AUD/USD

The Australian dollar tried to rally during most of the week but gave back the gains to form a bit of a shooting star. That happened last week as well, so the question now is whether or not we can continue to find buyers? Although this looks very negative, I recognize that the 0.70 level is massive support that extends down to the 0.68 level. With that in mind, I think that we will continue to see buyers on dips in relatively tight trading.

EUR/USD

The Euro has had a couple of rough weeks, but at this point it’s very likely that the 1.12 level will continue to attract a certain amount of attention. At this point, if we break down below there we could drop to the 1.11 handle, and then possibly the 1.10 level. More likely though, I do think that the buyers come back to trying to recapture the overall consolidation area. To the upside, there is a bit of a ceiling at the 1.15 handle.

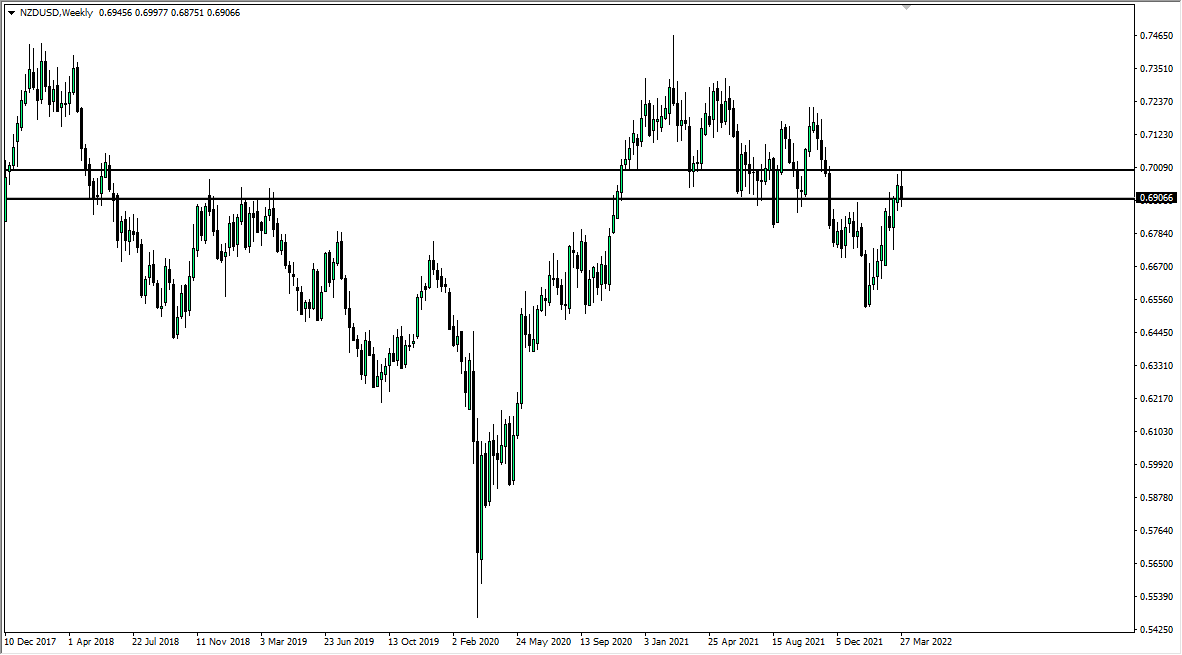

NZD/USD

The New Zealand dollar has had a rough week but at the end of the week we are starting to see support at the same trendlines. Even though the Royal Bank of New Zealand has suggested that its next move might be a rate cut, we have seen a recovery on Friday. At this point, we are forming an ascending triangle as we challenge the 0.69 level that extends to the 0.70 level. A break above that level freeze the New Zealand dollar to go much higher. In the short term, I think traders will continue to pick up the kiwi dollar as it drops.

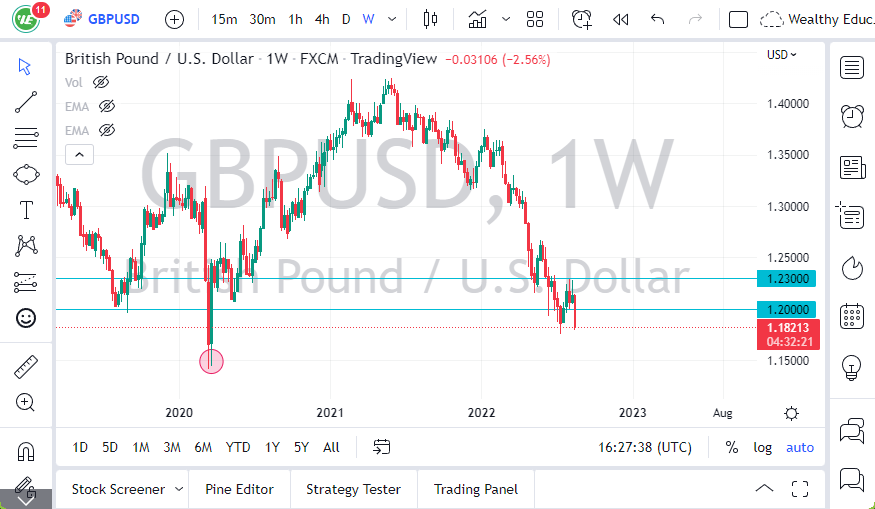

GBP/USD

The British pound fell during the bulk of the week, reaching down towards the 1.30 level. We still have a lot of noise and drama involving the Brexit, so that of course continues to be the main driving factor in this pair. At this point, if we break down below the 1.30 level we could see support jump into the market at 1.28 underneath. I suspect we will probably continue to grind in this overall area and try to get back to the 1.3350 level.