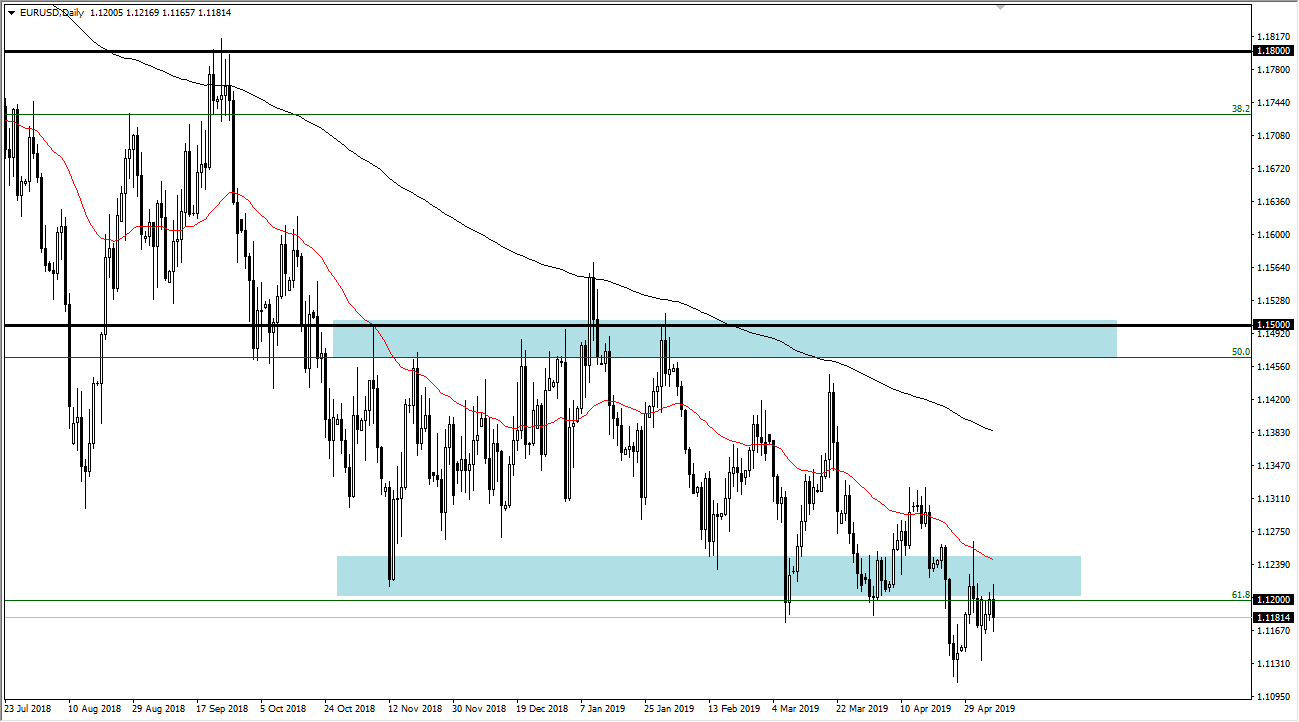

EUR/USD

The Euro has been very volatile as of late, as we continue to chop around a major level. The 1.12 level of course is crucial, so if we can continue to see this level offer significant interest in the market, we will continue to see a lot of back-and-forth. Looking at this chart, it looks very likely that we will continue to see sellers every time it rallies. However, there is a significant amount of support underneath at the 1.11 handle, so I don’t think it’s going to be easy to break this pair down either. I believe that we continue to go back and forth, with the 50 day EMA above pictured in red showing significant resistance. In general, this is a market that I believe is trying to form a bottom but it’s going to take several weeks if not months to make that happen. I believe that we trade right around the 1.12 level with a slightly downward bias.

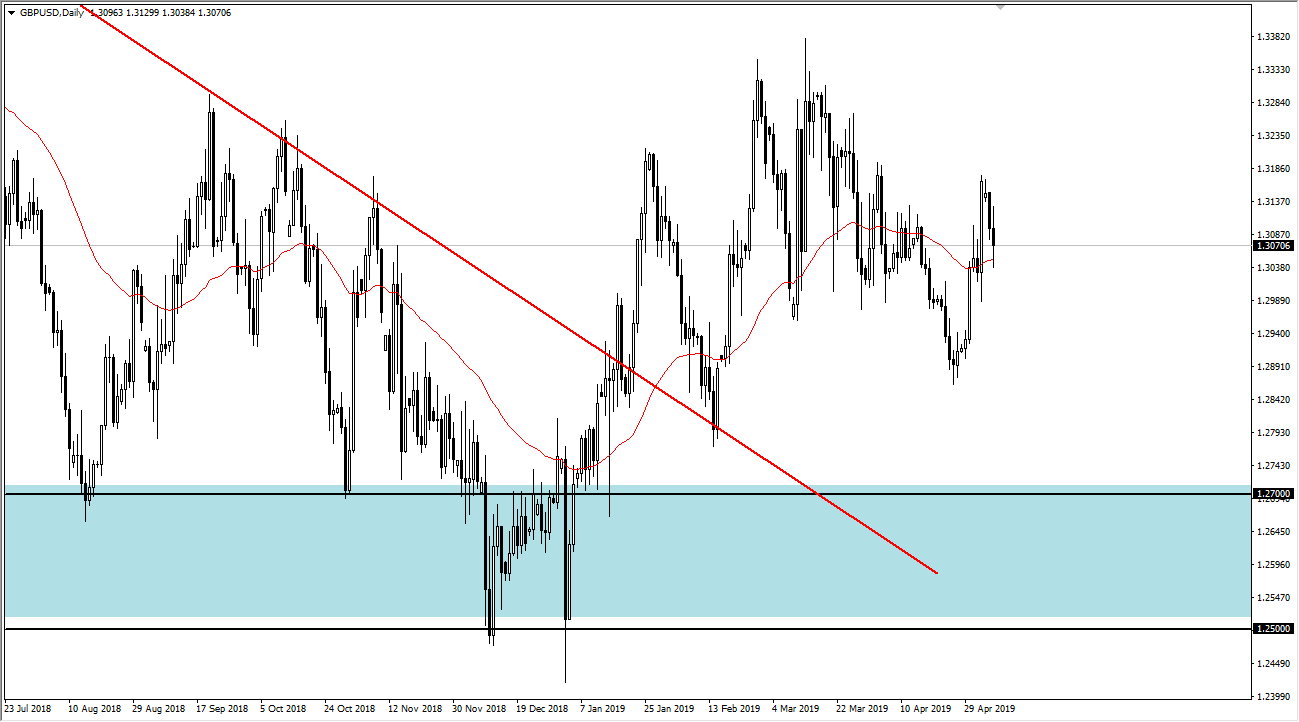

GBP/USD

The British pound went back and forth during trading as you can see on the daily chart, with the lot of attention paid to the 50 EMA which is pictured in red. The market will continue to cause a lot of issues, and with that being the case it’s very likely that we will see the market participants still act as erratic as they always have. The 1.32 level above is massive resistance and should be respected as such. To the downside, I believe that the 1.29 level will continue to offer support. In other words, I would expect a lot of back and forth in this market but ultimately what we are looking at is what could be best described as “a chop fest.” Only those looking to lose money should be trading the British pound right now.