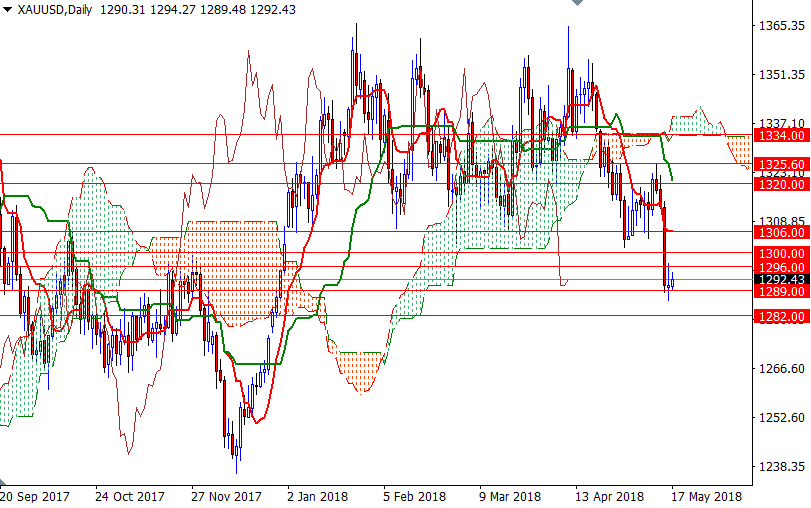

Gold prices rose $0.59 an ounce on Wednesday, posting the first gain in four sessions, on short-covering as the U.S. dollar clawed back some of its recent losses. XAU/USD initially grinded lower but found some support just above the $1285-$1282 zone. The market rebounded from a 4-1/2-month low but higher U.S. bond yields capped gold’s gains. XAU/USD is currently trading at $1292.43, higher than the opening price of $1290.31.

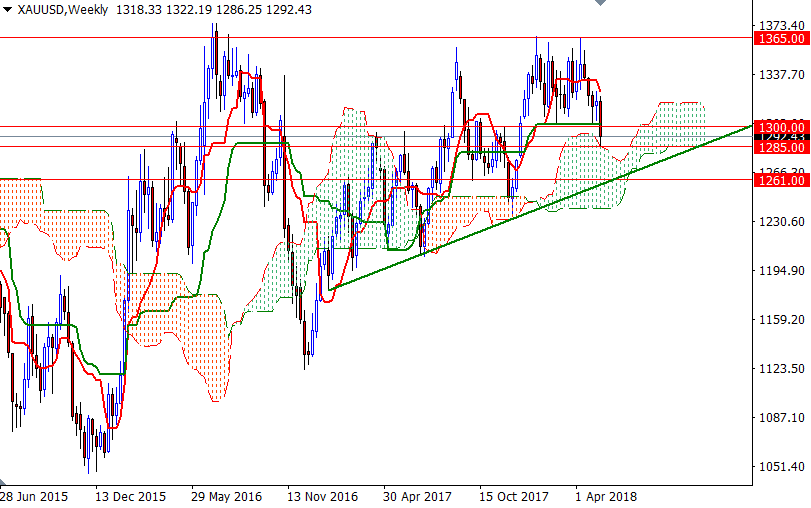

The key levels I emphasized yesterday are still valid today as prices were stuck in a narrow range yesterday. The market is trading below the daily and the 4-hourly Ichimoku clouds, suggesting that the bears still have the overall near-term advantage. Negatively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) on both time frames and the daily Chikou-span (closing price plotted 26 periods behind, brown line), which dropped below the daily cloud, suggest that the market will tend to return to the bottom of the weekly cloud. However, down below, we have the weekly cloud that occupies a large area, and it could act as a support.

The bulls have to lift price back above the previous support (which has now become strong resistance) in the 1300-1296 area if they don’t intend to give up. In that case, they may have a chance to revisit 1303.50 and 1306. Closing above 1306 on a daily basis paves the way for a test of 1313/1. However, if the market fails to break through 1300-1296, keep an eye on the 1285/2 area. If this support is broken, XAU/USD will be targeting the 1276/4 area. The bears have to produce a daily close below 1274 to make an assault on 1270.