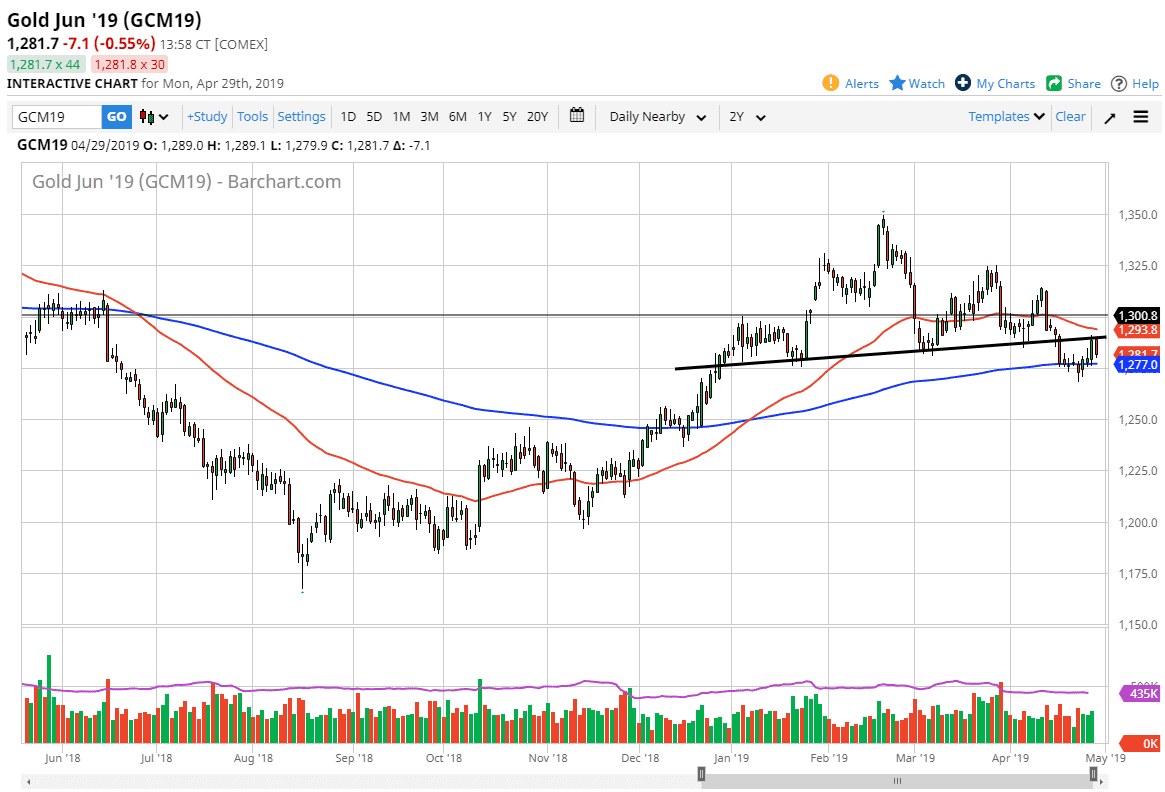

Gold markets broke down a bit during the trading session on Monday, after testing the neckline of a head and shoulders pattern. We had recently broken down through this, tested the 200 day EMA underneath, bounced, and has now been rejected at the previous neckline. With that being the case it’s very likely that the gold market will continue to drop from here, perhaps reaching towards the $1225 level. Ultimately, that is the measured move from the head and shoulders pattern.

The US dollar continues to a driver as to where the Gold markets go, and if it starts to strengthen again, it’s very likely that Gold could drop. If we were to break above the neckline and perhaps the red 50 day EMA, then it could change a lot of things as the market would then go looking towards the $1300 level, possibly the $1310 level.

The breakdown of the market below the couple of hammers that sit at the $1275 level could bring in a flood of more shorts to the market. Gold has gotten a bit heavy as of late, and the action over the last 48 hours makes a “two day shooting star” if you smash the two candlesticks together. That of course shows that we simply cannot continue to go higher. Having said that, if we were to break above it, that would also be a very bullish sign so it’ll be interesting to see how this plays out.

The US dollar did take it on the chin a bit during the day so I find it interesting that Gold couldn’t take off to the upside simultaneously. With that, it’ll be interesting to see what happens next, but we have a couple of levels to pay attention to and trade off of.