Bitcoin markets did initially try to push higher during the trading session on Thursday, but I think it’s a good thing that we have fallen a bit. This is a market that has a bad habit of getting ahead of itself, and we all know how getting ahead of yourself in a marketplace can cause problems. All we have to do is look at late 2017 going into early 2018, for a perfect example of this market doing exactly that. You see, that’s one of the biggest problems with Bitcoin. It’s simply not as liquid as some other asset such as the British pound or the Japanese yen. It is because of this that these parabolic moves are quite dangerous, and certainly are still fresh in the mind of a lot of traders.

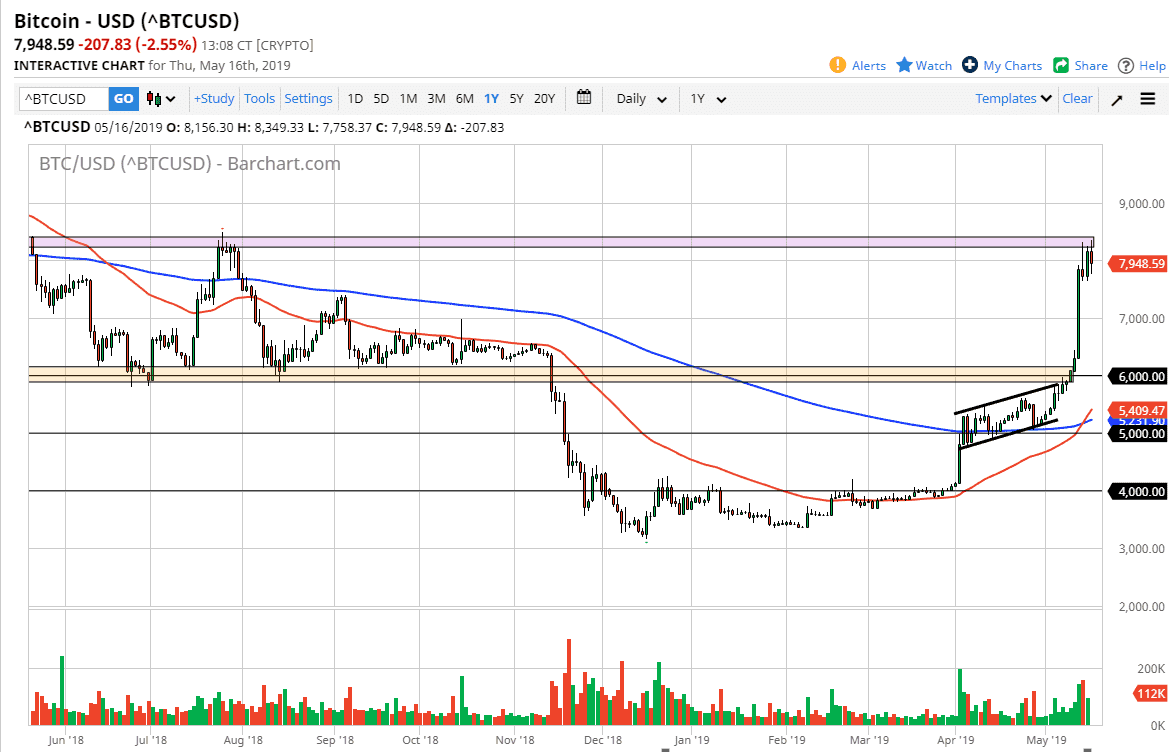

With all of that being said, I believe that a pullback is the best thing that can happen to this market. Simply doubling in value in a few short weeks is a recipe for disaster. A pullback from here and even as low as $6000 would be exactly what the doctor ordered. I’d be looking for value underneath, and at this point I think everybody knows that bitcoin has bottomed, if for nothing else than the short-term. Even the most bearish of traders understand that the momentum of the trend therefore has changed.

There are a lot of retail traders out there who are still very deep underwater when it comes to bitcoin, so these rallies will give them an opportunity to get out of the market at basically breakeven. Keep in mind how important that is for people, it is a psychologically known fact that people are much quicker to cash out when the trade goes in their way after being down. I think that’s one of the biggest headwinds in this market.

The prudent and longer-term attitude of a trader should have you looking at drop from here as value. A breakout above the highs of course is a bullish sign, but it’s a very scary one. $6000 should be your floor.