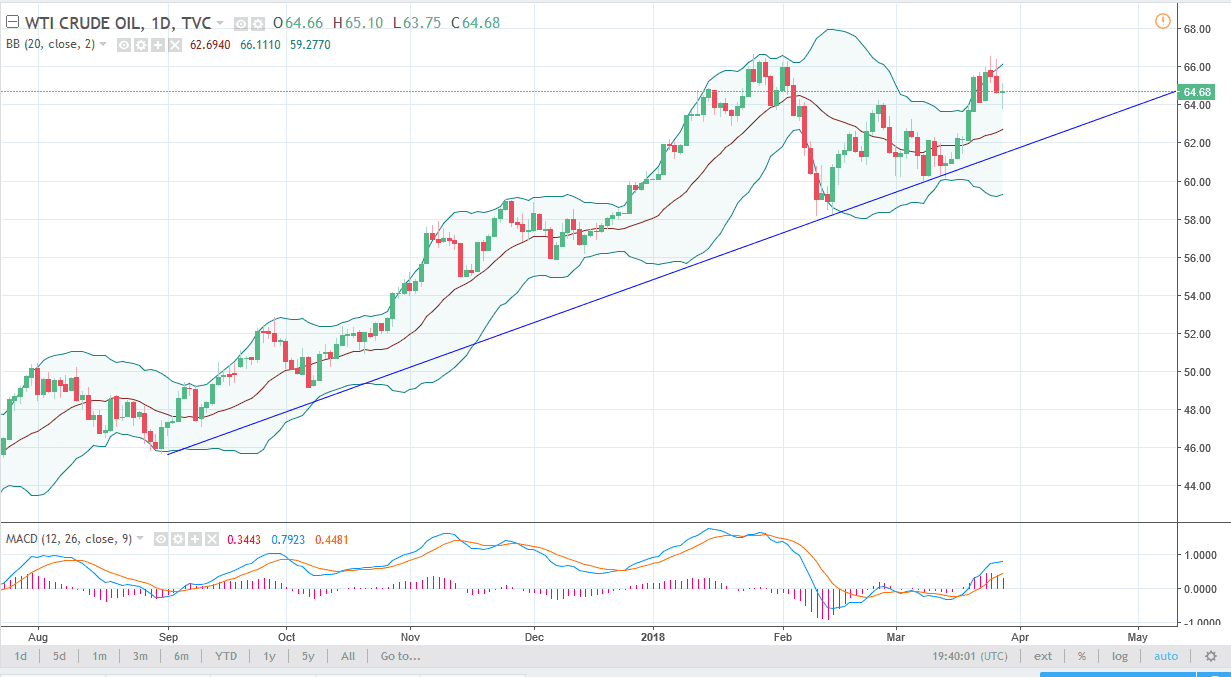

WTI Crude Oil

The WTI Crude Oil market has been noisy during training on Wednesday, dropping as low as $64 before bouncing. By the end of the day, we formed a bit of a hammer, so it looks as if the buyers are willing to step in and pick up these dips, and I think that is going to continue to be the way this market goes, buyers stepping in every time there is a bit of weakness. I think that the uptrend line continues to keep this market afloat, so it’s not until we break down below that uptrend line that I would be interested in shorting. Eventually, if we can break above the $66 handle, the market is probably ready to continue to go higher. I believe that the overall attitude of this market is short term focus, but right now it appears that the buyers are in control.

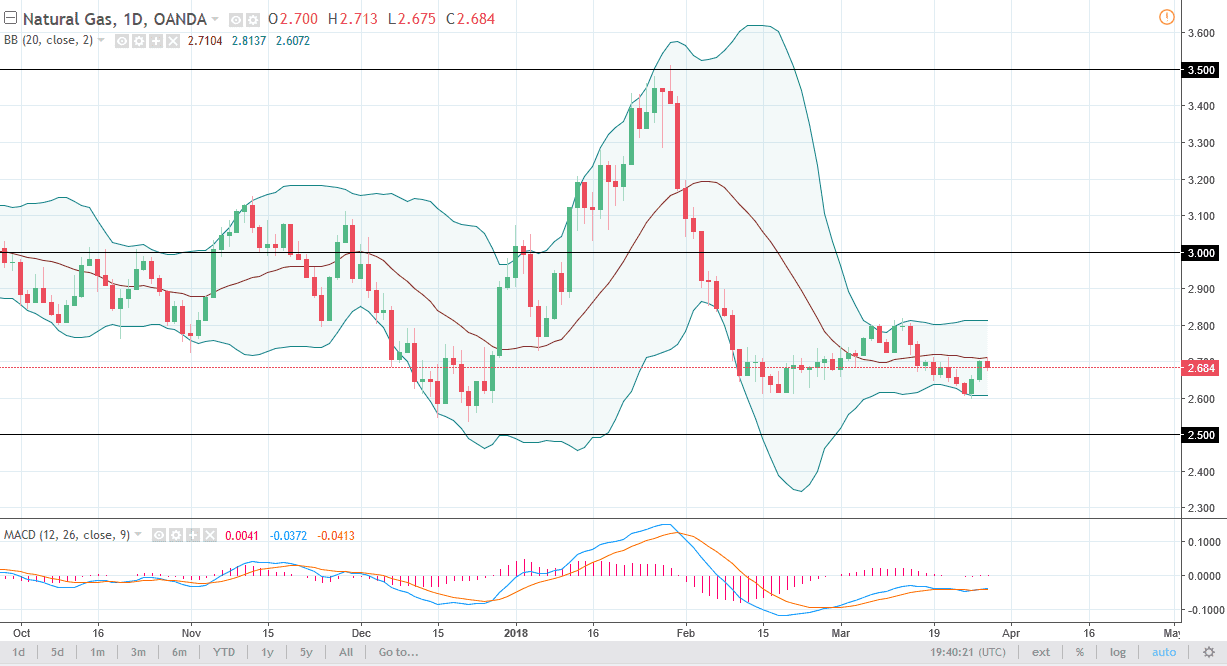

Natural Gas

The natural gas markets drifted a bit lower during trading on Wednesday, as the $2.70 level offered a bit of resistance. I think that the market could drift down to the $2.60 level, an area that has shown support several times. I think on the other, if we can break above the top of the range for the day on Wednesday, the market could probably go to the $2.80 level. That’s an area that I think will cause a lot of bit of resistance, and therefore it’s likely that sellers would jump back into this market in that area. I’m looking to short this market every time it rallies, as the fundamentals for natural gas are horrible in general, and if the US dollar rallies, that will be yet another reason this market breaks down.