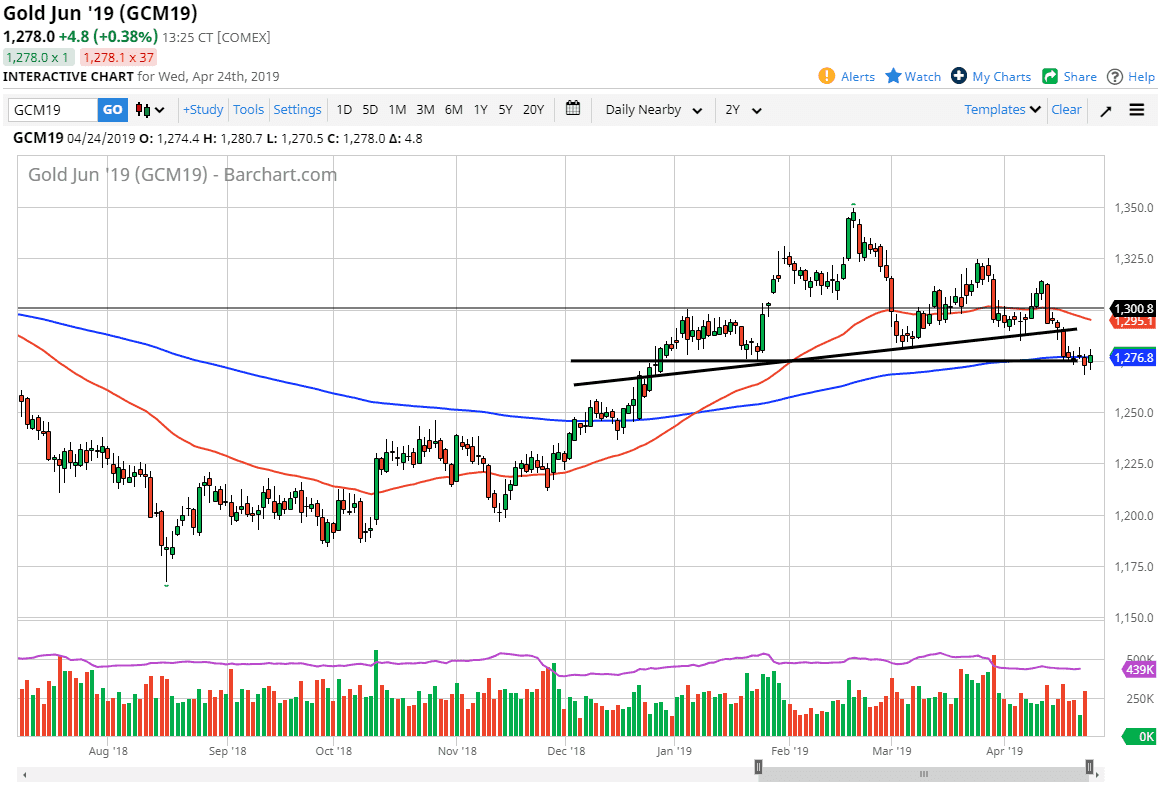

Gold markets went back and forth during the trading session on Tuesday to show quite a bit of volatility at the crucial support levels that we have been dancing around. We are testing the 200 day EMA, but as you look at the last couple of sessions, you can see we simply go back and forth at the $1275 level. If we were to break down below the lows of the Tuesday session, then I think it opens up the trap door to lower trading. However, there still the possibility that we rally from here. At this point, I think that the $1290 level above will be significant resistance, as it was the scene of a major break down based upon the uptrend line that you see on the chart. Ultimately, that could happen but any rally at this point will probably give us an opportunity to start shorting again.

On the break down, which I think is much more likely, then I believe we go down to the $1250 level, the $1225 level, and then eventually the $1200 level. The reason I say these levels, is simply the gold market tends to move in $25 increments. I like selling gold, especially considering that the US dollar has been strengthening, and therefore it should weigh upon gold overall.

The $1300 level above is also significant resistance, and now that we have formed a head and shoulders pattern and possibly even more negativity, I’m looking for an opportunity to sell at any given chance. As far as buying is concerned, I probably wouldn’t bother until we break above the $1300 level, something that doesn’t look very likely to happen anytime soon.