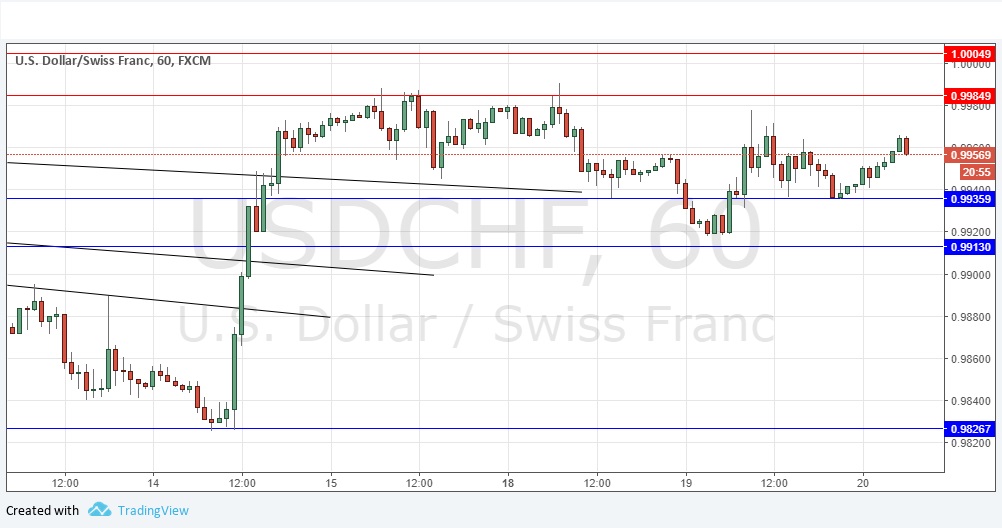

Yesterday’s signals were not triggered, as there was no bearish price action at 0.9936.

Today’s USD/CHF Signals

Risk 0.75%.

Trades must be entered between 8am and 5pm London time today, during the next 24-hour period.

Short Trades

Short entry following a bearish price action reversal upon the next touch of 0.9985 or 1.0005.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trades

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.9936 or 0.9913.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CHF Analysis

I did not have much to say yesterday apart from mentioning that a short from the 1.0000 area looked like the best possible long-term trade which might set up. The price has broadly gone sideways since yesterday and now seems to be subject to equal forces of close support and resistance both above and below. This makes the short-term outlook seem very uncertain. However, what I said yesterday still stands regarding the resistance close to 1.0000 looking more likely to hold over the medium and long terms. I have no directional bias today and note that we are quite likely to see further consolidation ahead of the SNB’s quarterly central bank input tomorrow.

There is nothing due concerning the CHF. Regarding the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time.