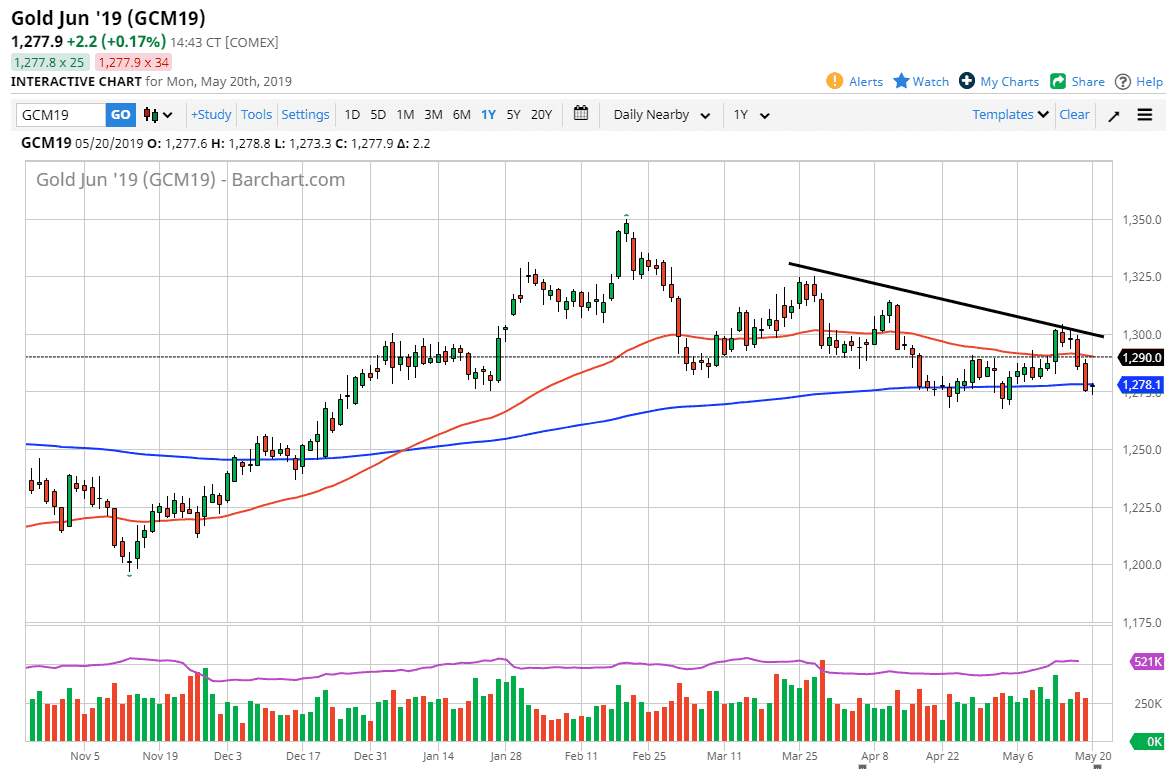

Gold markets initially fell during the trading session on Monday, but then turned around to recover a bit. The $1275 region is an area of significant support, so the fact that we have turned around of form a hammer is a very good sign. At this point, if we bounce from here it’s likely that the $1290 level will be targeted for resistance, and then of course the $1300 level based upon the down trending line that we have on the chart.

Keep in mind that the US dollar is crucial, so if it starts to rally significantly is very likely that the Gold markets will sell off. That’s not to say that they can’t both pick up strength over the longer-term, because sometimes Gold is bought in a safety bid. At the same time, you may have the treasury markets catching a bit, which of course needs to be facilitated by using greenbacks.

Looking at the candlestick from both Thursday and Friday, it’s very obvious that there has been a lot of selling pressure, and at this point it’s likely that rallies will of course attract a lot of attention. Signs of exhaustion will be jumped on when it comes to short-term charts, so keep an eye on short time frames that we can take advantage of. Hammers and the link will be selling opportunities. However, if we break down below the $1275 level, it’s likely that we would just simply fall from there as well. We are dancing around the 200 day EMA so expect a lot of noise, but ultimately we certainly look a bit week, so I am either selling at higher levels or selling the breakdown. If we did break above the $1300 level, then the entire market would change.