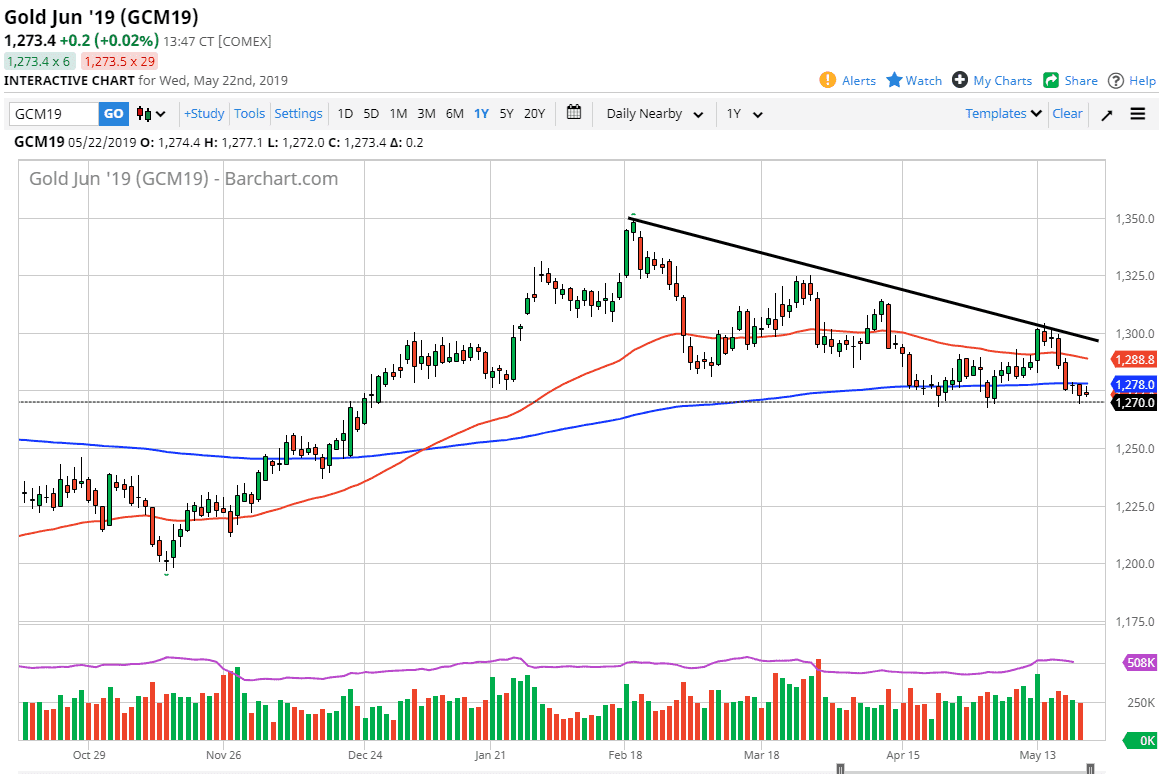

Gold markets went back and forth during the trading session on Wednesday, bouncing around the $1270 level. I think at this point it’s likely that we continue to see sellers on rallies mainly because no matter what we do, we simply can’t hang onto gains. That doesn’t mean that we can’t pop higher from here, but I think the downtrend line that is currently crossing the $1300 level will be a difficult barrier to break above that.

Beyond that, the 50 day EMA is at the $1288 level, so I think bounces are selling opportunities there as well. You will notice how the 200 day EMA has offered resistance during the trading session on Wednesday as well, as we pull back from the $1278 level. This tells me that longer-term traders are looking at this in a negative light, and I think more than likely we will eventually break down. If we break down below the support just underneath, then it’s likely that we go down to the $1250 level, possibly the $1225 after that, and then eventually the $1200 level which I see as the “floor” in the market.

There is the possibility of buying this market, but it’s not until we get a daily close above the $1300 level. If we can break above there, then I think that the attitude of the market will probably change rather drastically, perhaps sending traders looking for the $1315 level, and then possibly even the $1325 level. However, that seems to be very unlikely, at this point in time I think that the market continues to be very heavy and the US dollar strength will continue to weigh upon Gold overall.