level is probably a more realistic target. However, if we were to break down below the bottom of the hammer for the December candle, we probably go back towards the $50 handle underneath. Volatility will continue to be a major issue, but the one thing that could send prices skyrocketing as if we get war in the Middle East, as the Iranians and Saudi Arabians are arguing so much these days.