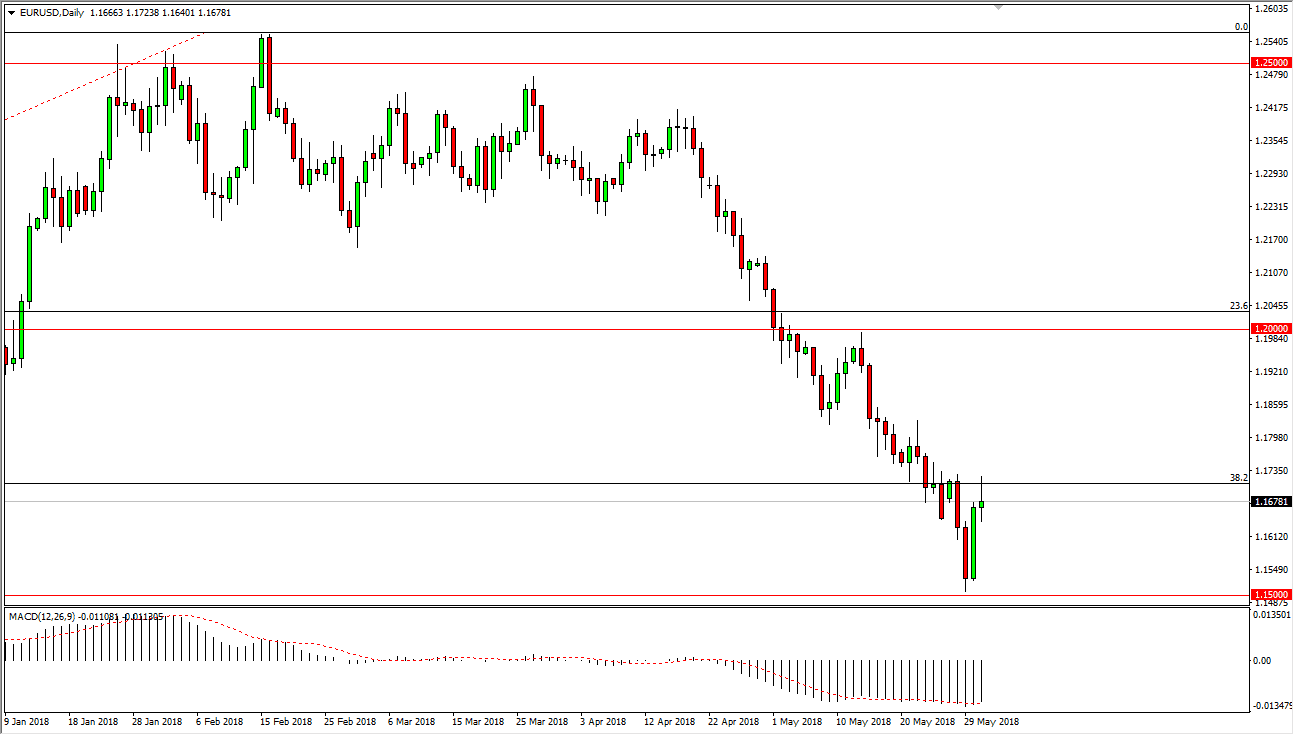

EUR/USD

The Euro was rocked back and forth during the trading session on Thursday, as the United States announced fresh tariffs against the European Union consisting of 25% for steel, and 10% for aluminum. Ultimately, this is a market that has been in a downtrend anyway, and even though the Italians are starting to show signs of working together, this downtrend is significantly strong, and the fact that we formed a bit of a shooting star during the day doesn’t surprise me, as we desperately need some type of bounce. I think the 1.15 level will be targeted, and on a break of the lows for the session on Thursday, I think the sellers will jump in. I don’t know if we can break below 1.15, because quite frankly it is so structurally sound. If we did, that would be an extraordinarily negative sign in this market.

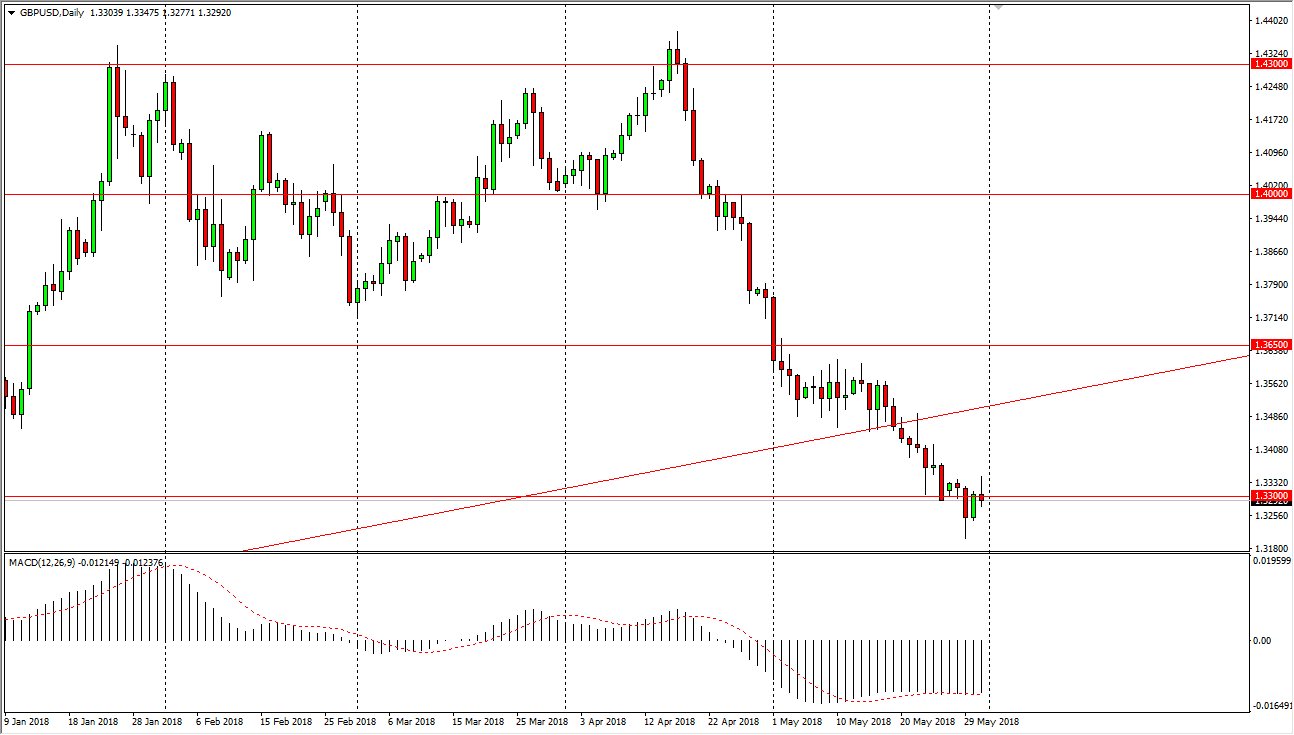

GBP/USD

The British pound trying to rally during the day as well but turned around form a bit of a shooting star. It looks likely that we can continue to go lower, perhaps trying to reach the 1.32 level again. By forming a shooting star, this only confirms the bearish attitude in this market, and I think that the GBP/USD pair will eventually even go down to the 1.30 level. We recently broke through a major uptrend line, so this pullback and break down later in the day makes a lot of sense. This shows just how much bearishness there is in the marketplace, and I think that selling rallies continues to be the best way to play this market, as we will most certainly have seen a lot of bullish pressure on the US dollar with rising interest rates this summer.