Bitcoin markets fell slightly during the trading session again on Wednesday, as we are approaching significant resistance above. This is a good sign, because I believe that the market had gotten far ahead of itself. This market continues to be very noisy, but overall retains its massive bullish pressure.

We have been a bit parabolic until the last couple of days, and I think that a lot of the psychology of Bitcoin may have changed due to what happened last time we went parabolic. I’m sure you all remember that during 2017 we would have the surges higher and then another explosive move, perhaps even a few thousand dollars to the upside. At this point, I think that the market will probably take it’s time getting to its final destination and that’s a good thing. Parabolic markets cannot last very long as we have all learned.

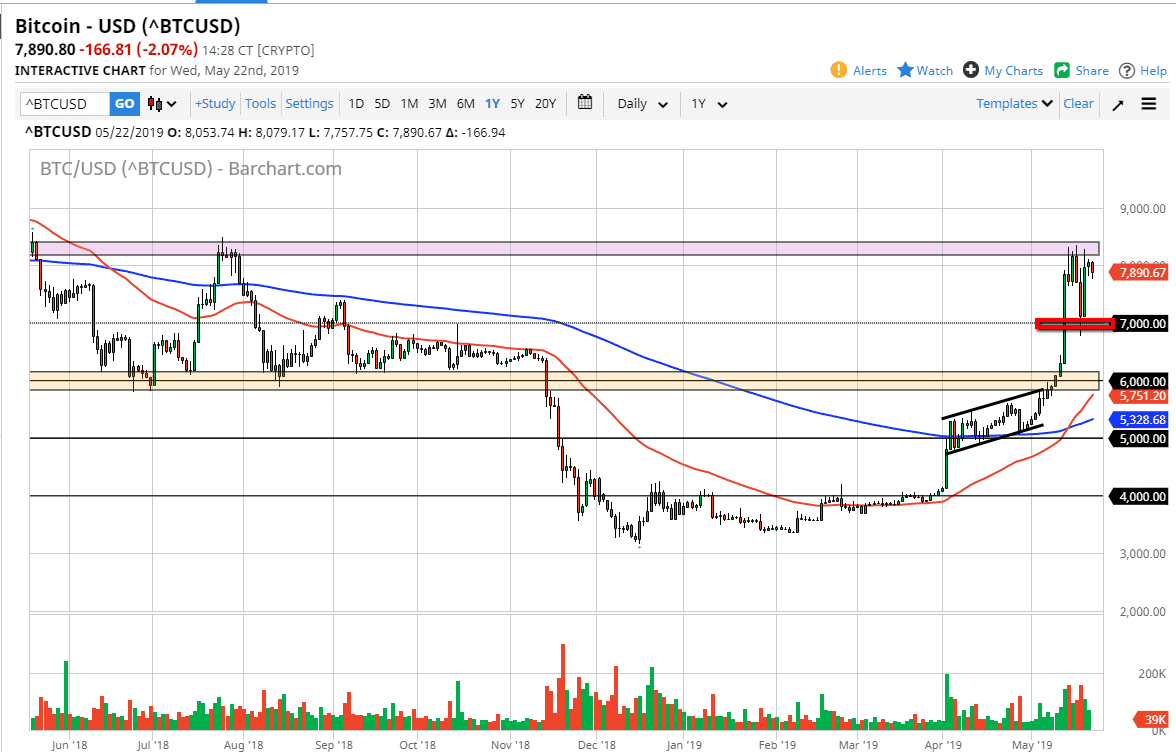

Just above, I see a lot of resistance that starts at roughly $8000, but I think it extends to about $8250 as well. We have pulled back just a bit, and I think that we have recently identified the $7000 level as a rather significant support level as well. Below there, I think the next major support level is at the $6000 level. In fact, it’s not until we break down through the $6000 level that I would be concerned about bitcoin. This simple pullback makes sense, because we are trying to build up the necessary inertia to break out. That’s not always an easy thing to do, and therefore sometimes it takes several different times.

On the breakout, we should then go towards the $10,000 level but it’s going to take some time to get there. That being said, we have recently broken to the upside and it now looks as if we are simply trying to attract fresh money, something that should be easy to do considering how things have panned out of the last several weeks.