Gold prices settled at $1313.52 an ounce on Friday, posting a loss of 0.76% on the week, as a stronger dollar reduced demand for the precious metal as an alternative investment. The U.S. dollar has been supported by rising short-term bond yields. All eyes will be on the Federal Reserve policy meeting on Wednesday, for any indications on the number of rate hikes this year. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 167948 contracts, from 183823 a week earlier.

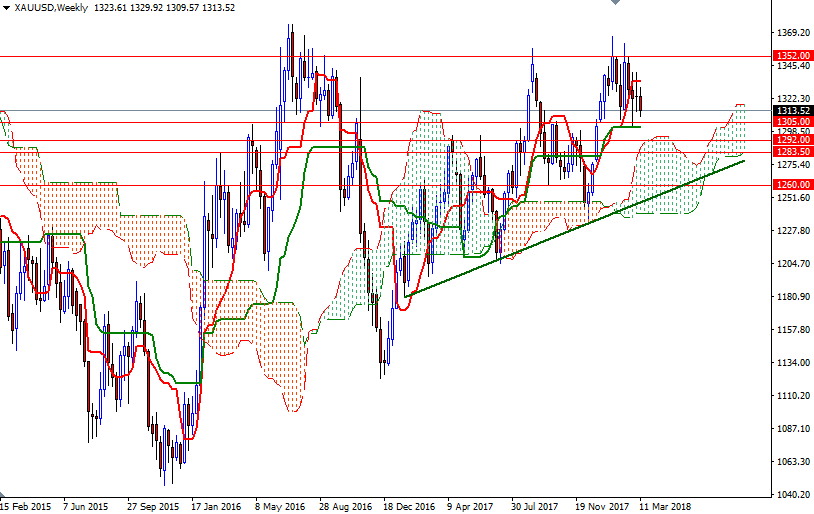

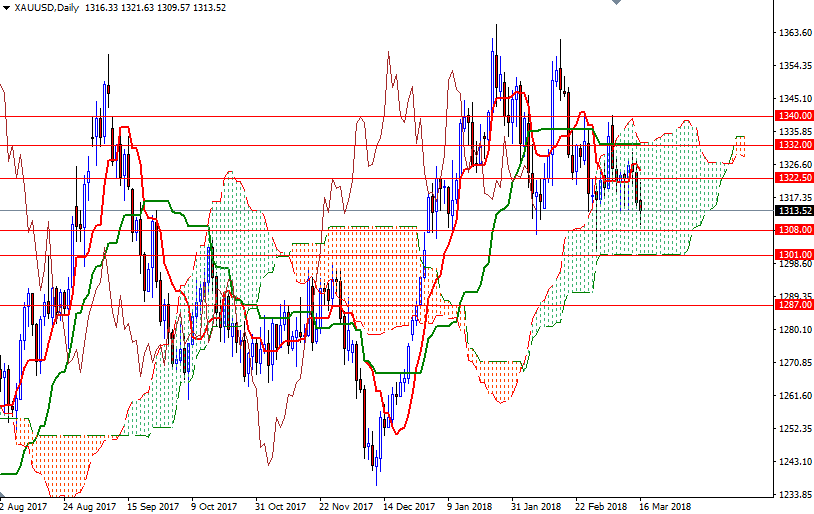

The gold market tends to weaken going into the Fed meetings, at which a rate hike is expected, so we will probably start the week in a similar environment. Also keep in mind that this type of pressure usually creates a temporary reaction and once the Fed makes the actual announcement, XAU/USD may reverse its course - unless the statement sounds more hawkish than what the market is expecting. From a technical perspective, bearish weekly close (the lowest weekly close since late December) also suggests more selling pressure early this week. The market is trading below the 4-hourly Ichimoku cloud; plus, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are negatively aligned on both the daily and the 4-hourly charts.

To the downside, the bears have to clear nearby supports such as 1308/5 and 1301/0. If the market successfully dives below the bottom of the daily cloud, which also happens to be the 50% retracement of the bullish run from 1236.40 to 1365.95, it is quite possible that the XAU/USD pair will extend its losses, targeting the 1287/3.50 region. On its way down, expect to see some support in the 1294/2 area, the top of the weekly cloud. The bulls, on the other hand, have to lift prices above 1322.50 to tackle the next barrier in the 1328/5 area. A daily close above 1328 would pave the way for a test of 1334.32-1332 (or even 1336-1335.50). Beyond there, the 1347/5 area stands out as a solid technical resistance.