EUR/USD

The Euro continues to dance around in a larger consolidation area that started at the 1.12 level and extends all the way up to the 1.15 handle. I don’t think anything changes anytime soon, as there is the 61.8% Fibonacci retracement level underneath, and of course previous action that suggests that there should be buyers here. Beyond that, the Federal Reserve has stepped away from monetary tightening. In the short term, it looks as if we are consolidating between the 1.12 and the 1.1250 levels, and if we can break out to the upside it’s very likely that we will go looking to higher levels.

AUD/USD

The Australian dollar has gone back and forth during the course of the week, but I think there is a significant amount of support underneath at the 0.70 level. That is an area that extends all the way down to the 0.68 level, so it’s very likely that the buyers are going to continue to jump into the Australian dollar to pick up value. Looking at the overall picture, I believe that we are looking at the market trying to anticipate a US/China trade deal as well, which of course would be very bullish for this market.

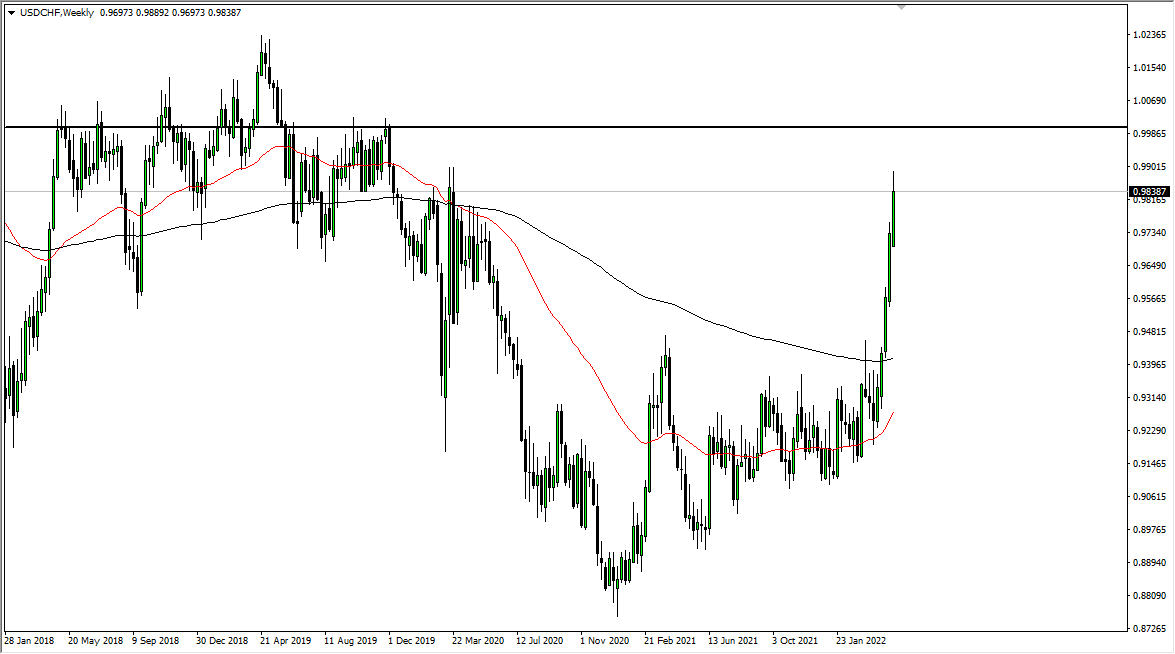

USD/CHF

the US dollar initially pulled back during the week but then broke towards the parity level. That is an area that of course attracts a lot of attention because there is no such thing as a more round figure than “one.” If we can break above there, the market is very likely to go looking towards the 1.01 handle after that. Pullbacks at this point should continue to find buyers unless we can break down below the uptrend line that is drawn on the chart.

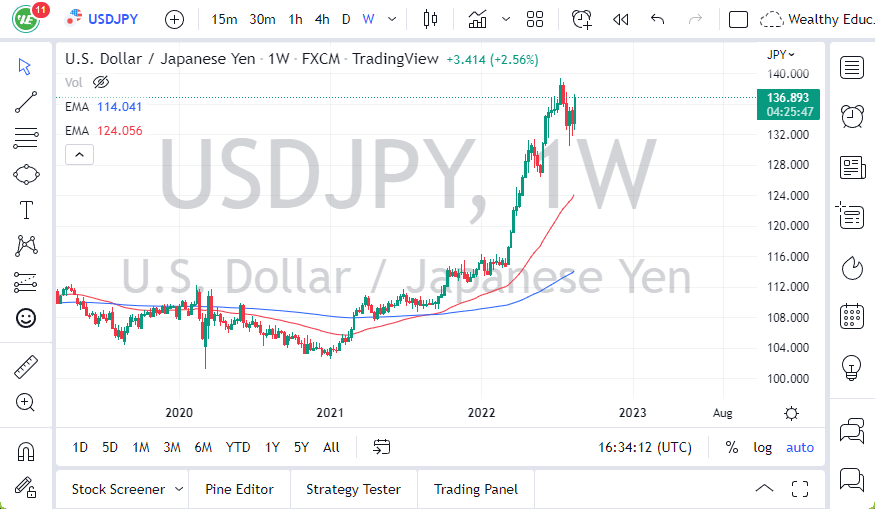

USD/JPY

The US dollar has rallied significantly during the week, breaking above the ¥111.50 level. This is a market that extends to the ¥112 level. This is an area that I think is going to be difficult to break above, and quite frankly needs the S&P 500 to slice through the 2900 level to drag this market right along with it. However, if we pull back from here, I think we could drift as low as ¥110.