AUD/USD

The Australian dollar fell during the bulk of the week but showed stability and resiliency at the 0.70 level yet again, so therefore it looks as if we have more of the same going forward: a proclivity for the market to find buyers at that level. Longer-term traders seem to be accumulating down here, so therefore I like buying on the dips as they occur just as I have for some time. Granted it was a bit deeper of a correction this week that had been in the past, but on the monthly charts the area just below the 0.70 is massive.

EUR/USD

The Euro got hammered by dovish comments out of the ECB press conference but at the end of the week, we had seen the cluster at 1.1 to hold. At this point, it’s probably going to continue to find buyers but it’s not going to be an easy trade to take. While we did get a bit of a scare on the downside, it looks like stabilization is probably going to be the theme here, and very choppy back and forth action over the next week.

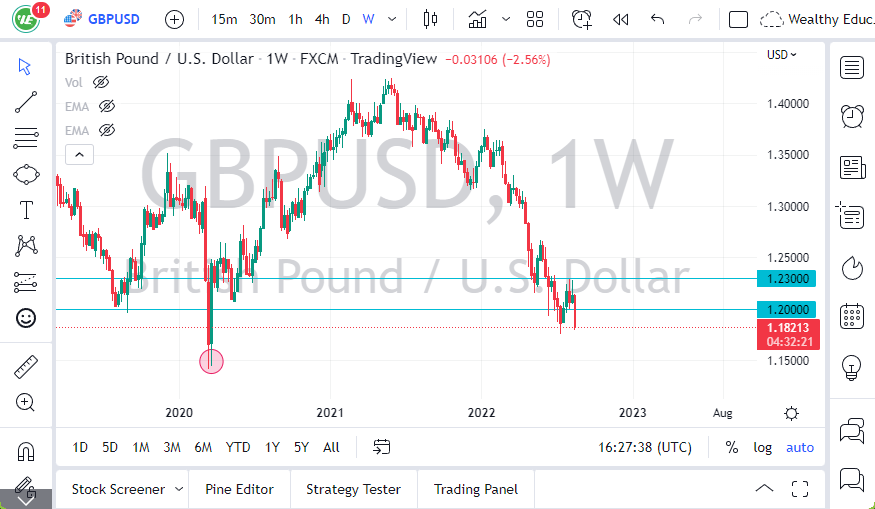

GBP/USD

The British pound fell during the week, repelled from major resistance above. You can see on the chart I have a couple of areas I have been watching, but at the end of the day the most important thing to pay attention to is that we have broken through a downtrend line and found it to be supportive. This pullback should end up being a nice buying opportunity and as I write this we are currently hovering right around the 1.30 level. This is an area that I think will continue to attract a lot of buying.

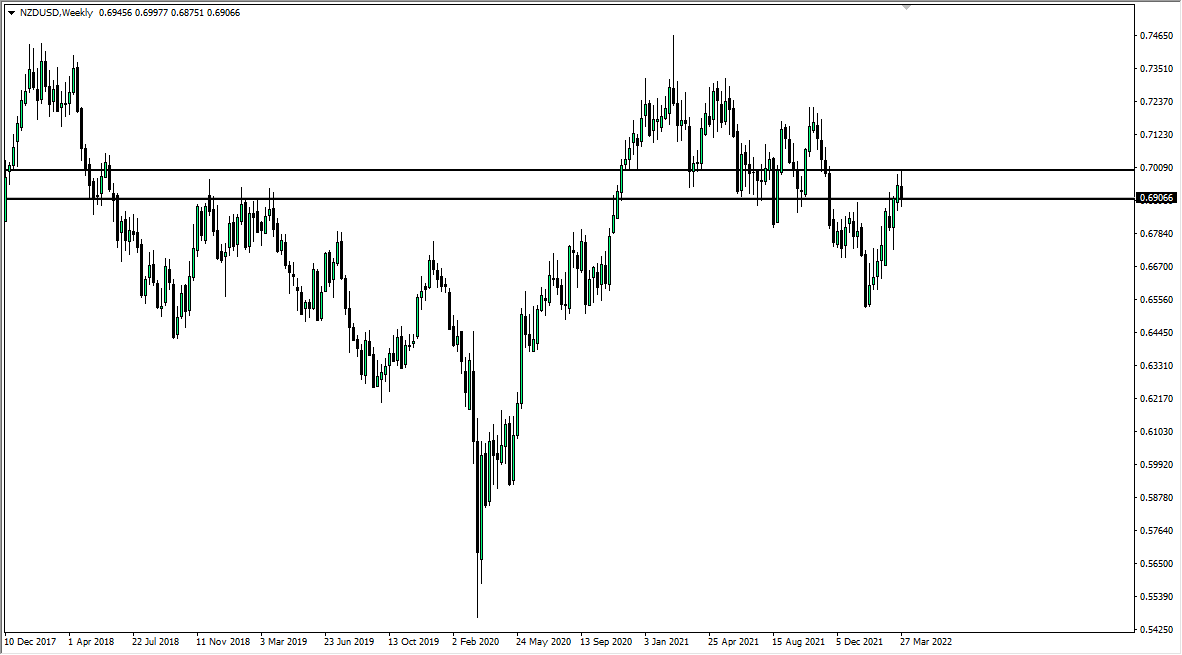

NZD/USD

The New Zealand dollar fell during the week but has seen buyers come back in. It looks as if the 0.79 level will continue to offer resistance above, but we are building pressure to the upside in a bit of an ascending triangle. This next week should be relatively positive for the New Zealand dollar, and will be even more so if we get good news out of China/US trade relations.