Gold ended the week down $25.87 at $1292.46 an ounce, weighed down by a rally in the U.S. dollar index amid surging U.S. Treasury yields. A batch of upbeat U.S. economic data corroborated views that the Federal Reserve would continue to raise interest rates. The dollar was also boosted by weakness in the euro which suffered from a downbeat gross domestic product report that came out of the bloc and concerns about Italy. Gold is usually inversely correlated with the main reserve currency (the greenback) and correlated with the second reserve currency (the euro). The surging U.S. dollar will continue to cast a bearish shadow over the market. However, a fresh dose of geopolitical unrest may lend some sort of short-term support to safe-haven gold.

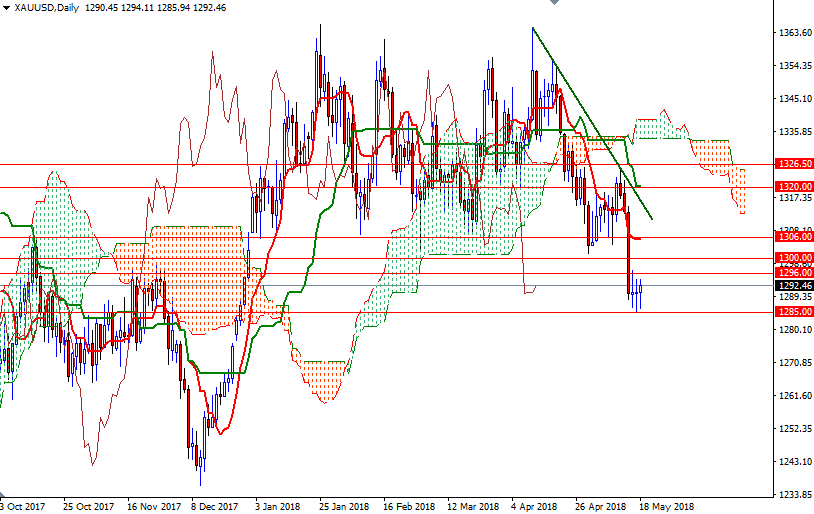

From a chart perspective, the bears have the overall near-term advantage, with the market trading below the daily and the 4-hourly Ichimoku clouds. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-day moving average, green line) are negatively aligned on the daily and the 4-hourly charts. In addition to that, the daily Chikou-span (closing price plotted 26 periods behind, brown line) is also below the cloud. All these, along with the fact that prices pierced below the support in the 1300-1296 area, suggest that a push lower is possible.

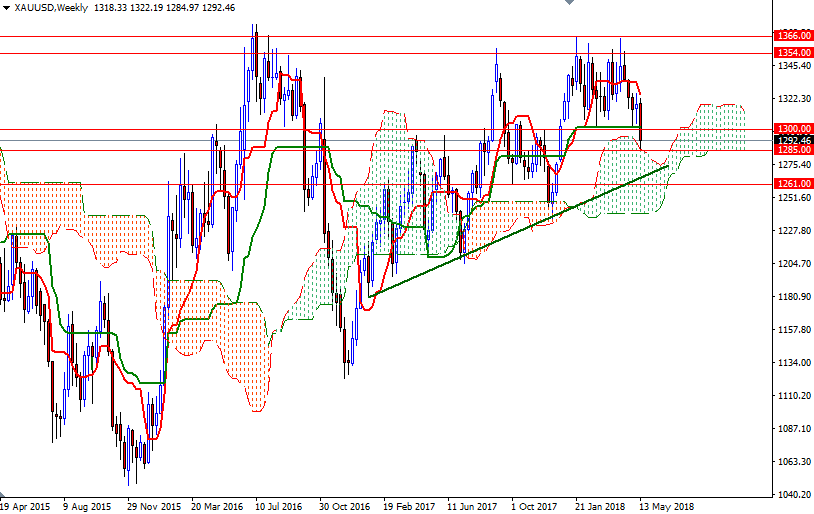

If XAU/USD falls through 1285, then 1282/1 and 1277/4 will be the next targets. A break below 1274 implies that the market is aiming for 1270. The bears have to produce a daily close below 1270 to make an assault 1261. However, as I pointed out last week, the weekly Ichimoku cloud sits right below and it is acting as a support. If prices can successfully climb above the resistance in the 1297/6 area, expect a push up to 1300 or even 1303.50. The top of the 4-hourly cloud stands at 1306 and the bulls have to capture that strategic barrier to make a run for 1313/0.