BTC/USD

Bitcoin fell initially during the trading session on Tuesday against the US dollar, as we continue to see a bearish pressure. We did recoup some of those losses though, forming a bit of a supportive candle. I think that this market may be ready to bounce due to the $6000 level underneath, but that bounce is probably going to be short-lived. The $6800 level above will almost certainly be resistive, assuming that we can get there. At the first signs of exhaustion, I am a seller of Bitcoin because quite frankly I think that the markets have scared away most of the speculative money. If we break down below the near-perfect hammer that formed on Sunday, that would be an ominous signal for this market, sending it much lower. In the meantime, I think that rallies are to be expected but I also think they are to be sold.

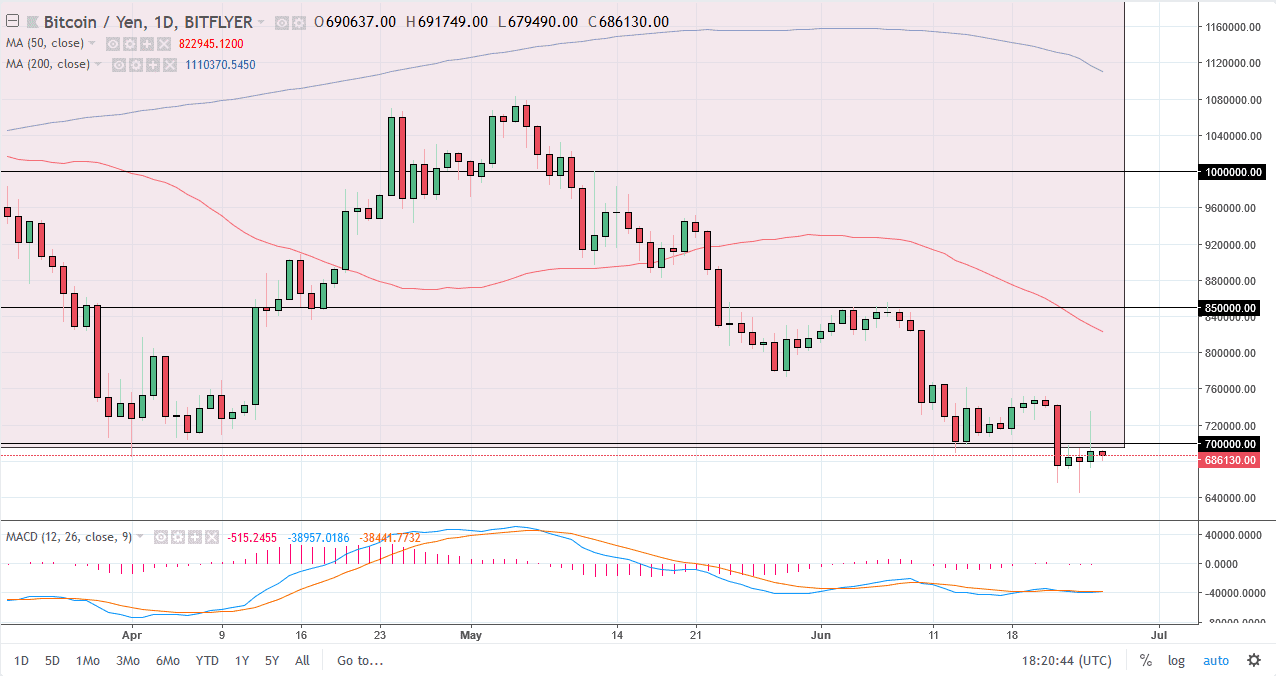

BTC/JPY

Bitcoin continues to hover below the vital ¥700,000 level, which of course is a very negative sign. We had formed a hammer on Sunday, shooting star on Monday, and now look like we are essentially stuck in this short-term range. The question now is whether we can hang on to this support, or do we break down from here. I suspect that eventually the market will break down below here. Rallies at this point are to be treated with suspicion, at least until we can break above the ¥775,000 level, something that we have failed to do recently. I think selling rallies will continue to pay those who are patient enough to wait for those opportunities, but if you are a longer-term investor you could look at these dips as potential value. All things being equal though, I think we go lower.