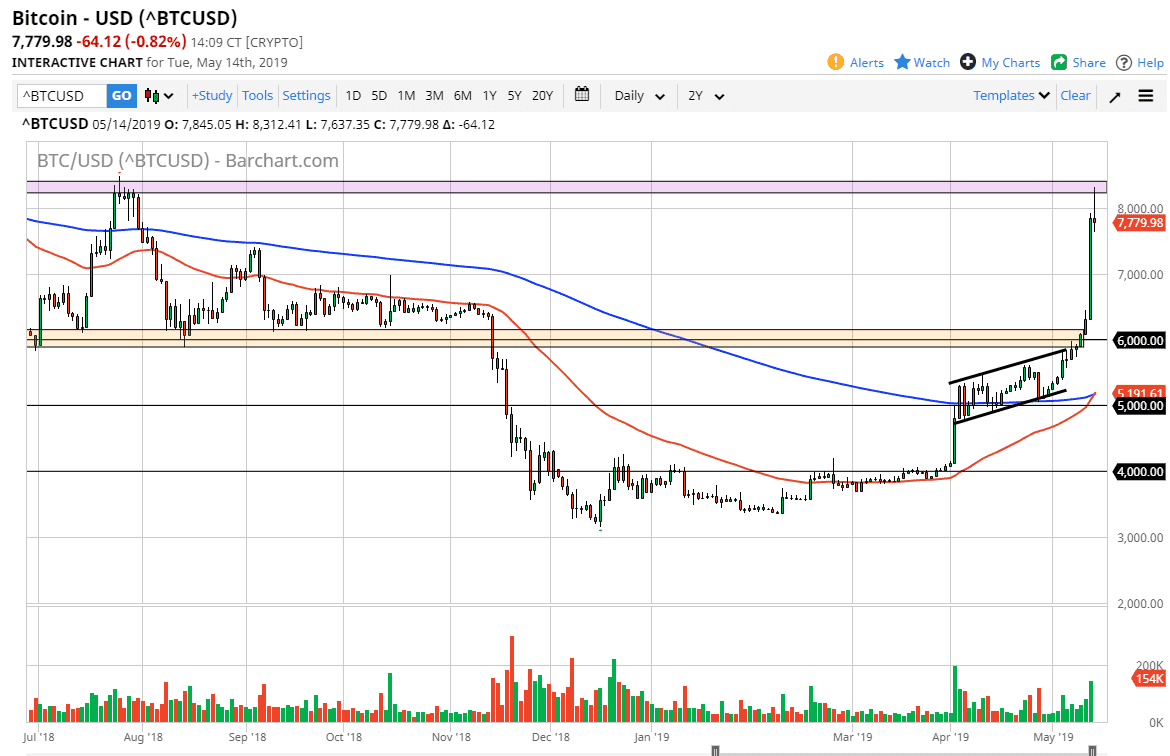

Bitcoin rallied initially during the trading session on Tuesday, slamming through the $8000 level. However, we have given back those gains later in the day and started to form a shooting star as of the end of the US trading session. This is not a surprise, because as you can see the $8000 level has offered a lot of trading interest in the past. This is an extraordinarily bearish candle stick, but that doesn’t necessarily mean you should come in and start selling.

What I mean by this is that we may get a bit of a pullback but quite frankly that’s necessary after this type of move. There are a lot of people out there who remember getting burnt by trying to hold onto Bitcoin until it became $1 million per coin, so when they see this type of parabolic rise, it’s not a surprise that they may want to take some profit. Beyond that, you have to ask who’s left to buy at this level?

That being said, I do think there are plenty of reasons to be optimistic. I fully anticipate that a pullback is coming, and I also believe that the $6000 level is going to offer support. It is the side of the most recent breakout, and of course the 50 day EMA which is pictured in red is now starting to cross the blue 200 day EMA so that’s a longer-term bullish signal as well.

It comes down to your timeframe, but quite frankly if you are shorter term trader this may be your cue to exit. Of course, we could break above the top of the shooting star for the day and that would show it and even more parabolic move. Remember though, a lot of people got hurt from being far too greedy in this market. Those memories remain.