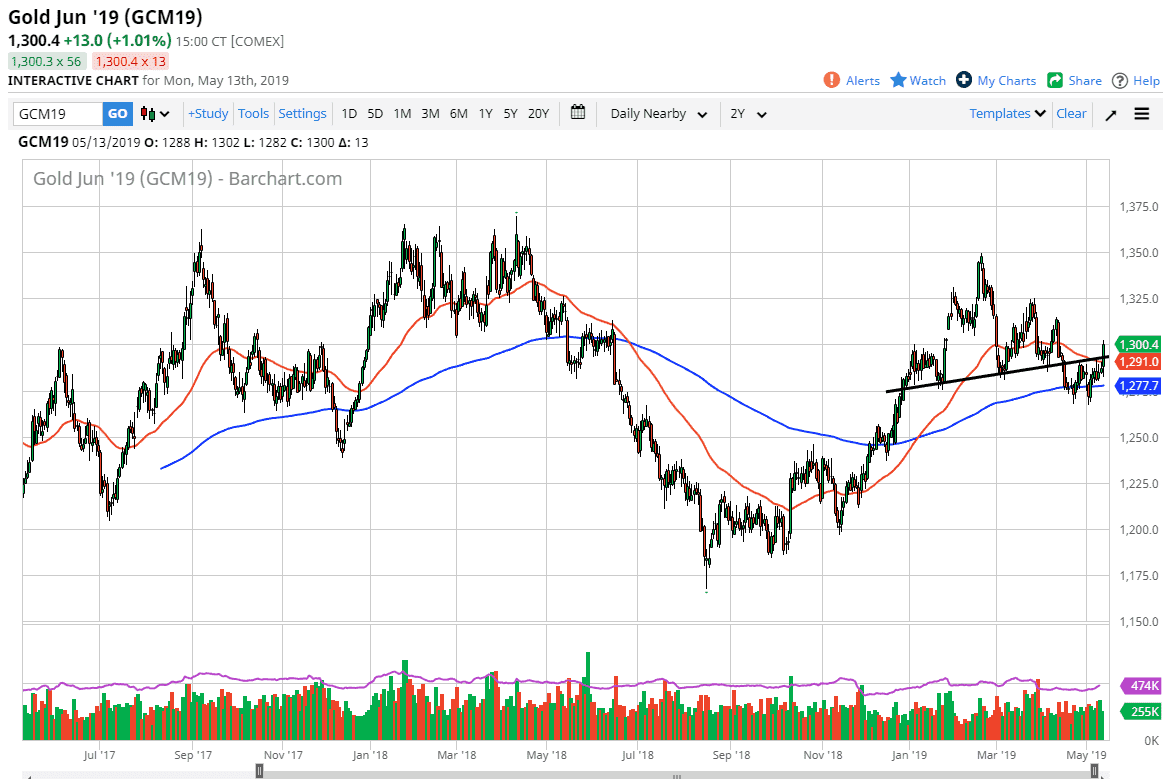

Gold markets took off to the upside on Monday, slicing through the previous neckline that had people looking for a head and shoulders pattern. By doing so, we have wiped out that potential set up, and have caught a lot of people on the wrong side of the market. With that, we are closing the day at the $1300 level, which shows just how confused we are, because this is an area that also features a downtrend line. This market is a mess to say the least.

A lot of this will have to do with the US/China trade relations, and people worried about what’s coming next. The Chinese retaliated, which should not have been much of a surprise quite frankly. However, it seems to have been for a lot of traders out there who bought gold for protection. The US dollar got hammered initially, but then started to strengthen as people bite US treasuries. Because of that, gold is moving up in a major “risk off” move, right along with the greenback, which typically only happens when the markets are very nervous.

To the upside, if we can break this downtrend line which sits just above the highs of the day, then the market will more than likely go looking towards the $1315 level. However, we roll over from here we could drift back down towards the $1290 level, but I think you are probably wise if you stay out of this market for the next 24 hours and let things calm down as there is just so much uncertainty out there to say the least. With that, expect extreme volatility in a market that quite frankly seems to be moving on a motion more than anything else.