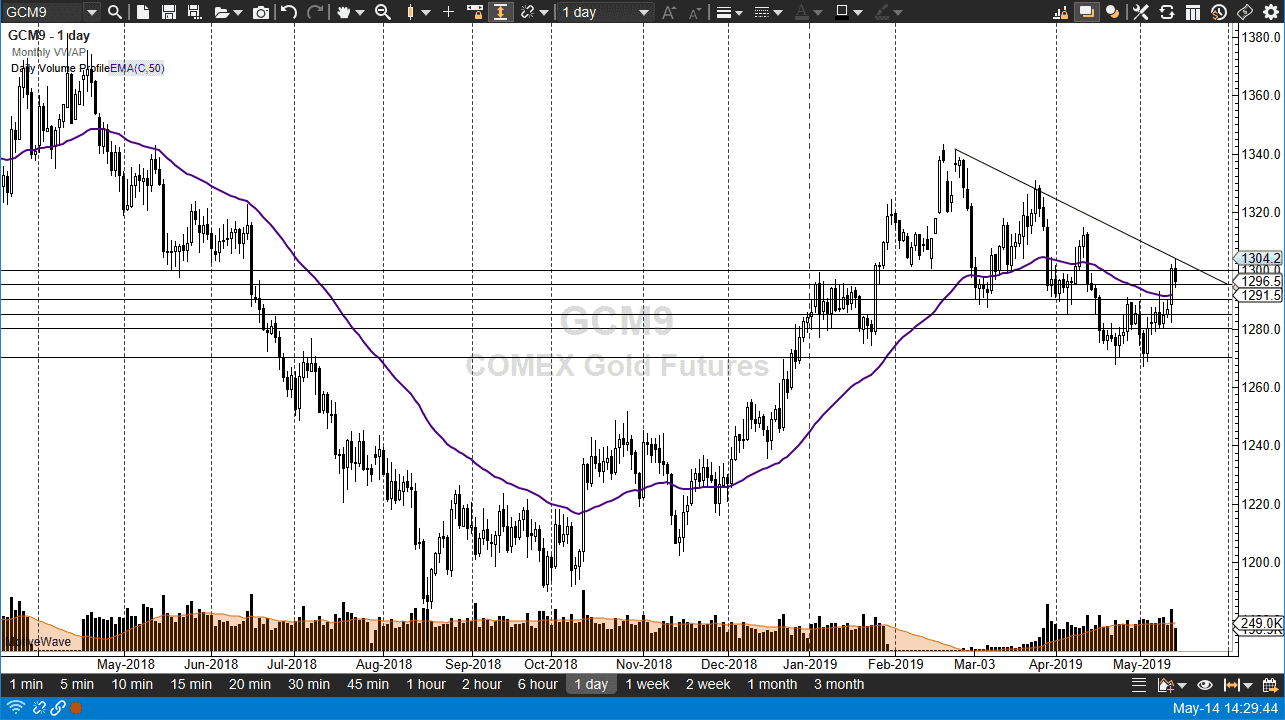

Gold markets initially tried to rally again during the day on Tuesday but failed at the downtrend line that I have drawn on the chart. Gold markets got a huge boost due to a “risk off” move during the Monday session. By doing so, traders started to pick up gold in fear. However, we are starting to see a significant amount of resistance just above, and of course the $1300 level has of course offered a bit of psychological resistance as well.

Because of this, it looks as if the downtrend could continue, and although we had a negative candle stick, there is a lot of order flow to chew through to go lower. At this point, it’s very likely that the $1290 level will be a major support area, not only because of the round figure, but also the fact that it was previous resistance. Throwing more importance into the number is the fact that the 50 day EMA is currently sitting in that general vicinity as well.

To the upside, if we can break above the $1305 level on a daily close, it’s likely that we will continue to go to the $1315 level, possibly even the $1325 level after that. That being said, it would probably take some type of panic type of decision by market participants to get the market rallying that violently. While trading during the day was very difficult to discern which direction of the last 48 hours, when you look at the chart it really hasn’t been a huge turn of events. Sometimes it’s difficult to keep these things in mind in the heat of the moment.

We are still in a downtrend, but above the $1305 level I’m willing to reassess the entire situation, and perhaps look for this lower drive higher. I believe that gold markets will be very choppy and back and forth, so be prepared to keep your position size reasonable, and make sure to honor your stops. Below the $1295 level, I would expect a five dollar drop. If we can break below the $1290 level, then we could start to pick up a little bit more momentum.