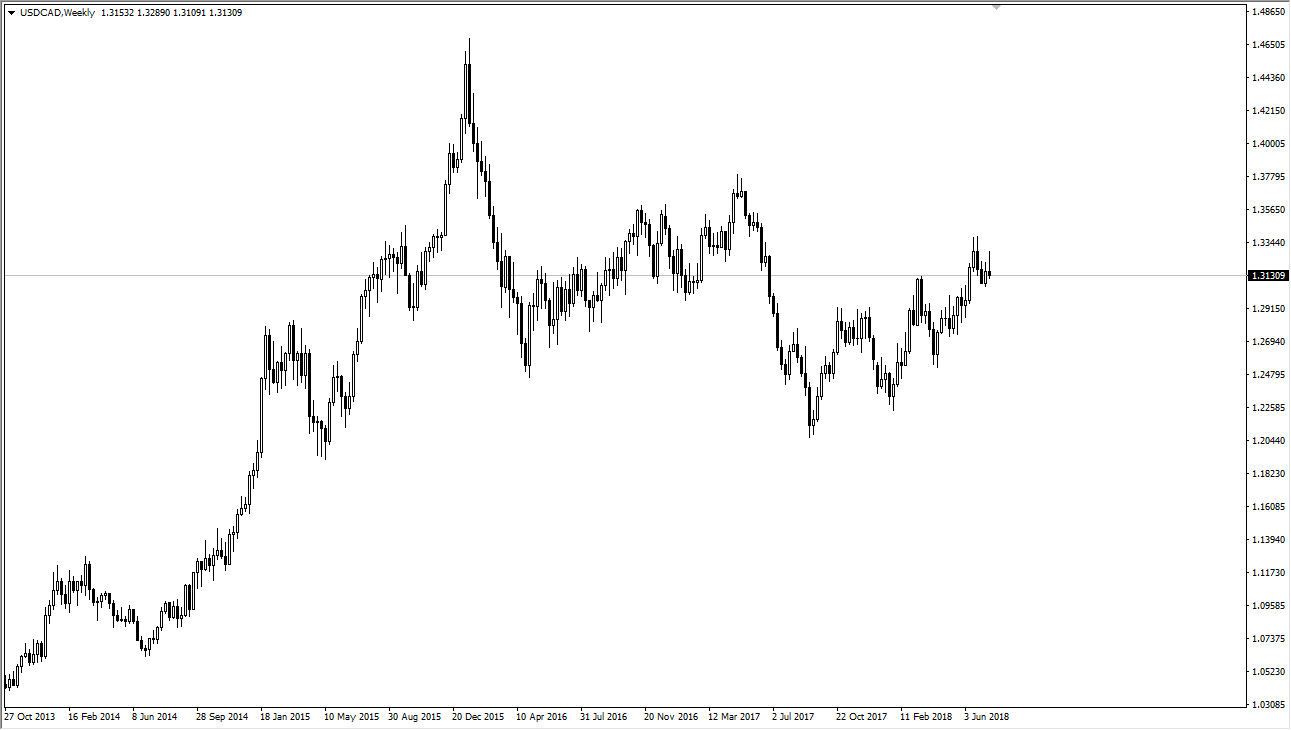

USD/CAD

The US dollar has rallied for most of the week but ended up turning around against the Canadian dollar to form a shooting star. The shooting star is a negative sign, as we said just above the 1.31 level. If we break down below there, the market probably goes down to the 1.30 level, which of course has a certain amount of psychological importance attached to it. I believe there is significant support at 1.29 as well, so keep an eye on that. Obviously, oil will have its say when it comes to this market.

EUR/USD

The Euro fell during most of the week but saw the markets turnaround on Friday as the reaction to a Donald Trump tweet sank the US dollar. Overall though, when I look at this market it’s clear to see that the 1.15 level offers plenty of support, and I think that if we were to turn around and break down below that level, the market would roll over drastically. I believe that we continue to see buyers on dips, as we build up the necessary base to turn things around finally.

