The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 31st March 2018

In my previous piece last week, I wrote that the market looked too choppy and uncertain right now to make any forecast. This was a relatively good call as there were a lot of reversals over the week; however, I could have had more faith in the long-term bearish trend in the EUR/USD which moved lower this week by 0.73%.

Last week’s Forex market saw the strongest rise in the relative value of the Australian Dollar, and the strongest fall in the relative value of the British Pound.

Last week’s market has changed again – markets have reverted to a more “risk-on” mode as stocks, Crude Oil, and riskier assets such as the commodity currencies have largely risen, albeit not by a lot.

The week before last, a more dovish Federal Reserve cut its forecasts for U.S. economic growth, fueling fears of a coming slowdown in global economic growth. However, the flight to safety which occurred during the previous week seems to have halted. Britain’s Brexit drama continues, with the British Parliament again rejecting the E.U.’s Brexit deal, and the U.K. is now on track to leave with no deal on 12th April unless an alternative arrangement is agreed before then. This has weakened the Pound as markets contemplate the possibility that Britain’s Parliament will fail to prevent a no deal exit, although I see it as more likely that Parliament will use the crisis to try to compel the government to revoke Article 50.

In addition to a probable crucial Brexit vote, this week will probably be dominated by U.S. Non-Farm Payrolls data and the RBA Rate Statement.

Fundamental Analysis & Market Sentiment

Fundamental analysis has turned more bearish on the U.S. Dollar and on global stock markets following the Federal Reserve’s more dovish approach to monetary policy and growth. This can be expected to strengthen the Japanese Yen and Swiss Franc and weaken the commodity currencies, although price movements have not been significantly large. This week, prices moved in the opposite direction to those indicated by these fundamental factors.

If somehow the U.K. leaves the U.K. at the end of this week without a deal – which I think is very unlikely – the British Pound will fall sharply, probably by more than 10%. If a deal is agreed in the British Parliament, then the Pound will rise strongly, perhaps by as much as 5%.

Technical Analysis

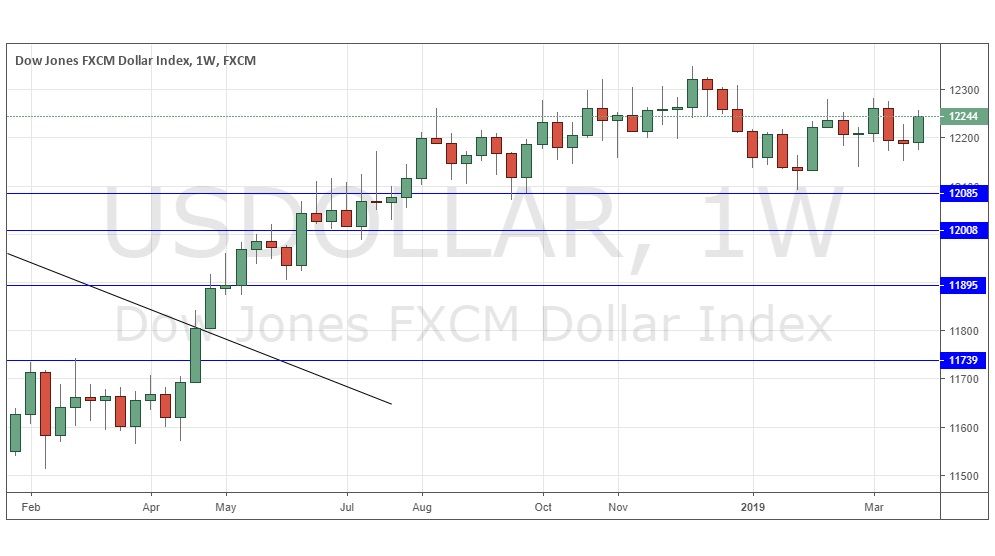

U.S. Dollar Index

The weekly price chart below shows that last week the USD Index printed a normal sized, bullish, engulfing candlestick within a multi-month area of consolidation. The price is up over 3 months and 6 months, indicating a bullish trend. Overall, next week’s direction looks a little more certain, with the technical pointing to a slight chance in favor of a further rise next week.

