EUR/USD

The Euro went back and forth during the week, showing signs of choppiness but by the time we were done we ended up forming something you can to a shooting star. While this is a negative candle stick, in reality there’s no reason to put a lot of money to work because we are in the middle of a major consolidation area. I think that this week will feature more of the same, and any pullback from here will more than likely invite a lot of buying at the 1.1250 level.

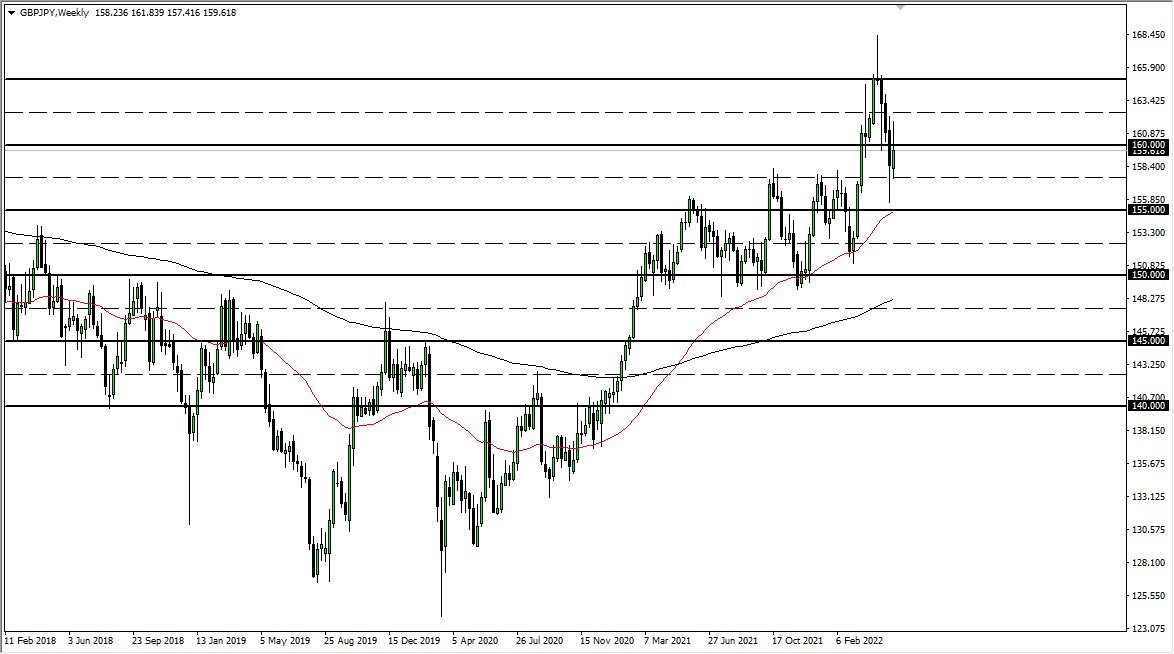

GBP/JPY

The British pound broke out above the down trending channel that we have been in for so long over the past week, and now this confirms that we should continue to go higher. However, in the meantime I would not be surprised at all to see a little bit of a pullback as we have gotten ahead of ourselves. I believe that the ¥145 level should be an excellent support level though. Look for value later in the week.

USD/CAD

The US dollar had a strong week against the Canadian dollar but is still seeing a bit of resistance near the 1.33 region. Because of this, I would not be surprised at all to see a little bit of a pullback but it clearly looks as the buyers are underneath and waiting to pick this pair up. With poor Canadian economic numbers, the argument for rate cuts in Ottawa are starting to get louder. Look for value on dips.

USD/JPY

The US dollar initially pulled back during the week and then shot like a rocket towards the ¥112 level. This is quite impressive, and it looks very likely that we are winding up momentum to reach towards the ¥113.50 level. However, we do need to clear the ¥112 level initially in order to do that. Pullbacks at this point will more than likely be supported. However, I’ll be the first to say that this is not one of my favorite markets right now.