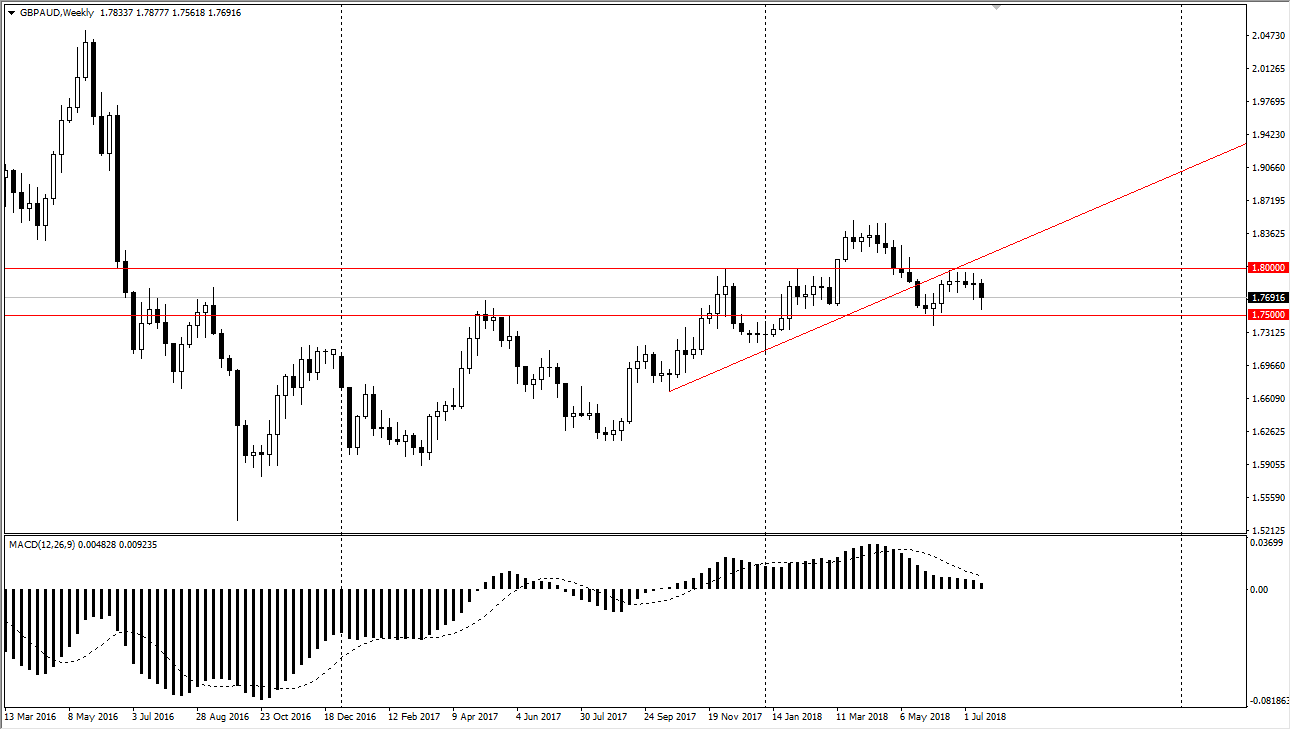

GBP/AUD

The British pound fell during most of the week but found enough support just above the 1.75 level to turn around and bounce. I believe that the market will continue to bounce around below the 1.80 level above, and the 1.75 level underneath. I think that if we break down below the 1.74 level, then the market probably breaks down rather significantly. However, I think that the market is probably going to be more of a back-and-forth type of situation, so short-term range bound traders will love this pair.

NZD/JPY

The New Zealand dollar had a very noisy week against the Japanese yen, breaking as high as the 77 region before turning over. By forming a shooting star the way we did though, it looks as if we could continue to see a bit of negativity in the short term. I anticipate that will probably go looking towards the ¥75 level, but if we can break above the ¥77 level, that could send this market much higher. Remember, this is a highly risk sensitive market.