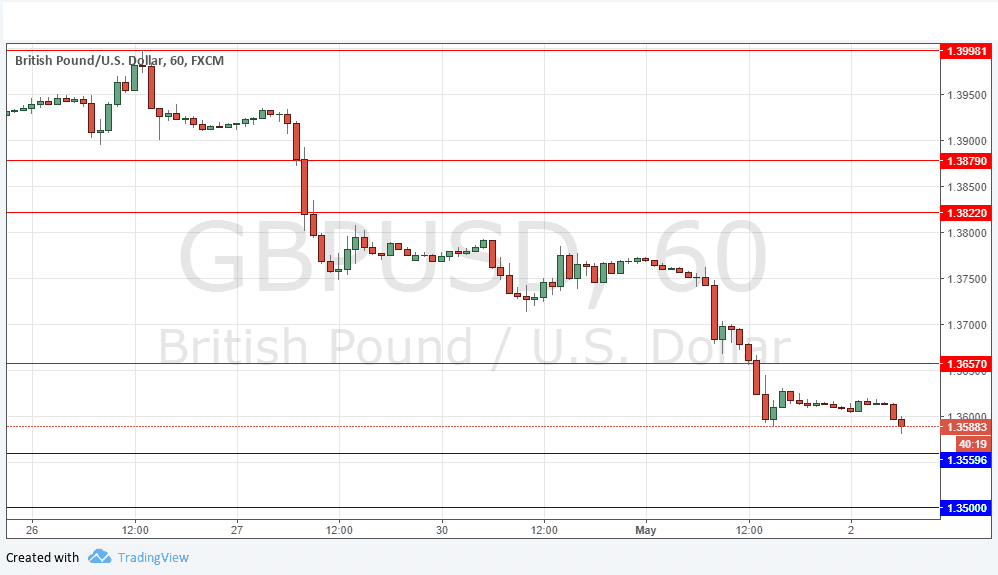

Yesterday’s signals were not triggered, as there was no bullish price action at 1.3657.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered between 8am and 5pm London time today only.

Short Trade

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3657.

* Put the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 25 pips in profit.

* Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Long Trades

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3560 or 1.3500.

* Put the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 25 pips in profit.

* Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote yesterday that the trend was bearish and so if the news items supported that then there could be a strong downwards movement. It was difficult to see the Pound really being bought again so soon after such disappointing GDP data was released. I was concerned about the bullish U which had printed previously at 1.3714. As it happened, the price fell strongly, triggered initially by poor U.K. manufacturing data. The fall was strong and wiped out support. It is notable that this pair has fallen by almost one thousand pips in just over two weeks, which is a strong movement for a major currency pair. Due to the momentum, and bearish price action during the late part of the Asian session today, I expect that the fall will continue to some extent, and we will see still lower prices. I have a bearish bias. This pair will be getting a lot of attention from traders.

Concerning the GBP, there will be a release of Construction PMI data at 9:30am London time. Regarding the USD, there will be a release the ADP Non-Farm Employment Change forecast at 1:15pm, followed by Crude Oil Inventories at 3pm and the FOMC Statement and Federal Funds Rate at 7pm.