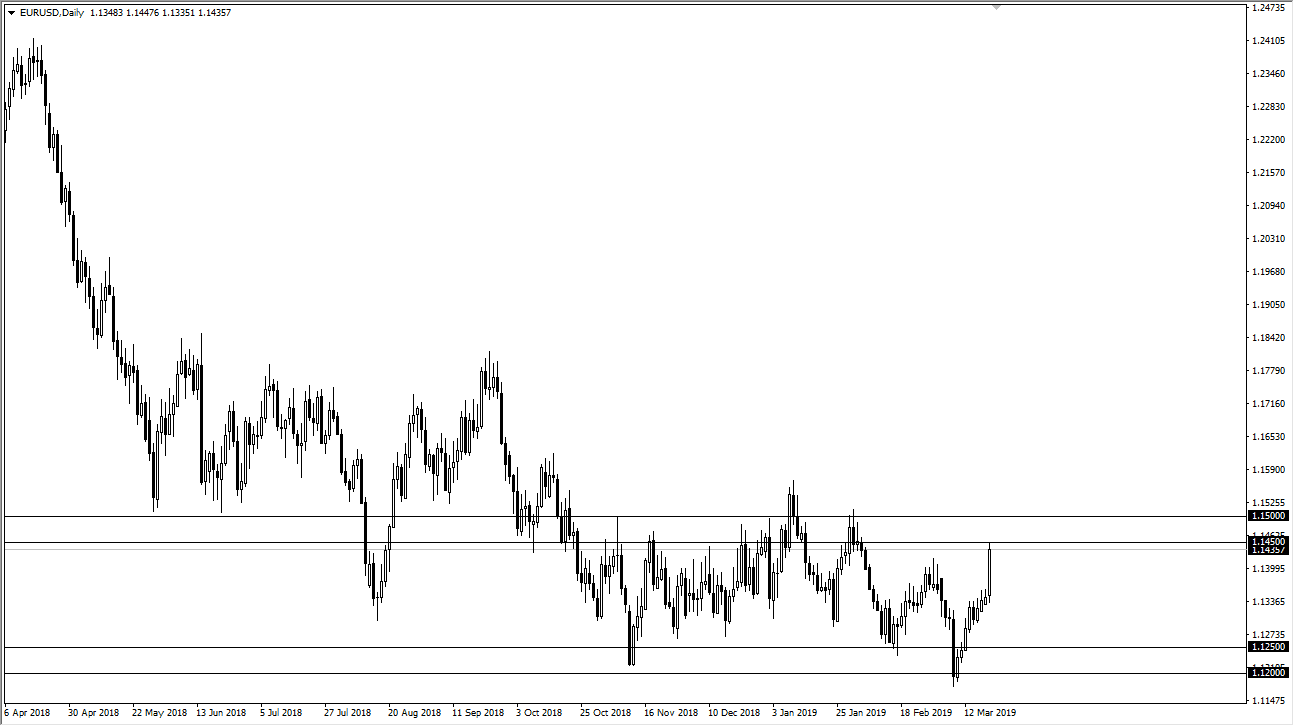

EUR/USD

The Euro rallied significantly during the trading session on Wednesday, slamming into the 1.1450 level. That is an area that is significant resistance that extends to the 1.15 handle. With that, it’s likely that we will continue to see sellers in this area. At this point, I do not believe that we are going to break out significantly, and I think that we are stuck in this range, because even though the Federal Reserve has admitted a lack of interest rate hikes this year, the reality is that the European Central Bank is in the same situation. With that being the case, it’s very likely that we will continue to find a bit of an equilibrium near the 1.1350 level. This is a market that should continue to favor consolidation, because quite frankly not much has changed over the last 24 hours and this impulsive candle is probably going to bring in value hunters for the greenback.

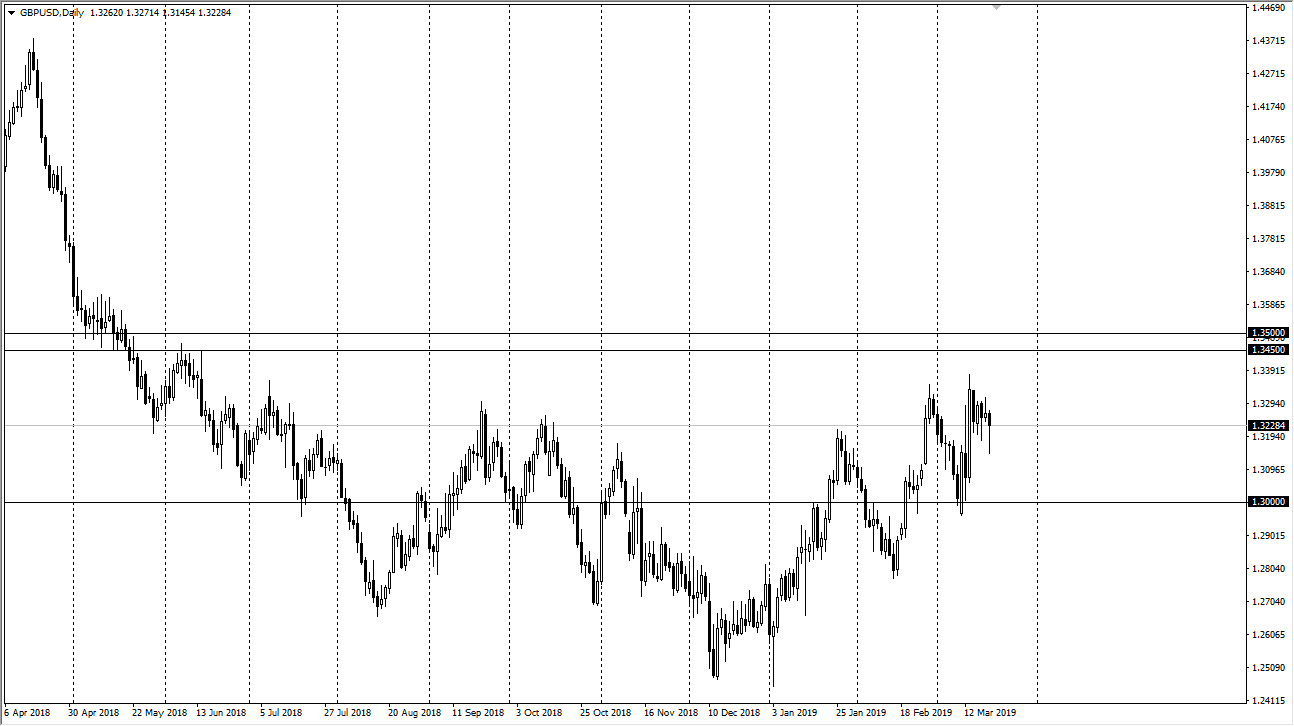

GBP/USD

As I record this, Theresa May is expected to come out with some type of statement for the public in just a few short hours. It is probably some type of conversation about a potential Brexit delay, which should overall be good for the British pound. The market could find its way towards the 1.35 handle, but we need to break above the 1.3350 level before then, an area that has been rather resistive. However, if we turned around to break down below the bottom of the range for the session on Wednesday, then the market is probably going to reach down towards the 1.30 level underneath which should be massive support. Ultimately, this is a market that is trying to grind higher, and quite frankly it is simply looking for some type of excuse.