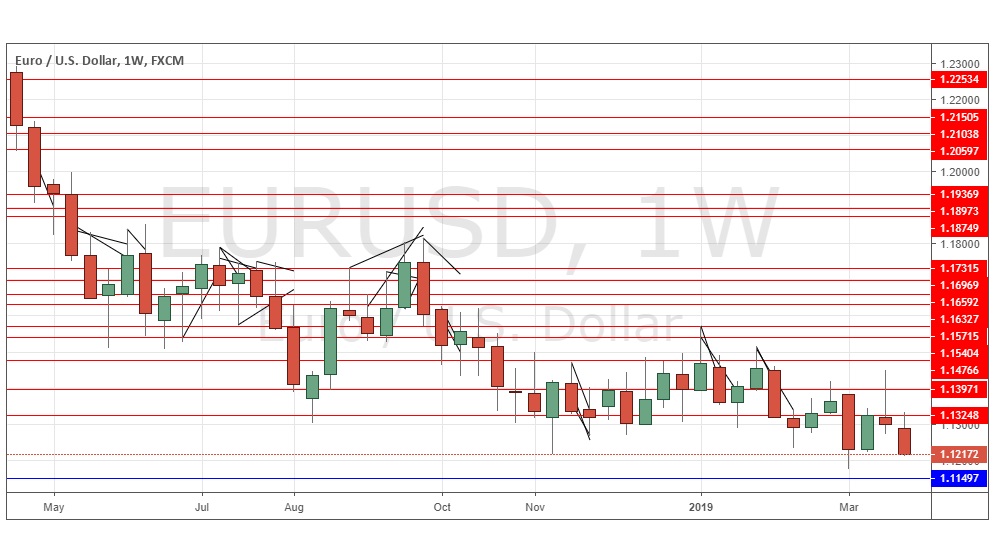

EUR/USD

The weekly chart below shows last week produced a relatively small but very bearish candlestick which closed right on its low. The price is in a clear long-term downwards trend, with this week’s close the lowest close for a long time. The price has not moved much in recent months but there has certainly been a steady drift down, with the price looking heavier and heavier. An important break below these long-term low prices looks likely to happen very soon.

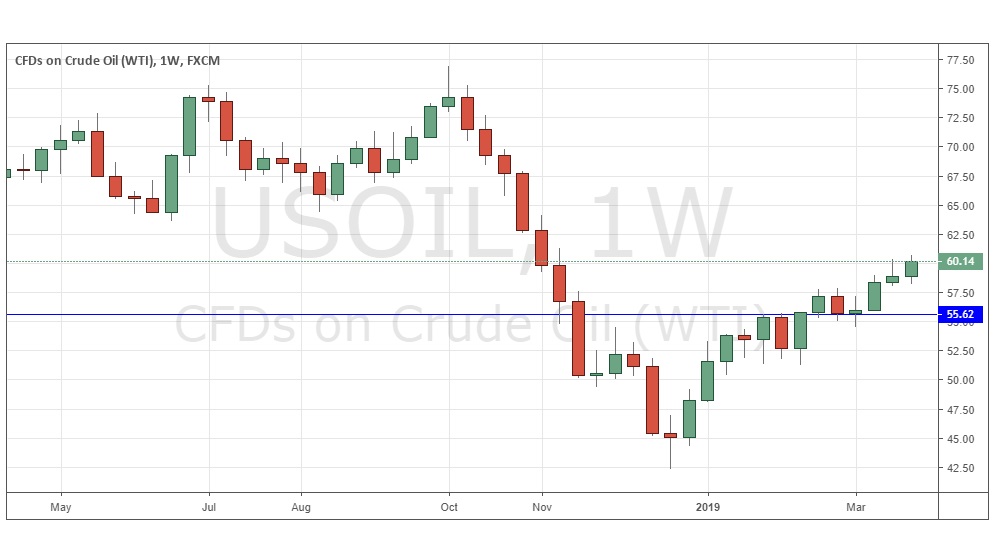

WTI Crude Oil

This commodity has been moving steadily upwards over recent weeks to touch new 4-month highs above $60. Volatility has been low so we can see that WTI is struggling to really get established above $60 per barrel. I think that if we get a strong move up to take the price to $61 or higher, we are likely to see $62.50 quickly and maybe even $65.

Conclusion

This week I forecast the best trade will be long EUR/USD, and long WTI Crude Oil is also likely to be interesting if the price can break above $61.