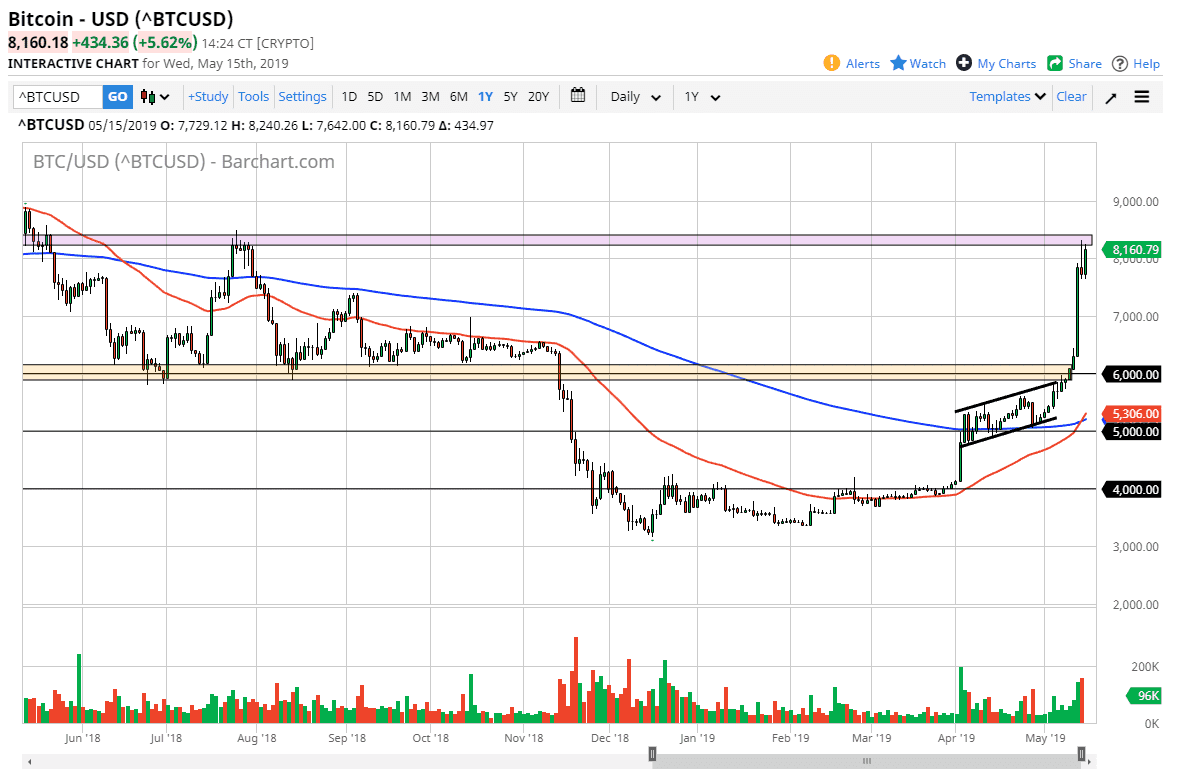

Bitcoin markets rallied again during the trading session on Wednesday, but at this point we are getting away overextended. Granted, we formed a massive shooting star during the day on Tuesday, and breaking above that is a very bullish sign, but at this point we have gotten so far ahead of ourselves that it is more than likely going to have a significant correction. It’s very possible that we may see an extreme fall in the short term.

Don’t get me wrong, I don’t think that Bitcoin is suddenly going to collapse like it did at the peak, but we have clearly gotten ahead of ourselves. I would look at bitcoin and something that you can by on the dips, because it will give you the ability to pick up a little bit of value. I believe that the $6000 level underneath is a significant support level just waiting to happen, so as long as we can stay above there I feel pretty good about the market.

Near the $5300 level, we have the 50 day EMA breaking above the 200 day EMA, which of course is what is known as a “golden cross.” That means that longer-term traders may be looking to buy. The $5000 level underneath is massive support, as it is a psychologically important figure as well. Quite frankly, if we go down below the $5000 level, this market will probably collapse. I put that at about a 15% probability, but it is something that we should be aware of.

If we do break out above the $8300 level, I would be very cautious about buying or even adding to a position. One would have to think that sooner or later serious pain could be felt. In the short term, I would welcome pullbacks and by bounces as they appear.