The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 17th March 2018

In my previous piece last week, I was bearish on the EUR/USD currency pair and bullish on the USD/SEK currency pair provided their respective low/high from the previous weak was breached. There were no such price breakouts in either pair.

Last week’s Forex market saw the strongest rise in the relative value of the British Pound, and the strongest fall in the relative value of the Japanese Yen.

Last week’s market has changed again – stocks and commodity currencies recovered as the market reverted to a more “risk-on” mode. Forex price movements were dominated by the British Pound, which is no great surprise. The British Parliament voted to rule out a “no deal” Brexit for good and to request a postponement of the Brexit date beyond 29th March. Parliament will be voting again a third time on accepting the draft deal later this week and that result is likely to again provide strong volatility in the British Pound. If somehow the deal is passed then we can expect the British Pound to rise sharply, although it seems to be an unlikely outcome. However, if the deal fails, the British Government may feel justified in requesting a very long Brexit postponement, which would be likely to lead to Brexit never happening at all – and this scenario would also see the Pound rise. The biggest danger to the Pound this week would be the E.U. refuses to agree an extension of the Brexit date, which would leave the British Government with a choice between accepting “no deal” on 29th March or to simple revoke Article 50 which would mean the U.K. could not leave the E.U. again for at least another 2 years.

In addition to the Brexit vote, this week will probably be dominated by the FOMC release and central bank input from the Swiss National Bank and the Bank of England.

Fundamental Analysis & Market Sentiment

Fundamental analysis remains quite bullish on the U.S. Dollar. The stock market has begun to rise again and has reached new short-term high prices. Fears remain that the recent boost to the U.S. economy has run out of steam will little left to sustain it, as well as the seeming high sensitivity of the economy to any further rate hikes, as evidenced by the fact that the FOMC appears to have largely given up on its originally planned further rate hikes for 2019. The ongoing trade dispute with China appears to be moving towards a positive resolution, which is a good sign.

Legally, less than two weeks remain until the U.K. leaves the European Union, and the default position is that there will be no deal unless one is agreed before that date.

The ECB has recently taken a more dovish line on the Euro, however, the Euro recovered quite strongly from its recent long-term lows over the past week.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows that last week the USD Index fell quite firmly, printing an average-sized bearish engulfing candlestick with a small but significant lower wick, which suggests a small chance of a further fall next week. However, as the price is down over 3 months, but still slightly up over 6 months, so we have a more mixed wider price action context picture on the Dollar. Overall, next week’s direction again looks relatively uncertain.

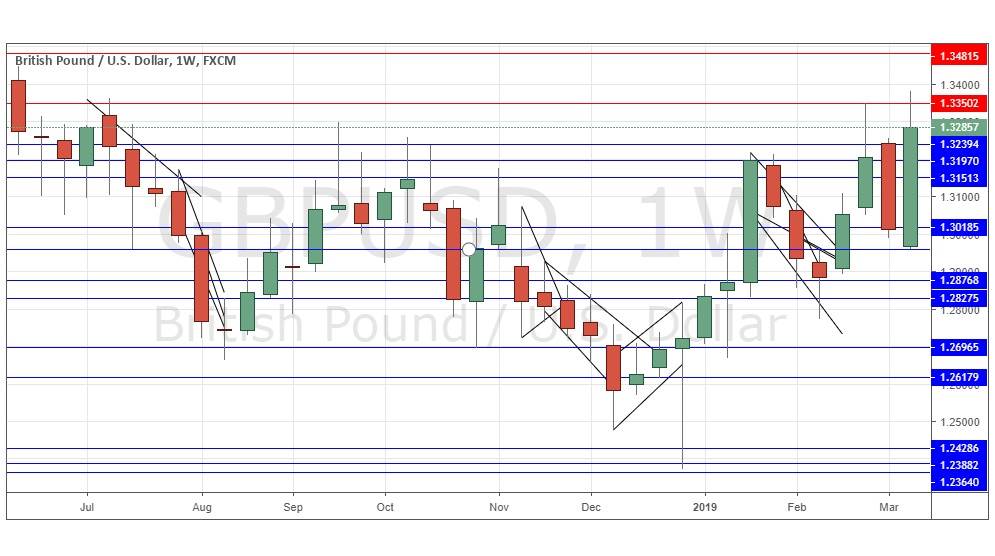

GBP/USD

The weekly chart below shows last week produced a relatively large, strongly bullish candlestick, which reached a new 9-month long-term high price, which is a bullish sign. However, there was a clear rejection of the resistance above at 1.3350 and the candlestick has a significant upper wick. The British Pound could be on the verge of a strong bullish movement, in line with the long-term 3- and 6-month price trends, but I want to see last week’s high exceeded before being bullish. This week is likely to see either the passage of a Brexit deal or a long-term postponement of Brexit and both should boost the value of the Pound meaningfully.

S&P 500 Index

The weekly chart below shows last week produced an average-sized, bullish candlestick, which reached a new 5-month long-term high price, which is a bullish sign. The recovery of recent weeks has been strong and by most technical measurements we are now back in a bull market. The close was also very near the high and was also above the key resistance level at 2816 which was a bullish sign. For these reasons, I would be bullish on this stock index if last week’s high is exceeded.

Conclusion

This week I will be bullish on the GBP/USD currency pair and the S&P 500 Index, if last week’s highs are breached.