The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases, it will be trading the trend. In other cases, it will be trading support and resistance levels during more ranging markets.

Big Picture 9th December 2018

In my previous piece last week, I again forecasted that the best trade would be short of the EUR/USD currency pair. The price rose by a relatively small amount, giving a loss of 0.66%.

Last week saw a rise in the relative value of the Japanese Yen and the Euro, and a strong all in the relative value of the Australian Dollar.

Last week’s Forex market was relatively quiet, with the U.S. Dollar changing little in value and the market dominated by other, more minor currencies.

This week is likely to be dominated by Britain’s crucial Brexit Parliamentary vote plus GDP data, U.S. inflation data, and the monthly input from both the European Central Bank and the Swiss National Bank.

Fundamental Analysis & Market Sentiment

Fundamental analysis still tends to support the U.S. Dollar, as American economic fundamentals continue to look strong, although there is an increasing consensus that the picture is weakening which is supported by the lower than expected number of jobs added last week. It now seems that the path of hikes in the near term will be slowed considerably, which shows increasing relative fragility in the U.S. economy. Sentiment seems to be still in favor of the U.S. Dollar, but it is weakening. Fundamentals remain bearish on the Japanese Yen, but this currency can still benefit occasionally from safe-haven “risk off” money flow.

Brexit remains an unknown, as the British Parliament prepares to vote on the draft Brexit later this week. It currently looks as though the Government will not be able to secure approval of the deal and then anything could happen, from no Brexit to a “no deal Brexit”. Either extreme scenario should be expected to produce a strong directional movement in the British Pound.

The fundamental outlook on Canada is mixed after its central bank produced a more dovish than expected report last week, but this was followed by very strong employment data.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows that after last week’s weakly bullish candlestick, this week printed another weakly bullish candlestick which failed to break above the resistance level shown in the price chart. The price remains within a multi-week consolidation between support and resistance and I have no strong confidence as to short-term direction, although the edge is still technically in line with the long-term bullish trend, which remains intact. It is now looking a little more likely that the bullish trend will continue.

GBP/USD

The weekly chart below shows last week produced another bearish candlestick, but it is a near-doji which suggests that it may be ambiguous. This is a continuation of the general long-term bearish downwards trend which has slowed but seems to still be intact. However, bears should watch out for potentially strong support below as these are 1-year lows. The biggest problem is that the relative value of the Pound is almost entirely driven by the terms upon which the U.K. will eventually depart the European Union, and this is subject to political uncertainty. If the British Government loses the vote on Tuesday very heavily, we can expect to see the Pound break down to new long-term low prices in line with the long-term trend. Due to the uncertainty, “set and forget” trades on the Pound are not advisable.

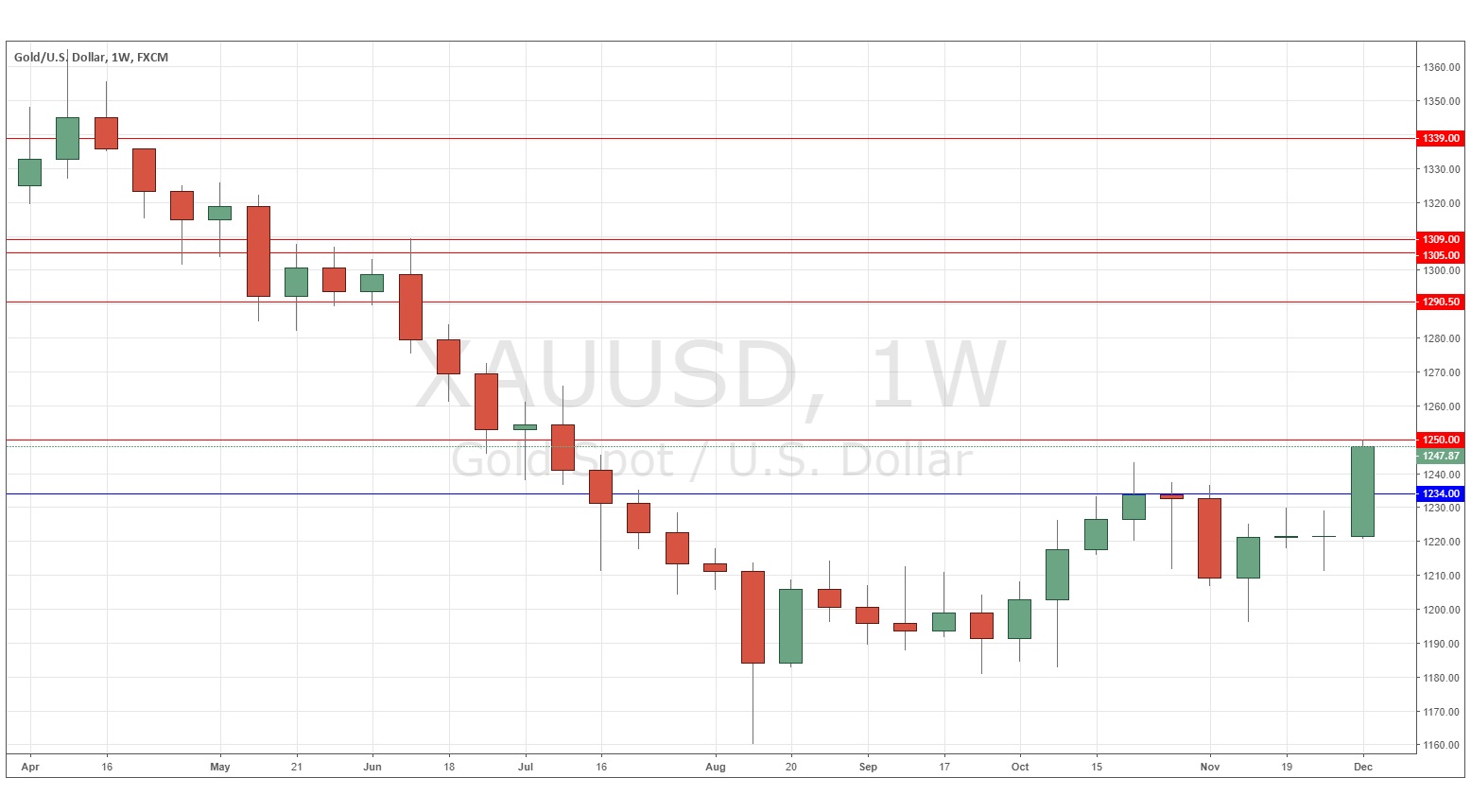

GOLD

The weekly chart below shows last week produced a strongly bullish candlestick, of a large range and closing very close to its high. We now have a long-term bullish trend here and it is particularly noticeable as the price has now broken strongly above the former long-term resistance at $1235. However, bulls should beware resistance at the major quarter-number of $1250. Gold has been boosted by a risk-off sentiment which has been triggered by renewed U.S. – China tension, causing stocks to sell off. If this environment continues, Gold is likely to continue to rise over this week.

Conclusion

Bullish on Gold against the U.S. Dollar.