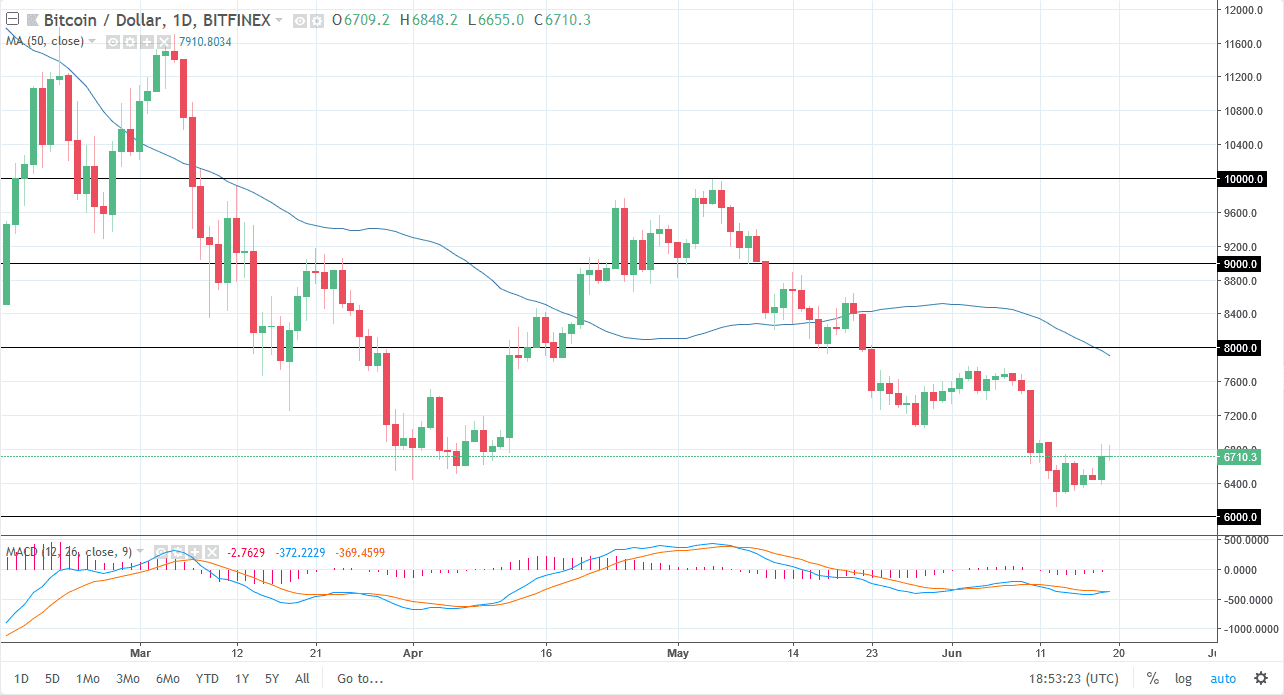

BTC/USD

Bitcoin markets initially tried to rally during the trading session on Tuesday, but failed to keep the gains, turning around to form a shooting star. The $6800 level has offered a bit of resistance, and it looks as if the market is trying to avoid the $7000 altogether. By forming a shooting star, that is a very negative sign, and could bring in fresh selling as it shows signs of exhaustion at the first hints of resistance. We still have plenty of support in the form of $6000 underneath, but I think it would take quite a bit of momentum to finally break down through there. I think what we are more likely to see in the short term is a bit of consolidation between the $7000 level above, and the $6000 level below as we continue to go back and forth. However, if we did turn around to break above the $7000 level, the market could very well find itself reaching towards $7200 level rapidly.

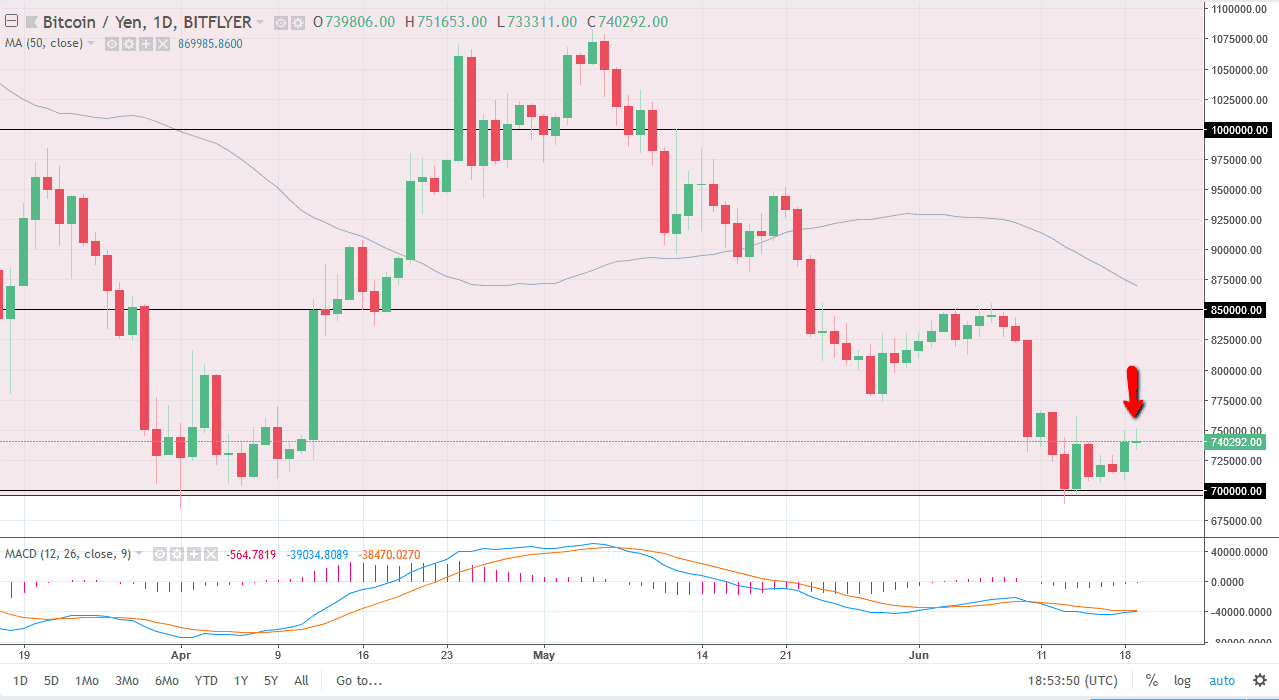

BTC/JPY

Bitcoin also tried to rally against the Japanese yen but seems to be struggling at the ¥750,000 level to form a candle very similar to the one against the US dollar. This show signs of exhaustion, and it shows signs that we will probably consolidate at the bottom of the overall consolidation area again. That has a floor of ¥700,000 underneath, but if that market gets broken it’s likely that we will go much lower, perhaps down to the ¥600,000.

Quite frankly, it seems as if every time Bitcoin rallies, it’s a relatively safe bet to start shorting it again. At this point, it doesn’t look as if there is enough momentum in Bitcoin to sustain a rally for any length of time.