Gold prices settled at $1222.78 an ounce on Friday, suffering a loss of 0.71% on the week, as expectations of higher U.S. interest rates weighed on demand for the safe-haven metal. Recent data suggest that the world’s biggest economy is on a solid growth path, though concerns about trade frictions persist. The European Central Bank confirmed it won’t raise interest rates through next summer, weakening the euro against the dollar. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 48597 contracts, from 57841 a week earlier.

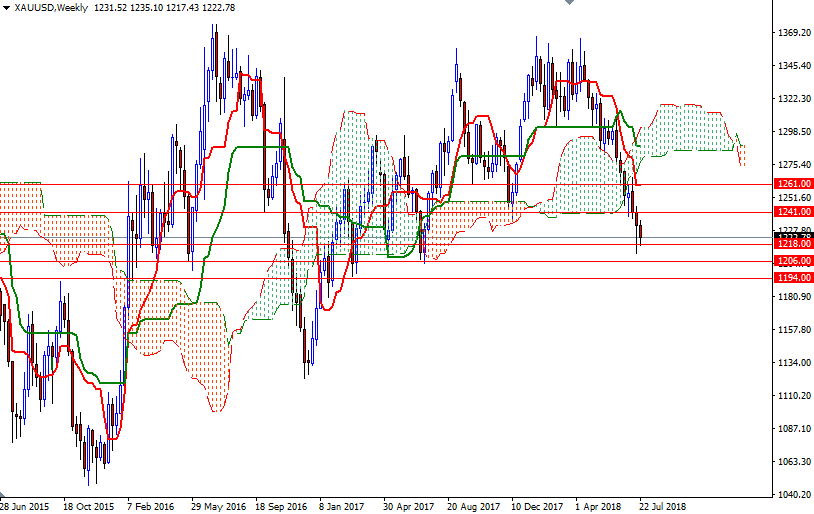

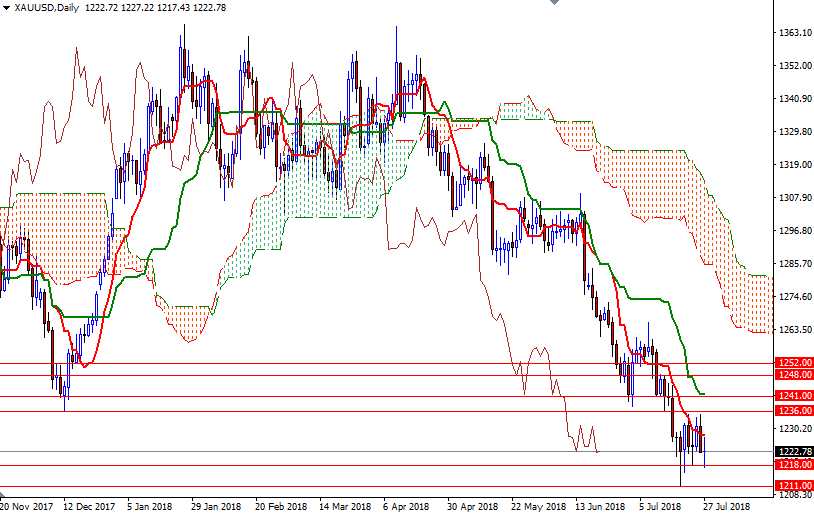

From a chart perspective, the bears still have the overall near-term technical advantage amid a three-month-old downtrend on the daily chart. Prices are below the Ichimoku clouds on the weekly and the daily charts. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned. The weekly and the daily Chikou-span (closing price plotted 26 periods behind, brown line) reside below prices.

There are no strong clues to suggest that the current sell-off is over, but XAU/USD managed to find some support above 1218. Also note that prices have been stuck in a relatively narrow range of around $25. If the market can get back above 1236, I think XAU/USD will challenge a strategic resistance in the 1242/1 area, where the daily Kijun-Sen sits. Once above there, the market will be targeting 1248/7 and 1252. The bulls will have to overcome this barrier to set sail for 1261/0. If the support at 1218 fails to hold, we will probably revisit 1215 and 1211/09. A break below 1209 could foreshadow a move to 1206/2. The bears have capture this camp to make an assault on 1198/4.